|

市场调查报告书

商品编码

1906266

印尼IT服务:市场占有率分析、产业趋势与统计、成长预测(2026-2031年)Indonesia IT Services - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2026 - 2031) |

||||||

※ 本网页内容可能与最新版本有所差异。详细情况请与我们联繫。

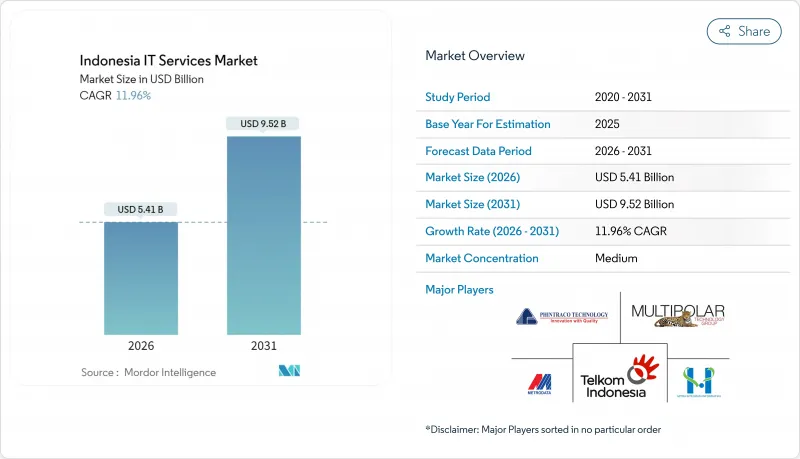

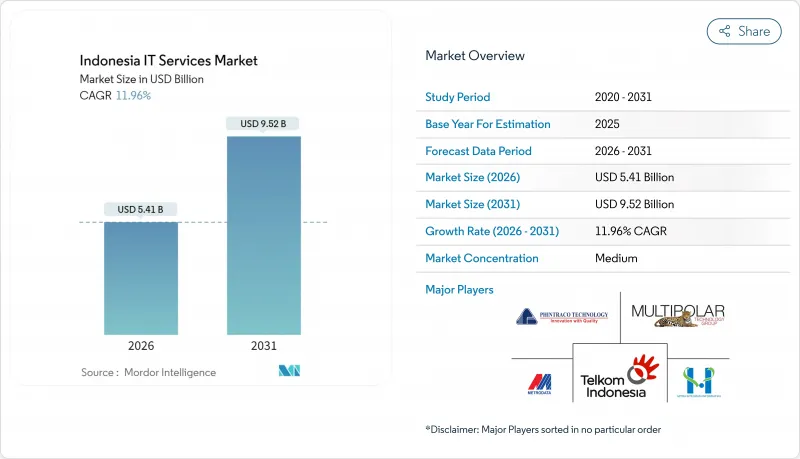

2025年,印尼的IT服务市值为48.3亿美元,预计到2031年将达到95.2亿美元,高于2026年的54.1亿美元。

预计在预测期(2026-2031 年)内,复合年增长率将达到 11.96%。

印尼经济成长得益于「印尼4.0」和「金色印尼2045愿景」等国家计画、不断成长的外国直接投资对数位基础设施的投入,以及企业对以云端为中心和託管服务解决方案的持续需求。儘管大型企业仍是主导,但随着价格合理的云端平台降低了采用门槛,中小企业(SME)的收入成长速度最快。由于严格的监管、安全性和客户体验要求,金融服务机构仍然是最大的单一行业,这些要求需要先进的分析和即时处理能力。云端技术已成为主流,随着企业考虑延迟、主权和成本等因素,云端技术的应用正向混合架构发展。区域机会仍集中在爪哇岛,但光纤骨干网路和资料中心园区的扩张正在加速苏拉威西岛、苏门答腊岛和加里曼丹岛的云端技术应用。

印尼IT服务市场趋势与洞察

快速的企业数位化优先策略

印尼企业正围绕全天候运作平台重塑其经营模式。印尼曼迪利银行(Bank Mandiri)利用即时系统每天处理1,000万笔记录,将贷款核准时间从5天缩短至1天。印尼Pegadiaan公司迁移到云端原生架构后,系统可用性提升至99.99%,资料库配置时间从数天缩短至不到90分钟。製造业企业正在整合物联网和分析技术,以实现工业4.0的目标。各行各业的董事会也将预算从硬体投资转向以结果为基础的管理服务合约。这为印尼IT服务市场带来了对咨询、迁移和营运支援的持续需求。

云端原生应用程式迁移的激增

已完成迁移计划的公司目前正在将其应用程式现代化改造为微服务架构。透过采用 Red Hat OpenShift 标准,中亚银行将其新服务的引进週期从三个月缩短至一个月。混合云策略正变得越来越普遍,企业越来越多地将其与国内自主云(例如 Lintasarta 的 Cloud Sovereign)相结合,后者旨在符合个人资料保护法。同时,为了满足延迟和隐私要求,私有 AI 基础架构的建置也在不断扩展,这涵盖了架构设计、Kubernetes 运维和 FinOps 最佳化等方面的服务范围。

国内持续存在先进云端技术和DevSecOps技能人才短缺问题

根据国际劳工组织(ILO)的数据,目前全球资讯通讯技术(ICT)专业人才缺口高达50万,尤其是在高阶云端运算工程和DevSecOps领域。 IBM的一项调查显示,48%的印尼企业受到数位技能不足的限制。儘管职业技能培训卡(Kartu Prakerja)计画已培训了1,400万公民,但培训速度仍无法满足企业需求,导致引进週期延长,企业更加依赖海外人才。能够将技能转移专案与计划交付结合的机构将获得竞争优势。

细分市场分析

到2025年,随着企业从企划为基础的合约转向以结果为导向的服务水准协议,IT外包和託管服务将占印尼IT服务市场份额的33.02%。金融服务公司将即时诈欺分析外包给利用FICO决策平台的专业合作伙伴,每年保护16.4亿笔交易。在要求建立审核资料主权环境的监管推动下,受云端服务和SaaS普及应用的推动,印尼IT服务市场规模预计将以14.01%的复合年增长率成长。

随着企业应对监管变化并评估多重云端模式,咨询服务需求依然强劲。电信和银行后勤部门的业务流程外包持续成长,因为专业知识能够带来可衡量的价值。由于《个人资料保护法》(PDPL) 的实施,网路安全和资料分析专案正在蓬勃发展,为零信任架构和资料管治框架创造了利基市场。能够提供整合安全、分析和自动化管理服务的供应商正在赢得长期合约和高利润率,从而推动印尼IT服务市场的结构性变革。

大型企业将占2025年总收入的63.72%,这反映了它们庞大的应用资产和合规实践。典型的合约包括多年混合云端计划和旨在满足董事会风险指标的託管保全行动。同时,随着云端市场捆绑包的推出,中小企业(SME)正以14.72%的复合年增长率快速成长,企业级平台触手可及。 TikTok直播销售额有望使小规模企业的销售额增长高达七倍,这表明中小企业可以从现成的数位化工具中获益匪浅。

政府补贴和简化的数位化融资方案正在推动会计SaaS、POS分析和轻量级ERP的普及。提供预先配置模板、快速上手和计量收费模式的供应商正在印尼IT服务市场的中小企业领域迅速扩张。随着这些企业的成熟,需求正从基础架构转向进阶分析和网路安全,进而提升客户终身价值。

印尼IT服务市场按服务类型(IT咨询和实施支援、业务流程外包服务等)、公司规模(中小企业和大型企业)、产业(金融、保险和证券、IT和通讯、製造业等)、实施类型(本地部署、云端部署、混合部署)、技术(云端运算等)和地区进行细分。市场预测以以金额为准。

其他福利:

- Excel格式的市场预测(ME)表

- 3个月的分析师支持

目录

第一章 引言

- 研究假设和市场定义

- 调查范围

第二章调查方法

第三章执行摘要

第四章 市场情势

- 市场概览

- 市场驱动因素

- 快速的企业数位化优先策略

- 云端原生应用程式迁移的激增

- 政府的「印尼4.0」奖励措施

- 金融科技与电子商务的快速扩张

- 与国营企业签订资料中心建设-营运-移交(BOT)合同

- 关键数据的强制性国内灾害復原託管

- 市场限制

- 国内持续存在先进云端技术和DevSecOps技能人才短缺问题

- 主要都会区以外的老旧基础设施

- 各地区采购标准有差异

- 电费上涨对超大规模经济的影响

- 产业价值链分析

- 监管环境

- 技术展望

- 产业吸引力-波特五力分析

- 买方的议价能力

- 供应商的议价能力

- 新进入者的威胁

- 替代品的威胁

- 竞争对手之间的竞争

- 宏观经济因素如何影响市场

第五章 市场规模与成长预测

- 按服务类型

- IT咨询与实施支持

- 业务流程外包 (BPO) 服务

- IT外包与管理服务

- 云端服务和SaaS实施

- 其他IT服务

- 按公司规模

- 中小企业

- 大公司

- 按行业

- BFSI

- 资讯科技/通讯

- 製造业

- 卫生保健

- 政府/公共部门

- 零售与电子商务

- 能源与公共产业

- 教育

- 其他行业

- 按部署模式

- 本地部署

- 云

- 杂交种

- 透过技术

- 云端运算

- 人工智慧和机器学习

- 物联网 (IoT)

- 保全服务

- 巨量资料与分析

- 区块链和新兴技术

- 其他的

- 按地区

- Java

- 苏门答腊

- 加里曼丹

- 苏拉威西

- 巴布亚马克

- 其他地区

第六章 竞争情势

- 市场集中度

- 策略趋势

- 市占率分析

- 公司简介

- PT Telekomunikasi Indonesia Tbk(Telkomsigma)

- PT Multipolar Technology Tbk

- PT Mitra Integrasi Informatika(MII)

- PT Metrodata Electronics Tbk

- PT Phintraco Technology

- PT Lintasarta

- PT Sigma Cipta Caraka

- Accenture Indonesia

- IBM Indonesia

- Microsoft Indonesia

- Hewlett Packard Enterprise Indonesia

- Fujitsu Indonesia

- Tata Consultancy Services Indonesia

- Wipro Indonesia

- PT Indosat Tbk(Indosat Ooredoo Hutchison Business Services)

- PT XL Axiata Tbk(XL Business Solutions)

- PT Biznet Gio Nusantara

- PT WOWrack Indonesia

- PT Kharisma(Kharisma Group)

- PT ABeam Consulting Indonesia

- PT Xapiens Teknologi Indonesia

- TDCX Indonesia

- PT Cloud4C Services Indonesia

- PT DCI Indonesia Tbk

- PT EdgeConneX Indonesia

- PT Equine Global

- PT Jatis Solutions

- PT Soltius Indonesia

第七章 市场机会与未来趋势

- 閒置频段与未满足需求评估

The Indonesia IT Services Market was valued at USD 4.83 billion in 2025 and estimated to grow from USD 5.41 billion in 2026 to reach USD 9.52 billion by 2031, at a CAGR of 11.96% during the forecast period (2026-2031).

Growth is anchored in national programs such as Making Indonesia 4.0 and the Golden Indonesia 2045 Vision, rising foreign direct investment in digital infrastructure, and sustained enterprise demand for cloud-centric and managed services solutions. Large enterprises continue to dominate spending, yet small and medium enterprises (SMEs) are delivering the fastest revenue uplift as affordable cloud platforms lower adoption barriers. Financial services institutions remain the single largest vertical because of intensive regulatory, security, and customer experience requirements that favour advanced analytics and real-time processing capabilities. Cloud deployment, already the predominant model, is evolving into hybrid architectures as firms weigh latency, sovereignty, and cost considerations. Regional opportunity is still centred on Java, but expansion of fibre backbones and data-centre campuses is accelerating uptake in Sulawesi, Sumatra, and Kalimantan.

Indonesia IT Services Market Trends and Insights

Rapid enterprise digital-first strategies

Indonesian corporations are rebuilding business models around always-on digital platforms. Bank Mandiri processes 10 million records per day on a real-time system that has cut loan approval times from five days to one day. PT Pegadaian reached 99.99% system availability and slashed database provisioning from days to under 90 minutes after moving to a cloud-native stack. Industrial manufacturers are embracing integrated IoT and analytics to meet Industry 4.0 targets, and across sectors, boards are shifting budgets from capital hardware to outcome-based managed service agreements. The result is durable demand for consulting, migration, and run-phase support across the Indonesian IT services market.

Surge in cloud-native application migration

Enterprises that finished lift-and-shift projects are now modernising applications into microservices. Bank Central Asia cut new-service rollout cycles from three months to one by standardising on Red Hat OpenShift. Hybrid strategies are widespread as firms pair local sovereign clouds such as Lintasarta's Cloud Sovereign, which is purpose-built to comply with the Personal Data Protection Law. A parallel trend is the standing up of private AI infrastructure to meet latency and privacy needs, widening the service scope for architecture design, Kubernetes operations, and FinOps optimisation.

Persistent domestic skills gap in advanced cloud and DevSecOps

The International Labour Organization cites a shortage of 500,000 ICT professionals, notably in advanced cloud engineering and DevSecOps roles. IBM finds 48% of Indonesian firms hampered by digital-skills deficits. Although the Kartu Prakerja scheme has trained 14 million citizens, the pace lags enterprise demand, lengthening implementation cycles and increasing reliance on expatriate or offshore talent. Providers that integrate skills-transfer programs with project delivery gain a competitive edge.

Other drivers and restraints analyzed in the detailed report include:

- Government "Making Indonesia 4.0" incentives

- Accelerated fintech and e-commerce expansion

- Ageing legacy infrastructure outside tier-1 cities

For complete list of drivers and restraints, kindly check the Table Of Contents.

Segment Analysis

IT outsourcing and managed services secured 33.02% of the Indonesian IT services market share in 2025 as enterprises shifted from project-based engagements to outcome-driven service-level agreements. Financial services firms outsource real-time fraud analytics to specialist partners using FICO's decision platform, which protects 1.64 billion annual transactions. The Indonesian IT services market size attributed to cloud services and SaaS implementation is forecast to expand at a 14.01% CAGR, underpinned by regulations that require auditable data-sovereign environments.

Demand for consulting remains steady as enterprises navigate regulatory updates and evaluate multi-cloud patterns. Business-process outsourcing persists in telecom and banking back offices where domain expertise adds measurable value. Cybersecurity and data analytics engagements are climbing on the back of the Personal Data Protection Law, creating niches for zero-trust architectures and data-governance frameworks. Providers able to deliver integrated security, analytics, and automation within a managed offering are winning longer contracts and higher margins, reinforcing the structural shift in the Indonesian IT services market.

Large enterprises concentrated 63.72% of 2025 revenue, reflecting their extensive application estates and compliance workloads. Typical engagements include multi-year hybrid cloud programmes and managed security operations designed to meet board-level risk metrics. In contrast, SMEs are on a high-growth path with a 14.72% CAGR as cloud marketplace bundles bring enterprise-grade platforms within reach. TikTok-enabled live-stream selling lifted small-merchant sales by up to seven times, showcasing the leverage SMEs gain from ready-made digital tools.

Government grants and simplified digital-loan facilities spur adoption of accounting SaaS, point-of-sale analytics, and lightweight ERP. Providers that deliver preconfigured templates, rapid onboarding, and pay-as-you-go models are scaling quickly in the SME segment of the Indonesian IT services market. As these companies mature, demand progresses from basic infrastructure to advanced analytics and cybersecurity, enlarging lifetime customer value.

Indonesia IT Services Market is Segmented by Service Type (IT Consulting and Implementation, Business Process Outsourcing Services, and More), Enterprise Size (Small and Medium Enterprises and Large Enterprises), Industry (BFSI, IT and Telecom, Manufacturing, and More), Deployment (On-Premise, Cloud, and Hybrid), Technology (Cloud Computing, and More), and Region. The Market Forecasts are Provided in Terms of Value (USD).

List of Companies Covered in this Report:

- PT Telekomunikasi Indonesia Tbk (Telkomsigma)

- PT Multipolar Technology Tbk

- PT Mitra Integrasi Informatika (MII)

- PT Metrodata Electronics Tbk

- PT Phintraco Technology

- PT Lintasarta

- PT Sigma Cipta Caraka

- Accenture Indonesia

- IBM Indonesia

- Microsoft Indonesia

- Hewlett Packard Enterprise Indonesia

- Fujitsu Indonesia

- Tata Consultancy Services Indonesia

- Wipro Indonesia

- PT Indosat Tbk (Indosat Ooredoo Hutchison Business Services)

- PT XL Axiata Tbk (XL Business Solutions)

- PT Biznet Gio Nusantara

- PT WOWrack Indonesia

- PT Kharisma (Kharisma Group)

- PT ABeam Consulting Indonesia

- PT Xapiens Teknologi Indonesia

- TDCX Indonesia

- PT Cloud4C Services Indonesia

- PT DCI Indonesia Tbk

- PT EdgeConneX Indonesia

- PT Equine Global

- PT Jatis Solutions

- PT Soltius Indonesia

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET LANDSCAPE

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 Rapid enterprise digital-first strategies

- 4.2.2 Surge in cloud-native application migration

- 4.2.3 Government "Making Indonesia 4.0" incentives

- 4.2.4 Accelerated fintech and e-commerce expansion

- 4.2.5 Data-center build-operate-transfer (BOT) deals with SOEs

- 4.2.6 Mandated domestic disaster-recovery hosting for critical data

- 4.3 Market Restraints

- 4.3.1 Persistent domestic skills gap in advanced cloud and DevSecOps

- 4.3.2 Ageing legacy infrastructure outside tier-1 cities

- 4.3.3 Fragmented provincial procurement standards

- 4.3.4 Rising electricity tariffs impacting hyperscale economics

- 4.4 Industry Value Chain Analysis

- 4.5 Regulatory Landscape

- 4.6 Technological Outlook

- 4.7 Industry Attractiveness - Porter's Five Forces Analysis

- 4.7.1 Bargaining Power of Buyers

- 4.7.2 Bargaining Power of Suppliers

- 4.7.3 Threat of New Entrants

- 4.7.4 Threat of Substitutes

- 4.7.5 Intensity of Competitive Rivalry

- 4.8 Impact of Macroeconomic Factors on the Market

5 MARKET SIZE AND GROWTH FORECASTS (VALUES)

- 5.1 By Service Type

- 5.1.1 IT Consulting and Implementation

- 5.1.2 Business Process Outsourcing (BPO) Services

- 5.1.3 IT Outsourcing and Managed Services

- 5.1.4 Cloud Services and SaaS Implementation

- 5.1.5 Other IT Services

- 5.2 By Enterprise Size

- 5.2.1 Small and Medium Enterprises (SMEs)

- 5.2.2 Large Enterprises

- 5.3 By Industry

- 5.3.1 BFSI

- 5.3.2 IT and Telecom

- 5.3.3 Manufacturing

- 5.3.4 Healthcare

- 5.3.5 Government and Public Sector

- 5.3.6 Retail and E-commerce

- 5.3.7 Energy and Utilities

- 5.3.8 Education

- 5.3.9 Other Industries

- 5.4 By Deployment Model

- 5.4.1 On-premise

- 5.4.2 Cloud

- 5.4.3 Hybrid

- 5.5 By Technology

- 5.5.1 Cloud Computing

- 5.5.2 Artificial Intelligence and Machine Learning

- 5.5.3 Internet of Things (IoT)

- 5.5.4 Cybersecurity Services

- 5.5.5 Big Data and Analytics

- 5.5.6 Blockchain and Emerging Tech

- 5.5.7 Others

- 5.6 By Region

- 5.6.1 Java

- 5.6.2 Sumatra

- 5.6.3 Kalimantan

- 5.6.4 Sulawesi

- 5.6.5 Papua and Maluku

- 5.6.6 Other Regions

6 COMPETITIVE LANDSCAPE

- 6.1 Market Concentration

- 6.2 Strategic Moves

- 6.3 Market Share Analysis

- 6.4 Company Profiles (includes Global level Overview, Market level overview, Core Segments, Financials as available, Strategic Information, Market Rank/Share for key companies, Products and Services, and Recent Developments)

- 6.4.1 PT Telekomunikasi Indonesia Tbk (Telkomsigma)

- 6.4.2 PT Multipolar Technology Tbk

- 6.4.3 PT Mitra Integrasi Informatika (MII)

- 6.4.4 PT Metrodata Electronics Tbk

- 6.4.5 PT Phintraco Technology

- 6.4.6 PT Lintasarta

- 6.4.7 PT Sigma Cipta Caraka

- 6.4.8 Accenture Indonesia

- 6.4.9 IBM Indonesia

- 6.4.10 Microsoft Indonesia

- 6.4.11 Hewlett Packard Enterprise Indonesia

- 6.4.12 Fujitsu Indonesia

- 6.4.13 Tata Consultancy Services Indonesia

- 6.4.14 Wipro Indonesia

- 6.4.15 PT Indosat Tbk (Indosat Ooredoo Hutchison Business Services)

- 6.4.16 PT XL Axiata Tbk (XL Business Solutions)

- 6.4.17 PT Biznet Gio Nusantara

- 6.4.18 PT WOWrack Indonesia

- 6.4.19 PT Kharisma (Kharisma Group)

- 6.4.20 PT ABeam Consulting Indonesia

- 6.4.21 PT Xapiens Teknologi Indonesia

- 6.4.22 TDCX Indonesia

- 6.4.23 PT Cloud4C Services Indonesia

- 6.4.24 PT DCI Indonesia Tbk

- 6.4.25 PT EdgeConneX Indonesia

- 6.4.26 PT Equine Global

- 6.4.27 PT Jatis Solutions

- 6.4.28 PT Soltius Indonesia

7 MARKET OPPORTUNITIES AND FUTURE TRENDS

- 7.1 White-Space and Unmet-Need Assessment