|

市场调查报告书

商品编码

1911387

印尼设施管理市场:市场占有率分析、产业趋势与统计、成长预测(2026-2031)Indonesia Facility Management - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2026 - 2031) |

||||||

※ 本网页内容可能与最新版本有所差异。详细情况请与我们联繫。

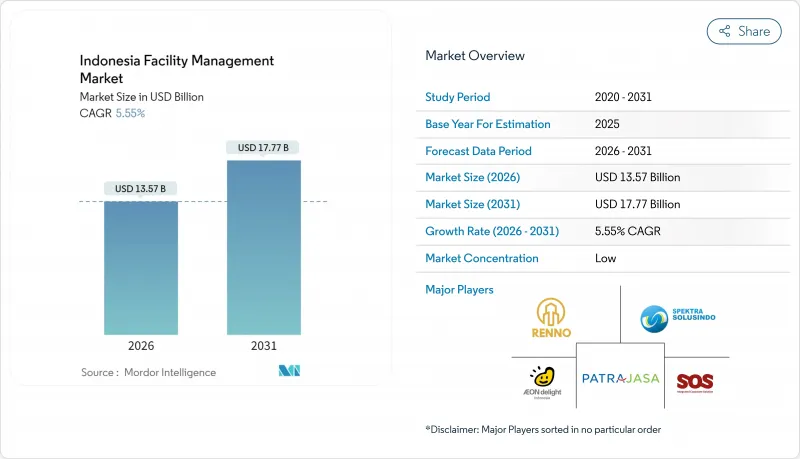

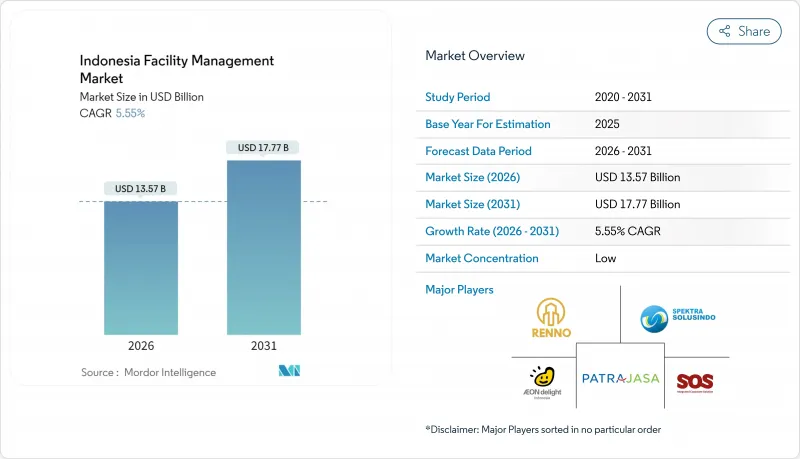

预计印尼设施管理市场将从 2025 年的 128.6 亿美元成长到 2026 年的 135.7 亿美元,到 2031 年将达到 177.7 亿美元,2026 年至 2031 年的复合年增长率为 5.55%。

加速的都市化、31.7亿美元的基础建设资金筹措计画以及政府设定的8%年经济成长目标,是推动印尼设施管理市场成长要素。雅加达及其他大都会圈商业房地产活动的活性化,不断推高了对综合服务的需求;同时,2022年332亿美元的工业投资也增加了对技术专长支援的需求。外包趋势的兴起、物联网平台的普及以及与永续性相关的强制性要求,正在重塑营运模式。同时,薪资上涨、监管日益复杂以及人才流失加剧,都给服务提供者的利润率带来了压力。因此,技术赋能的差异化和基于绩效的合同,正成为印尼设施管理市场的关键竞争策略。

印尼设施管理市场趋势与洞察

主要都会区的都市化

印尼城市人口的快速成长正在重塑其设施管理市场,住宅、办公室和交通计划激增,资产绩效要求也日益严格。雅加达1,130万居民给现有设施带来了越来越大的压力,而以公共交通为导向的开发项目(TOD)正推动房地产价值上涨高达10%,刺激了对先进维护、基于物联网的入住率监控和预测性服务模式的需求。居住者的涌入提高了服务品质标准,迫使服务提供者在安全、卫生和数位化报告通讯协定达到全球标准。

入住率优化方面的进展

混合办公模式正迫使业主和租户释放潜在的占地面积利用效率。设施管理人员正在部署感测器网路和分析平台,将人员占用数据与暖通空调、照明和安防系统连接起来,从而实现可衡量的节能效果,例如PT Aspex Kumbong位于茂物(Bogor)的工厂实现了8.5%的节能。薪酬结构与绩效的关联日益增强,资料驱动型文化正在印尼的设施管理市场中兴起。

主要企业面临利润压力

对价格敏感的顾客和不断上涨的工资给盈利带来了压力。索迪斯设施服务业务在2025年第一季成长了2.4%,印证了这一趋势。增值税(VAT)于2025年1月上调至12%,进一步推高了营运成本,对协商价格构成压力。主要企业正透过自动化工单管理、精简员工队伍以及重新谈判合同,转向基于绩效的收费系统来应对这项挑战。

细分市场分析

到2025年,硬性服务将占印尼设施管理市场58.42%的份额,这主要得益于基础建设的扩张和大型计划严格的安全标准。机电管道(MEP)工程建设占据主导地位,这主要受热带气候下空调需求增加以及紧急系统审核日益增加的推动。与新建收费公路、港口和铁路走廊相关的资产管理项目也为稳定的费用收入提供了保障。软性服务预计到2031年将以每年6.78%的速度成长,这主要得益于租户对使用者体验和卫生状况的重视。保安、清洁和餐饮营运商正在利用智慧摄影机、机器人清洁设备和营养分析来提高效率并满足ESG(环境、社会和治理)报告指标。医疗保健和酒店业不断提高的服务期望正在扩大高端外包的机会,并逐步重新平衡印尼设施管理市场的收入结构。

其他福利:

- Excel格式的市场预测(ME)表

- 3个月的分析师支持

目录

第一章 引言

- 研究假设和市场定义

- 调查范围

第二章调查方法

第三章执行摘要

第四章 市场情势

- 市场概览

- 目前运转率

- 主要FM业者的盈利能力

- 劳动指标 - 劳动参与率

- 按服务类型分類的设施管理市场占有率(%)

- 以硬性服务分類的设施管理市场占有率(%)

- 按软体服务分類的设施管理市场占有率(%)

- 主要都会区的都市化和人口成长

- 印尼基础设施发展计画中的产业投资优先事项

- 劳动和安全标准的监管驱动因素

- 市场驱动因素

- 主要都会区的都市化

- 优化运转率的进展

- 基础建设管道投资

- 劳动与安全法规

- ESG相关贷款的激增有利于获得绿色认证的设施。

- 区域城市混合用途大型开发案迅速增加

- 市场限制

- 主要企业面临利润压力

- 技术纯熟劳工短缺

- 对进口建筑自动化设备的依赖

- 分散的州级法律规范

- 价值链分析

- PESTEL 分析

- 新参与企业的监管和法律体制

- 宏观经济指标对FM需求的影响

- 波特五力分析

- 供应商的议价能力

- 买方的议价能力

- 新进入者的威胁

- 替代品的威胁

- 竞争对手之间的竞争

- 投资与资金筹措分析

第五章 市场规模与成长预测

- 按服务类型

- 硬服务

- 资产管理

- 机电及暖通空调服务

- 消防设备和安全措施

- 其他硬体维修服务

- 软服务

- 办公室支援与安全

- 清洁服务

- 餐饮服务

- 其他软性调频服务

- 硬服务

- 按规定表格

- 内部管理

- 外包

- 单频调频

- 综合设施管理

- 综合设施管理(综合FM)

- 按最终用户行业划分

- 商业设施(IT/通讯、零售/仓储等)

- 餐饮服务业(饭店、餐厅、大型餐厅)

- 公共及公共基础设施(政府机构、教育机构、交通运输)

- 医疗保健(公立和私立机构)

- 工业和流程(製造业、能源业、采矿业)

- 其他终端用户产业(多用户住宅、娱乐、运动和休閒)

第六章 竞争情势

- 市场集中度

- 策略发展与伙伴关係

- 市占率分析

- 公司简介

- PT. SGS Indonesia(Societe Generale de Surveillance SA(SGS SA))

- OCS Group Holdings Ltd

- PT Shield On Service Tbk(SOS)

- Sodexo Group

- ISS A/S

- PT Patra Jasa

- PT. Spektra Solusindo

- Titan Facility Services

- Astra Property Services

- Angkasa Pura Supports

- Colliers

- Renno Indonesia

- AEON Deligh Indonesia

- Indoservice

- Atalian Global Services

第七章 市场机会与未来展望

The Indonesia facility management market is expected to grow from USD 12.86 billion in 2025 to USD 13.57 billion in 2026 and is forecast to reach USD 17.77 billion by 2031 at 5.55% CAGR over 2026-2031.

Accelerating urbanisation, a USD 3.17 billion infrastructure financing pipeline, and the government's goal of 8% annual economic expansion are the primary growth catalysts. Commercial real-estate activity in Jakarta and other metros continues to spur demand for integrated services, while industrial investments worth USD 33.2 billion in 2022 amplify requirements for technically specialised support. Outsourcing momentum, the adoption of Internet-of-Things (IoT) platforms, and sustainability-linked mandates are reshaping operating models. Meanwhile, wage inflation, regulatory complexity and an intensifying talent drain put pressure on provider margins. Technology-enabled differentiation and outcome-based contracts therefore emerge as pivotal competitive strategies within the Indonesia facility management market.

Indonesia Facility Management Market Trends and Insights

Urbanisation in Major Metros

Soaring city populations reconfigure the Indonesia facility management market as surging housing, office and transit projects tighten asset-performance requirements. Jakarta's 11.3 million residents intensify pressure on existing stock, while transport-oriented developments raise property values by up to 10 %, triggering demand for advanced maintenance, IoT-based occupancy monitoring and predictive service models. Expatriate inflows heighten service-quality benchmarks, pushing providers toward globally aligned safety, hygiene and digital reporting protocols.

Rising Occupancy Optimisation

Hybrid work policies oblige landlords and tenants to unlock latent floor-space efficiencies. Facility managers deploy sensor networks and analytics platforms that knit occupancy data to HVAC, lighting and security systems, delivering measured energy savings such as the 8.5 % electricity reduction achieved at PT Aspex Kumbong's Bogor plant. Compensation structures are increasingly tied to utilisation outcomes, cementing a data-driven culture across the wider Indonesia facility management market.

Margin Pressure on Leading Firms

Price-sensitive clients and rising wages compress profitability. Sodexo's Q1 2025 facilities-services growth of 2.4 % underscores the trend. A January 2025 VAT rise to 12 % further heightens operating costs, squeezing negotiated rates. Key players counter by automating work-order management, consolidating labour pools and renegotiating contracts toward performance-linked fee structures.

Other drivers and restraints analyzed in the detailed report include:

- Infrastructure Pipeline Investment

- Labour and Safety Regulation

- Skilled Labour Shortages

For complete list of drivers and restraints, kindly check the Table Of Contents.

Segment Analysis

Hard Services held 58.42 % of the Indonesia facility management market share in 2025, driven by infrastructure build-out and stringent safety codes across mega-projects. Mechanical, electrical and plumbing (MEP) work dominates, backed by tropical-climate HVAC demand and stricter emergency-system audits. Asset-management programmes attached to new toll roads, ports and rail corridors underpin stable fee income. Soft Services, forecast to expand 6.78 % annually to 2031, gain momentum as occupants prioritise user experience and hygiene. Security, cleaning and catering providers leverage smart cameras, robotic cleaners and nutritional analytics to improve efficiency and satisfy ESG reporting metrics. Elevated service expectations in healthcare and hospitality amplify premium outsourcing opportunities, gradually rebalancing revenue weightings within the wider Indonesia facility management market.

The Indonesia Facility Management Market Report is Segmented by Service Type (Hard Services, and Soft Services), Offering Type (In-House, and Outsourced), and End-User Industry (Commercial, Hospitality, Institutional and Public Infrastructure, Healthcare, Industrial and Process, and Other End-User Industries). The Market Forecasts are Provided in Terms of Value (USD).

List of Companies Covered in this Report:

- PT. SGS Indonesia (Societe Generale de Surveillance SA (SGS SA))

- OCS Group Holdings Ltd

- PT Shield On Service Tbk (SOS)

- Sodexo Group

- ISS A/S

- PT Patra Jasa

- PT. Spektra Solusindo

- Titan Facility Services

- Astra Property Services

- Angkasa Pura Supports

- Colliers

- Renno Indonesia

- AEON Deligh Indonesia

- Indoservice

- Atalian Global Services

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET LANDSCAPE

- 4.1 Market Overview

- 4.1.1 Current Occupancy Rates

- 4.1.2 Profitability Rates of Major FM Players

- 4.1.3 Workforce Indicators - Labor Participation

- 4.1.4 Facility Management Market Share (%), by Service Type

- 4.1.5 Facility Management Market Share (%), by Hard Services

- 4.1.6 Facility Management Market Share (%), by Soft Services

- 4.1.7 Urbanization and Population Growth in Major Metros

- 4.1.8 Sector Investment Priorities in Indonesia's Infrastructure Pipeline

- 4.1.9 Regulatory Drivers Specific to Labour and Safety Standards

- 4.2 Market Drivers

- 4.2.1 Urbanisation in Major Metros

- 4.2.2 Rising Occupancy Optimisation

- 4.2.3 Infrastructure Pipeline Investment

- 4.2.4 Labour and Safety Regulation

- 4.2.5 Surge in ESG-linked Financing Favoring Green-Certified Facilities

- 4.2.6 Proliferation of Mixed-Use Mega-Developments in Secondary Cities

- 4.3 Market Restraints

- 4.3.1 Margin Pressure on Leading Firms

- 4.3.2 Skilled Labour Shortages

- 4.3.3 Dependency on Imported Building Automation Hardware

- 4.3.4 Fragmented Provincial Regulatory Oversight

- 4.4 Value Chain Analysis

- 4.5 PESTEL Analysis

- 4.6 Regulatory and Legislative Framework for Market Entrants

- 4.7 Impact of Macroeconomic Indicators on FM Demand

- 4.8 Porter's Five Forces Analysis

- 4.8.1 Bargaining Power of Suppliers

- 4.8.2 Bargaining Power of Buyers

- 4.8.3 Threat of New Entrants

- 4.8.4 Threat of Substitute Services

- 4.8.5 Intensity of Competitive Rivalry

- 4.9 Investment and Funding Analysis

5 MARKET SIZE AND GROWTH FORECASTS (VALUES)

- 5.1 By Service Type

- 5.1.1 Hard Services

- 5.1.1.1 Asset Management

- 5.1.1.2 MEP and HVAC Services

- 5.1.1.3 Fire Systems and Safety

- 5.1.1.4 Other Hard FM Services

- 5.1.2 Soft Services

- 5.1.2.1 Office Support and Security

- 5.1.2.2 Cleaning Services

- 5.1.2.3 Catering Services

- 5.1.2.4 Other Soft FM Services

- 5.1.1 Hard Services

- 5.2 By Offering Type

- 5.2.1 In-house

- 5.2.2 Outsourced

- 5.2.2.1 Single FM

- 5.2.2.2 Bundled FM

- 5.2.2.3 Integrated FM

- 5.3 By End-user Industry

- 5.3.1 Commercial (IT and Telecom, Retail and Warehouses, etc.)

- 5.3.2 Hospitality (Hotels, Eateries, Large-scale Restaurants)

- 5.3.3 Institutional and Public Infrastructure (Govt, Education, Transportation)

- 5.3.4 Healthcare (Public and Private Facilities)

- 5.3.5 Industrial and Process (Manufacturing, Energy, Mining)

- 5.3.6 Other End-user Industries (Multi-housing, Entertainment, Sports and Leisure)

6 COMPETITIVE LANDSCAPE

- 6.1 Market Concentration

- 6.2 Strategic Moves and Partnerships

- 6.3 Market Share Analysis

- 6.4 Company Profiles (includes Global level Overview, Market level overview, Core Segments, Financials as available, Strategic Information, Market Rank/Share for key companies, Products and Services, and Recent Developments)

- 6.4.1 PT. SGS Indonesia (Societe Generale de Surveillance SA (SGS SA))

- 6.4.2 OCS Group Holdings Ltd

- 6.4.3 PT Shield On Service Tbk (SOS)

- 6.4.4 Sodexo Group

- 6.4.5 ISS A/S

- 6.4.6 PT Patra Jasa

- 6.4.7 PT. Spektra Solusindo

- 6.4.8 Titan Facility Services

- 6.4.9 Astra Property Services

- 6.4.10 Angkasa Pura Supports

- 6.4.11 Colliers

- 6.4.12 Renno Indonesia

- 6.4.13 AEON Deligh Indonesia

- 6.4.14 Indoservice

- 6.4.15 Atalian Global Services

7 MARKET OPPORTUNITIES AND FUTURE OUTLOOK

- 7.1 White-space and Unmet-Need Assessment

- 7.2 Technology-led Integrated FM (IoT, BMS, AI-based Predictive Maintenance)

- 7.3 ESG-compliant FM Solutions Demand

- 7.4 Future Service-Model Shifts (Outcome-based Contracts)