|

市场调查报告书

商品编码

1910640

IT服务:市场占有率分析、产业趋势与统计、成长预测(2026-2031年)IT Services - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2026 - 2031) |

||||||

※ 本网页内容可能与最新版本有所差异。详细情况请与我们联繫。

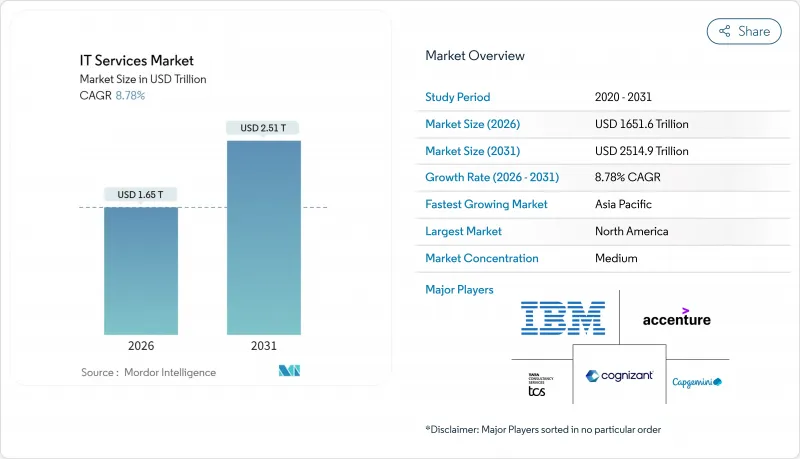

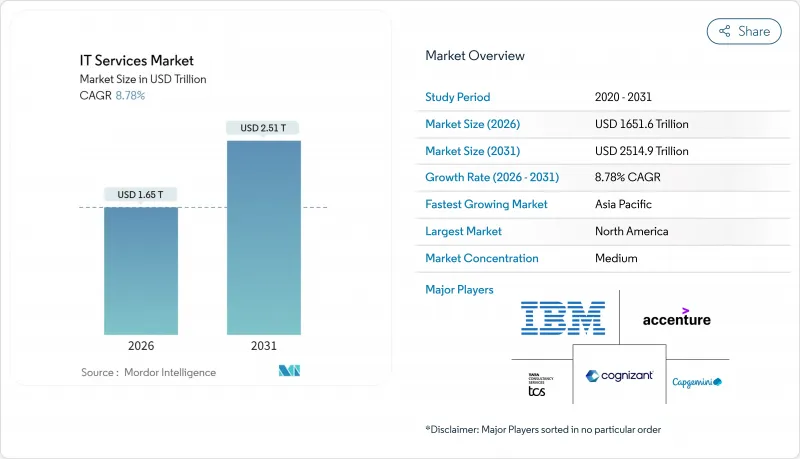

预计到 2026 年,IT 服务市场规模将达到 1,6,516 亿美元,高于 2025 年的 1,5,181 亿美元。

预计到 2031 年将达到 25,149 亿美元,2026 年至 2031 年的复合年增长率为 8.78%。

稳健的数位转型计划、企业对人工智慧日益增长的采用以及不断扩大的云端原生迁移正在推动市场需求成长。银行业和医疗保健产业是支出成长最强劲的产业,预计到2024年,随着各机构对其传统核心系统进行现代化改造,这两个产业的支出成长率将分别达到8.7%和15%。提供基于混合云端和人工智慧工作负载的综合咨询、实施和管理服务的供应商正在赢得高价值合约。同时,对价格敏感的外包协议仍然是建立大规模交付流程的基础。不断增加的整合活动,包括数十亿美元的收购,显示规模、垂直领域深度和差异化的智慧财产权正在成为赢得企业合约续约的关键因素。

全球IT服务市场趋势与洞察

新冠疫情后加速数位转型

多重云端部署的企业已超过 87%,其中 51% 的企业正在投资云端原生现代化计划,这些项目整合了应用程式重构、人工智慧服务和资料平台。全球 IT 服务市场如今更青睐那些容器编排管理、微服务和 DevOps 的供应商,而非仅提供简单迁移服务的供应商。 DXC Technology 的「Cloud Right」方法协助 Ocean Network Express 实现了零停机迁移,为供应商从基础设施管理转型为策略业务合作伙伴铺平了道路。收入来源正转向咨询和託管云端营运服务,这些服务既需要深厚的技术资质,也需要对产业有深刻的洞察。此类合约通常围绕共用的服务等级成果 (SLA) 构建,从而提高客户留存率和供应商的单位经济效益。 Kubernetes、站点可靠性工程 (SRE) 和财务维 (FinOps) 等领域的技能短缺进一步推高了服务费用,也印证了云端优先计画对长期成长有最大正面影响的原因。

混合云端迁移热潮

预计2022年至2027年间,全球云端ERP支出将成长近一倍,因为企业正在寻求工作负载可携性和合规性。到2025年,欧洲企业在IT服务上的支出将达到4,898亿欧元(5,535亿美元),其中45%将用于云端倡议。多重云端策略有助于避免供应商锁定,但也增加了管治的复杂性,并推动了对咨询和最佳化服务的需求。资料主权要求促使企业需要本地化的託管基础设施,从而扩大了近岸和在岸合约。提供认证云端架构师和託管FinOps人才的供应商正在整个IT服务市场赢得丰厚的合约。

服务价格商品化的压力

自动化和离岸规模化正在消除常见服务台和基础设施任务的进入门槛,挤压传统外包的利润空间。客户越来越倾向于收费模式,迫使供应商证明其服务能带来实际的业务影响。小规模的竞争对手透过降价来削弱服务,促使能够交叉销售高端咨询和保全服务的现有企业进行整合。预计未来两年,由此产生的市场洗牌将重塑IT服务市场的竞争格局。

细分市场分析

资安管理服务以 12.18% 的复合年增长率 (CAGR) 成长,是整个 IT 服务市场中成长最快的。企业意识到,专业服务提供者在威胁侦测和事件回应方面能够超越内部团队,因此越来越多地签订包含持续合规性监控的长期外包协议。 IT 外包仍占最大的营收份额,达到 28.04%,这主要得益于根深蒂固的成本优化需求。然而,商品化工作流程中的利润率压缩迫使供应商将外包和咨询服务打包,并捍卫其定价策略。云端和平台服务正受益于混合云端的普及。计划通常会与 ERP 现代化和资料整合层结合,从而促进交叉销售。

业务流程外包的需求趋势也十分有利,其中机器人流程自动化在财务、人力资源和产业专用的后勤部门职能部门尤为突出。随着复杂性的增加,IT咨询收入也在成长;企业需要指导来整合人工智慧、边缘运算和垂直云端。提供参考架构、迁移加速工具包和特定领域解决方案的供应商正在IT服务市场中占据越来越大的客户支出份额。

到2031年,中小企业市场将以10.92%的复合年增长率成长,反映出云端整合式ERP、CRM和网路安全解决方案的普及。付费使用制使中小企业能够采用以前只有大型企业才能使用的功能,并将实施时间从数月缩短至数週。医疗保健和金融服务业的合规负担促使中小企业利用外部专业知识,而不是建立内部控制机制,从而扩大了託管服务合作伙伴的潜在收入。

大型企业市场仍占总营收的69.42%,这主要得益于其庞大的传统资产,而这些资产需要製定长期的转型蓝图。融合内部专业中心和外部专业知识的混合模式正变得越来越普遍,为利基供应商创造了高价值的合约机会。企业买家在其招标书中越来越多地要求供应商提供永续性认证和碳排放报告应对力,这为在IT服务市场中追踪范围3排放的供应商开闢了差异化竞争的途径。

区域分析

2025年,北美将占全球收入的37.05%,这主要得益于2.7兆美元的企业技术支出以及人工智慧和云端平台的早期应用。联邦政府强制设立人工智慧管治委员会的倡议,使得策略咨询和实施服务的需求制度化。加拿大正在大力推动数位政府专案和自然资源自动化,而墨西哥的近岸提案则吸引寻求文化亲和性和智慧财产权保护的美国公司。

至2031年,亚太地区将以11.12%的复合年增长率领先全球。中国正大力推动智慧城市试点和绿色製造发展;印度正利用其作为分销中心的传统优势扩大国内需求;东南亚国协正努力弥合基础设施差距,以支持跨境电子商务和金融科技的成长。日本和韩国正将投资重点放在先进製造业和电信领域,并大力发展5G和边缘运算的专业咨询服务。儘管资讯科技支出日趋成熟,澳洲和纽西兰仍继续将网路安全和云端合规性作为银行和政府机构的优先事项。

到2025年,欧洲将在IT服务领域投入4,898亿欧元(约5,535亿美元),其中45%将用于云端运算专案。 GDPR、DORA和NIS2等法规结构将推动安全和合规方面的支出,确保合格供应商获得稳定的业务机会。德国主导製造业的数位化,英国将推动金融服务业的转型,法国、义大利和西班牙将加速采用云端ERP系统。东欧将发展成为近岸交付中心和现代化服务需求目的地,从而深化整体IT服务市场生态系统。

其他福利:

- Excel格式的市场预测(ME)表

- 分析师支持(3个月)

目录

第一章 引言

- 研究假设和市场定义

- 调查范围

第二章调查方法

第三章执行摘要

第四章 市场情势

- 市场概览

- 市场驱动因素

- 新冠疫情后加速数位转型

- 混合云端迁移热潮

- 网路威胁情势日益严峻

- 企业人工智慧和分析支出激增

- 产业特定云端平台的采用情况

- 以永续性为重点的绿色IT审核

- 市场限制

- 服务价格商业化的压力

- 全球人才短缺和离职率

- 数据主权面临的地缘政治障碍

- 范围 3 碳排放报告的合规成本

- 产业价值链分析

- 宏观经济因素的影响

- 关键法规结构评估

- 技术展望

- 波特五力分析

- 买方的议价能力

- 供应商的议价能力

- 新进入者的威胁

- 替代品的威胁

- 竞争对手之间的竞争

第五章 市场规模与成长预测

- 按服务类型

- IT咨询与实施支持

- IT外包(ITO)

- 业务流程外包(BPO)

- 资安管理服务

- 云端平台服务

- 按最终用户公司规模划分

- 中小企业

- 大公司

- 按部署模式

- 陆上交付

- 近岸交付

- 离岸交付

- 按最终用户行业划分

- BFSI

- 製造业

- 政府/公共部门

- 医疗保健和生命科学

- 零售和消费品

- 通讯与媒体

- 物流/运输

- 能源与公共产业

- 其他终端用户产业

- 按地区

- 北美洲

- 美国

- 加拿大

- 墨西哥

- 南美洲

- 巴西

- 阿根廷

- 南美洲其他地区

- 欧洲

- 德国

- 英国

- 法国

- 义大利

- 西班牙

- 俄罗斯

- 其他欧洲

- 亚太地区

- 中国

- 印度

- 日本

- 韩国

- ASEAN

- 澳洲和纽西兰

- 亚太其他地区

- 中东和非洲

- 中东

- 沙乌地阿拉伯

- 阿拉伯聯合大公国

- 土耳其

- 其他中东地区

- 非洲

- 南非

- 奈及利亚

- 埃及

- 其他非洲地区

- 中东

- 北美洲

第六章 竞争情势

- 市场集中度

- 策略趋势

- 市占率分析

- 公司简介

- Accenture plc

- International Business Machines Corporation(IBM)

- Tata Consultancy Services Limited(TCS)

- Infosys Limited

- Cognizant Technology Solutions Corporation

- Capgemini SE

- Wipro Limited

- HCL Technologies Limited

- DXC Technology Company

- Atos SE

- Fujitsu Limited

- NTT DATA Corporation

- CGI Inc.

- L&T Technology Services Limited

- Tech Mahindra Limited

- EPAM Systems Inc.

- Endava plc

- Globant SA

- Mindtree Limited

- Sopra Steria Group SA

- Rackspace Technology Inc.

- Virtusa Corporation

- Persistent Systems Limited

- UST Global Inc.

第七章 市场机会与未来展望

IT services market size in 2026 is estimated at USD 1651.6 billion, growing from 2025 value of USD 1518.1 billion with 2031 projections showing USD 2514.9 billion, growing at 8.78% CAGR over 2026-2031.

Robust digital-transformation agendas, an upswing in enterprise artificial-intelligence adoption, and rising cloud-native migrations are expanding addressable demand. Spending momentum is strongest in banking and healthcare, where 2024 outlays jumped 8.7% and 15% respectively as institutions modernized legacy cores. Providers able to bundle consulting, implementation, and managed services around hybrid-cloud and AI workloads capture premium contracts, while price-sensitive outsourcing engagements continue to anchor large-scale delivery pipelines. Heightened consolidation-including multibillion-dollar acquisitions-shows that scale, vertical depth, and intellectual-property differentiation are now decisive in winning enterprise renewals.

Global IT Services Market Trends and Insights

Digital-transformation acceleration post-COVID-19

Multi-cloud adoption has crossed 87% of enterprises, while 51% are funding cloud-native modernization tracks that bundle application refactoring, AI services and data platforms. The Global IT services market now rewards providers that master container orchestration, micro-services and DevOps over simple lift-and-shift migration. DXC Technology's "Cloud Right" approach enabled Ocean Network Express to achieve zero-downtime migration, showcasing how vendors move from infrastructure caretakers to strategic business partners. Revenue pools are shifting toward advisory and managed cloud operations layers that demand both deep technical credentials and sector insight. These engagements, typically structured around shared service-level outcomes, lift provider stickiness and unit economics. Skills scarcity in Kubernetes, site reliability engineering and FinOps is further buoying service rates, underscoring why cloud-first programmes add the highest positive delta to long-run growth.

Hybrid-cloud migration boom

Global cloud-ERP outlays are on track to nearly double between 2022 and 2027 as enterprises pursue workload portability and regulatory compliance. European firms directed EUR 489.8 billion (USD 553.5 billion) to IT services in 2025, with 45% tagged for cloud initiatives. Multi-cloud strategies help organizations avert vendor lock-in, yet they impose governance complexity that drives demand for advisory and optimization services. Data sovereignty mandates heighten the need for region-specific hosting footprints, bolstering nearshore and onshore engagements. Providers offering certified cloud architects and managed FinOps talent are capturing high-margin contracts across the IT services market.

Service-price commoditization pressure

Automation and offshore scale have erased entry barriers for common help-desk and infrastructure tasks, compressing margins in traditional outsourcing. Clients increasingly demand outcome-based billing, compelling vendors to prove tangible business impact. Smaller rivals undercut pricing, which accelerates consolidation among incumbents able to cross-sell premium consulting and security offerings. The resulting shake-out is likely to realign the competitive order within the IT services market over the next two years.

Other drivers and restraints analyzed in the detailed report include:

- Escalating cyber-threat landscape

- Enterprise AI and analytics spend surge

- Global talent shortage and attrition

For complete list of drivers and restraints, kindly check the Table Of Contents.

Segment Analysis

Managed Security Services is growing at a 12.18% CAGR, the steepest rate across the IT services market. Enterprises accept that specialized providers outperform internal teams in threat detection and incident response, prompting long-term outsourcing contracts that include continuous compliance monitoring. IT Outsourcing retains the largest 28.04% revenue position due to entrenched cost-optimization mandates. However, margin compression in commoditized workstreams is pushing vendors to package outsourcing with consulting to protect pricing. Cloud and Platform Services benefit from surging hybrid-cloud adoption; projects frequently bundle ERP modernization with data-integration layers, supporting cross-selling momentum.

Demand dynamics also favor Business Process Outsourcing, especially in finance, HR, and industry-specific back-office workflows where robotic process automation amplifies efficiency gains. IT Consulting revenues rise on complexity: organizations need guidance to harmonize AI, edge computing, and vertical clouds. Vendors that deliver reference architectures, accelerated migration toolkits, and domain-centric solutions increase wallet share across the IT services market.

Small and Medium Enterprises register an 10.92% CAGR through 2031, reflecting democratized access to cloud-delivered ERP, CRM, and cybersecurity bundles. Consumption-based pricing allows SMEs to deploy capabilities historically reserved for large corporations, compressing deployment timelines from months to weeks. Compliance burdens in healthcare and financial services incentivize SMEs to engage external specialists rather than build in-house controls, expanding addressable revenue for managed-service partners.

Large Enterprises still command 69.42% revenue, underpinned by sprawling legacy estates that demand long-duration transformation roadmaps. Hybrid models blending internal centers of excellence with targeted external expertise prevail, securing high-value contracts for niche providers. Enterprise buyers increasingly list sustainability credentials and carbon-reporting readiness in RFPs, offering differentiation avenues for providers that track Scope-3 emissions across the IT services market.

The IT Services Market Report is Segmented by Service Type (IT Consulting and Implementation, and More), End-User Enterprise Size (Small and Medium Enterprises, and More), Deployment Model (Onshore, Nearshore, and More), End-User Vertical (BFSI, Manufacturing, and More), and Geography (North America, South America, Europe, Asia-Pacific, and Middle East and Africa). The Market Forecasts are Provided in Terms of Value (USD).

Geography Analysis

North America represents 37.05% of 2025 revenue, steered by USD 2.7 trillion in enterprise tech spending and early-adopter behavior toward AI and cloud platforms. Federal mandates requiring AI governance boards have institutionalized demand for strategic advisory and implementation services. Canada advances digital-government programs and natural-resource automation, whereas Mexico's nearshore proposition attracts U.S. firms seeking cultural affinity and IP protection.

Asia-Pacific records the highest 11.12% CAGR through 2031. China scales smart-city pilots and green-manufacturing upgrades, India leverages its delivery-hub heritage while expanding domestic demand, and ASEAN economies close infrastructure gaps to support cross-border e-commerce and fintech growth. Japan and South Korea funnel investments into advanced manufacturing and telecom, spurring niche consulting around 5G and edge computing. Australia and New Zealand, despite mature IT spend, continue prioritizing cybersecurity and cloud compliance in banking and government.

Europe allocates EUR 489.8 billion (USD 553.5 billion) to IT services in 2025, 45% of which funds cloud programs. Regulatory frameworks-GDPR, DORA, and NIS2-propel security and compliance spend, ensuring consistent engagement pipelines for qualified providers. Germany spearheads manufacturing digitization, the United Kingdom leads in financial services transformation, and France, Italy, and Spain scale cloud-ERP rollouts. Eastern Europe develops as both a nearshore delivery basin and a consumer of modernization services, strengthening ecosystem depth across the IT services market.

- Accenture plc

- International Business Machines Corporation (IBM)

- Tata Consultancy Services Limited (TCS)

- Infosys Limited

- Cognizant Technology Solutions Corporation

- Capgemini SE

- Wipro Limited

- HCL Technologies Limited

- DXC Technology Company

- Atos SE

- Fujitsu Limited

- NTT DATA Corporation

- CGI Inc.

- L&T Technology Services Limited

- Tech Mahindra Limited

- EPAM Systems Inc.

- Endava plc

- Globant S.A.

- Mindtree Limited

- Sopra Steria Group SA

- Rackspace Technology Inc.

- Virtusa Corporation

- Persistent Systems Limited

- UST Global Inc.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET LANDSCAPE

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 Digital-transformation acceleration post-COVID-19

- 4.2.2 Hybrid-cloud migration boom

- 4.2.3 Escalating cyber-threat landscape

- 4.2.4 Enterprise AI and analytics spend surge

- 4.2.5 Vertical-specific cloud platforms adoption

- 4.2.6 Sustainability-driven Green-IT audits

- 4.3 Market Restraints

- 4.3.1 Service-price commoditization pressure

- 4.3.2 Global talent shortage and attrition

- 4.3.3 Data-sovereignty geopolitical barriers

- 4.3.4 Scope-3 carbon-reporting compliance costs

- 4.4 Industry Value Chain Analysis

- 4.5 Impact of Macroeconomic Factors

- 4.6 Evaluation of Critical Regulatory Framework

- 4.7 Technological Outlook

- 4.8 Porter's Five Forces Analysis

- 4.8.1 Bargaining Power of Buyers

- 4.8.2 Bargaining Power of Suppliers

- 4.8.3 Threat of New Entrants

- 4.8.4 Threat of Substitutes

- 4.8.5 Competitive Rivalry

5 MARKET SIZE AND GROWTH FORECASTS (VALUE)

- 5.1 By Service Type

- 5.1.1 IT Consulting and Implementation

- 5.1.2 IT Outsourcing (ITO)

- 5.1.3 Business Process Outsourcing (BPO)

- 5.1.4 Managed Security Services

- 5.1.5 Cloud and Platform Services

- 5.2 By End-User Enterprise Size

- 5.2.1 Small and Medium Enterprises (SMEs)

- 5.2.2 Large Enterprises

- 5.3 By Deployment Model

- 5.3.1 Onshore Delivery

- 5.3.2 Nearshore Delivery

- 5.3.3 Offshore Delivery

- 5.4 By End-user Vertical

- 5.4.1 BFSI

- 5.4.2 Manufacturing

- 5.4.3 Government and Public Sector

- 5.4.4 Healthcare and Life-Sciences

- 5.4.5 Retail and Consumer Goods

- 5.4.6 Telecom and Media

- 5.4.7 Logistics and Transport

- 5.4.8 Energy and Utilities

- 5.4.9 Other End-user Verticals

- 5.5 By Geography

- 5.5.1 North America

- 5.5.1.1 United States

- 5.5.1.2 Canada

- 5.5.1.3 Mexico

- 5.5.2 South America

- 5.5.2.1 Brazil

- 5.5.2.2 Argentina

- 5.5.2.3 Rest of South America

- 5.5.3 Europe

- 5.5.3.1 Germany

- 5.5.3.2 United Kingdom

- 5.5.3.3 France

- 5.5.3.4 Italy

- 5.5.3.5 Spain

- 5.5.3.6 Russia

- 5.5.3.7 Rest of Europe

- 5.5.4 Asia-Pacific

- 5.5.4.1 China

- 5.5.4.2 India

- 5.5.4.3 Japan

- 5.5.4.4 South Korea

- 5.5.4.5 ASEAN

- 5.5.4.6 Australia and New Zealand

- 5.5.4.7 Rest of Asia-Pacific

- 5.5.5 Middle East and Africa

- 5.5.5.1 Middle East

- 5.5.5.1.1 Saudi Arabia

- 5.5.5.1.2 United Arab Emirates

- 5.5.5.1.3 Turkey

- 5.5.5.1.4 Rest of Middle East

- 5.5.5.2 Africa

- 5.5.5.2.1 South Africa

- 5.5.5.2.2 Nigeria

- 5.5.5.2.3 Egypt

- 5.5.5.2.4 Rest of Africa

- 5.5.5.1 Middle East

- 5.5.1 North America

6 COMPETITIVE LANDSCAPE

- 6.1 Market Concentration

- 6.2 Strategic Moves

- 6.3 Market Share Analysis

- 6.4 Company Profiles (includes Global level Overview, Market level overview, Core Segments, Financials as available, Strategic Information, Market Rank/Share for key companies, Products and Services, and Recent Developments)

- 6.4.1 Accenture plc

- 6.4.2 International Business Machines Corporation (IBM)

- 6.4.3 Tata Consultancy Services Limited (TCS)

- 6.4.4 Infosys Limited

- 6.4.5 Cognizant Technology Solutions Corporation

- 6.4.6 Capgemini SE

- 6.4.7 Wipro Limited

- 6.4.8 HCL Technologies Limited

- 6.4.9 DXC Technology Company

- 6.4.10 Atos SE

- 6.4.11 Fujitsu Limited

- 6.4.12 NTT DATA Corporation

- 6.4.13 CGI Inc.

- 6.4.14 L&T Technology Services Limited

- 6.4.15 Tech Mahindra Limited

- 6.4.16 EPAM Systems Inc.

- 6.4.17 Endava plc

- 6.4.18 Globant S.A.

- 6.4.19 Mindtree Limited

- 6.4.20 Sopra Steria Group SA

- 6.4.21 Rackspace Technology Inc.

- 6.4.22 Virtusa Corporation

- 6.4.23 Persistent Systems Limited

- 6.4.24 UST Global Inc.

7 MARKET OPPORTUNITIES AND FUTURE OUTLOOK

- 7.1 White-space and Unmet-Need Assessment