|

市场调查报告书

商品编码

1911398

义大利设施管理市场:市场占有率分析、产业趋势与统计、成长预测(2026-2031)Italy Facility Management - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2026 - 2031) |

||||||

※ 本网页内容可能与最新版本有所差异。详细情况请与我们联繫。

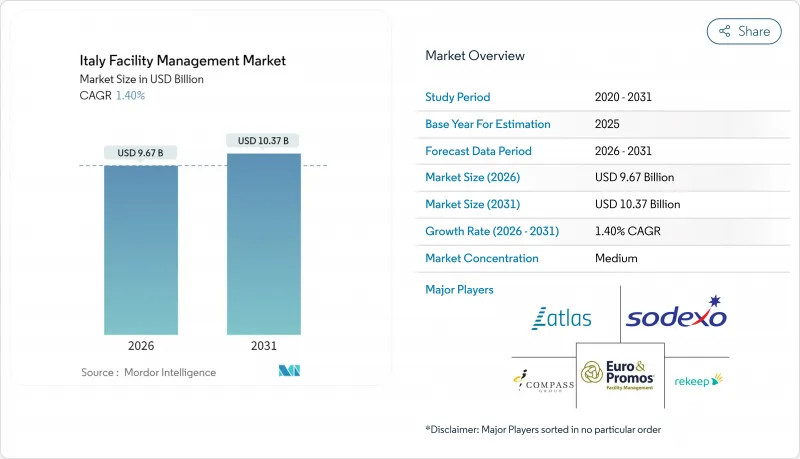

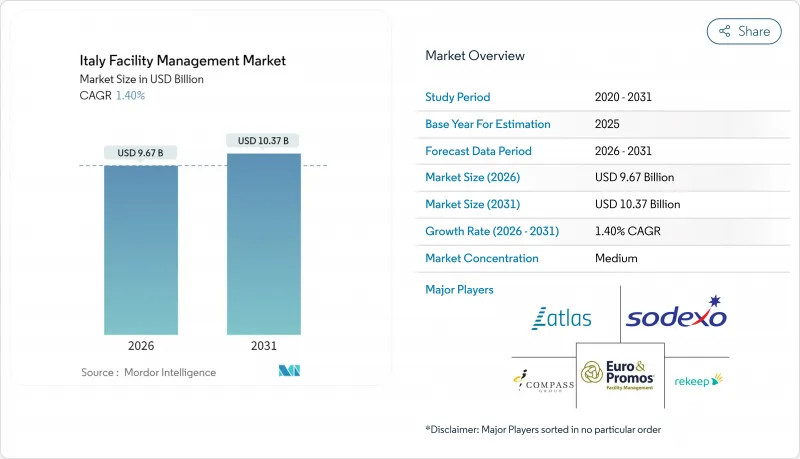

预计义大利设施管理市场将从 2025 年的 95.4 亿美元成长到 2026 年的 96.7 亿美元,到 2031 年将达到 103.7 亿美元,2026 年至 2031 年的复合年增长率为 1.4%。

这一稳步增长得益于国家復苏与韧性计划、商业房地产的逐步復苏以及儘管电力和天然气价格上涨,但对综合合约的需求仍然增加。预测性维护的日益普及、资产所有者对环境、社会和治理(ESG)监管的加强以及新的公共采购法规,共同塑造了义大利设施管理市场的竞争格局。同时,技术投资持续转向物联网赋能的暖通空调最佳化和远端资产监控。 2024年,义大利设施管理市场的核心硬性服务部门维持了稳健发展,而旅游业带来的资本流入则加速了饭店和豪华度假村对软性服务的需求。义大利北部地区的人手不足给供应商利润率带来了压力,促使他们转向自动化和基于绩效的合约模式(将报酬与可衡量的建筑性能指标挂钩)。

义大利设施管理市场趋势与洞察

公共部门组织的外包趋势正在扩大设施管理市场。

随着公共采购法(D.Lgs. 36/2023)引入简化的竞标程序,市政预算缩减,非核心业务外包的趋势也随之加速,使得市政当局能够将多项服务整合到基于绩效的合约中。例如,托斯卡纳大区已将38家博物馆的营运外包给同一家供应商,这展现了一种可扩展的文化遗产外包模式,该模式在降低协调成本的同时,也提高了服务品质。大规模框架合约也促进了统一数位平台和物联网技术的应用,为义大利设施管理市场提供了永续的成长动力。

义大利旅游和酒店业的成长推动了对软性设施管理服务的需求。

预计2024年酒店投资额将超过21亿欧元(24亿美元),比过去十年的平均值高出30%。这促使罗马、威尼斯和米兰等地的度假酒店更加重视客房清洁、礼宾服务和餐饮等高频次服务。平均每日住宿上涨了4%,吸引了6,450万游客。这推动了对能够灵活调整产能以应对季节性波动的饭店供应商的需求。永续发展认证和节能高效的后勤部门营运正成为重要的选择标准,进一步推动了以技术主导的软性服务的发展,并支持义大利物业管理市场的短期扩张。

义大利各州法规结构的碎片化增加了合规成本。

义大利20个大区依据2008年第81号法令(职业安全与健康法)拥有职场安全执法权,导致各地检查安排和文件记录有差异。儘管即将在2025年5月达成国家与各大区协议,但培训标准化的进展并不均衡,迫使跨区域的设施管理服务提供者必须维持各自独立的合规团队,从而阻碍了跨区域的规模经济效益。这些成本抵销了义大利设施管理市场部分营运利润率的提升。

细分市场分析

截至2025年,硬性服务占义大利设施管理市场占有率的58.85%。强制性消防检查、机电设备升级和暖通空调维修支撑了这一主导地位,尤其是在医院设施中,医院设施的年度平均设施管理支出达到每平方公尺161.58欧元。即使在可自由支配支出减少的时期,合规主导的投资也支撑了市场需求,硬性服务市场规模维持了温和成长。

然而,在高端旅游业復苏以及不断完善的职场通讯协定(包括卫生、餐饮和保全标准)的推动下,软性服务预计到2031年将以2.38%的复合年增长率成长。随着医疗保健和旅馆业客户加强感染控制措施,清洁服务成长尤为强劲。Lazio政府大楼的数位双胞胎试点计画展示了空间优化分析如何加强环境品质与居住者体验之间的联繫,从而为软性服务提供者创造利润丰厚的咨询业务。

义大利设施管理市场按服务类型(硬性服务、软性服务)、交付模式(内部交付、外包)和最终用户行业(商业(IT和电信、零售和仓储)、酒店(酒店、餐饮、大型餐厅)、公共及公共基础设施(政府、教育、交通))进行细分。市场预测以以金额为准。

其他福利:

- Excel格式的市场预测(ME)表

- 3个月的分析师支持

目录

第一章 引言

- 研究假设和市场定义

- 调查范围

第二章调查方法

第三章执行摘要

第四章 市场情势

- 市场概览

- 目前运转率

- 主要FM业者的盈利能力

- 劳动指标 - 劳动参与率

- 按服务类型分類的设施管理市场占有率(%)

- 以硬性服务分類的设施管理市场占有率(%)

- 软服务设施管理市场占有率(%)

- 主要都会区的都市化和人口成长

- 义大利基础设施计画中的产业投资优先事项

- 与劳动和安全标准相关的监管因素

- 市场驱动因素

- 公共部门组织的外包趋势扩大了设施管理市场

- 义大利旅游和酒店业的成长推动了对软性设施管理服务的需求。

- 为优化成本,越来越多采用综合设施管理合约。

- 老旧建筑需要预测性维护和维修服务。

- 欧盟復苏与韧性基金为学校维修计划提供的资金促进了当地设施管理的发展机会。

- 义大利北部资料中心产业的扩张推动了对专业技术设施管理人员的需求。

- 市场限制

- 义大利各地区法规结构的碎片化增加了合规成本。

- 技术工人成本不断上涨,对设施管理服务提供者的利润率带来压力。

- 5G基础设施部署的延迟将延缓智慧建筑设施管理的普及。

- 由于新冠疫情后地方政府预算紧张,中小型城市公共设施维护外包业务减少。

- 价值链分析

- PESTEL 分析

- 新参与企业的监管和法律体制

- 宏观经济指标对FM需求的影响

- 波特五力分析

- 供应商的议价能力

- 买方的议价能力

- 新进入者的威胁

- 替代品的威胁

- 竞争对手之间的竞争

- 投资与资金筹措分析

第五章 市场规模与成长预测

- 按服务类型

- 硬服务

- 资产管理

- 机电及暖通空调服务

- 消防系统和安全措施

- 其他硬体维修服务

- 软服务

- 办公室支援与安全

- 清洁服务

- 餐饮服务

- 其他软性调频服务

- 硬服务

- 以规定形式

- 内部管理

- 外包

- 单频调频

- 捆绑式设施管理(捆绑式FM)

- 综合设施管理(综合FM)

- 按最终用户行业划分

- 商业设施(IT/通讯、零售/仓储等)

- 餐饮服务业(饭店、餐厅、大型餐厅)

- 公共及公共基础设施(政府、教育、交通)

- 医疗保健(公立和私立机构)

- 工业和流程(製造业、能源业、采矿业)

- 其他终端用户产业(多用户住宅、娱乐、运动和休閒)

第六章 竞争情势

- 市场集中度

- 策略发展与伙伴关係

- 市占率分析

- 公司简介

- ATLAS IFM SRL

- Sodexo Facilities Management Services(SODEXO GROUP)

- Compass Group PLC

- Euro & Promos Facility Management SPA(EURO & PROMOS)

- Rekeep SpA

- Olly Services SRL

- NAZCA

- Elmet SRL

- Apleona GmbH

- SGI Srl

- CNS Consorzio Nazionale Servizi

- Siram SpA

- BumaQ Srl

- Ares Facility Management

- P&P Spa

第七章 市场机会与未来展望

The Italy facility management market is expected to grow from USD 9.54 billion in 2025 to USD 9.67 billion in 2026 and is forecast to reach USD 10.37 billion by 2031 at 1.4% CAGR over 2026-2031.

The measured expansion traced back to the National Recovery and Resilience Plan, the gradual rebound of commercial real estate, and stepped-up demand for integrated contracts despite rising electricity and gas prices. Growing adoption of predictive maintenance, heightened ESG scrutiny from asset owners, and new public-procurement rules all shaped the competitive logic of the Italy facility management market, while technology spending continued to shift toward IoT-enabled HVAC optimisation and remote asset monitoring. The hard-services core of the Italy facility management market retained a strong base in 2024, yet soft-services demand accelerated as tourism led capital inflows back into hotels and luxury resorts. Provider margins came under pressure from labour shortages in northern regions, prompting a shift towards automation and outcome-based contracting models that tie remuneration to measurable building-performance metrics.

Italy Facility Management Market Trends and Insights

Outsourcing Trend Among Public Sector Entities Expanding FM Market

Reduced municipal budgets intensified the outsourcing of non-core activities after the Public Procurement Code (D.Lgs. 36/2023) simplified tendering, enabling municipalities to bundle multiple services under performance-based contracts. The Tuscany region, for instance, awarded a single provider responsibility for 38 museums, demonstrating scalable cultural heritage outsourcing models that trim coordination costs while improving service consistency. Larger frameworks encouraged unified digital platforms and IoT adoption, creating sustained momentum for the Italy facility management market.

Growth of Italy's Tourism and Hospitality Sector Boosts Demand for Soft FM Services

Hotel investments exceeded EUR 2.1 billion(USD 2.4 billion) in 2024-30% above the decade average-prompting resorts in Rome, Venice, and Milan to sharpen focus on high-presence services such as housekeeping, concierge and catering. Average daily rates rose 4% alongside 64.5 million visitor arrivals, spurring providers that could flex capacity with seasonal volatility. Sustainability labels and energy-efficient back-of-house operations emerged as core selection criteria, further propelling technology-driven soft-service offerings and underpinning near-term expansion of the Italy facility management market.

Fragmented Regulatory Framework Across Italian Regions Complicates Compliance Costs

Italy's 20 regions retained discretion over workplace-safety enforcement under D.Lgs. 81/2008, leading to divergent inspection schedules and documentation formats. Efforts to harmonise training through the May 2025 State-Regions agreement progressed unevenly, forcing multi-region FM providers to maintain bespoke compliance teams and dampening cross-border economies of scale. These costs ultimately offset a portion of operating-margin gains in the Italy facility management market.

Other drivers and restraints analyzed in the detailed report include:

- Increasing Adoption of Integrated Facility Management Contracts for Cost Optimization

- Aging Building Stock Requiring Predictive Maintenance and Retrofit Services

- Rising Costs of Skilled Technical Labor Squeeze FM Provider Margins

For complete list of drivers and restraints, kindly check the Table Of Contents.

Segment Analysis

Hard services held 58.85% of the Italy facility management market share in 2025. Mandatory fire-safety inspections, MEP upgrades, and HVAC retrofits underpinned this dominance, especially within hospital estates that averaged EUR 161.58 per m2 in annual FM outlay. The Italy facility management market size for hard services advanced modestly as compliance-led investment cushioned volume even when discretionary spending softened.

Soft services nonetheless registered a 2.38% CAGR outlook through 2031, buoyed by the revival of luxury tourism and evolving workplace protocols that elevated hygiene, catering, and security standards. Cleaning services captured outsized gains as healthcare and hospitality clients enforced stricter infection-control routines. Digital Twin pilots at the Lazio Region headquarters illustrated how space-optimisation analytics tightened the linkage between environmental quality and occupant experience, giving soft-service providers higher-margin advisory roles.

Italy Facility Management Market is Segmented by Service Type (Hard Service, Soft Service), Offering Type (In-House, Outsourced), End-User Industry (Commercial (IT and Telecom, Retail and Warehouses), Hospitality (Hotels, Eateries and Large-Scale Restaurants), Institutional and Public Infrastructure (Government, Education, Transportation)) and More. The Market Forecasts are Provided in Terms of Value (USD).

List of Companies Covered in this Report:

- ATLAS I.F.M. SRL

- Sodexo Facilities Management Services (SODEXO GROUP)

- Compass Group PLC

- Euro & Promos Facility Management SPA (EURO & PROMOS)

- Rekeep SpA

- Olly Services SRL

- NAZCA

- Elmet SRL

- Apleona GmbH

- SGI Srl

- CNS Consorzio Nazionale Servizi

- Siram SpA

- BumaQ S.r.l.

- Ares Facility Management

- P&P Spa

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET LANDSCAPE

- 4.1 Market Overview

- 4.1.1 Current Occupancy Rates

- 4.1.2 Profitability Rates of Major FM Players

- 4.1.3 Workforce Indicators - Labor Participation

- 4.1.4 Facility Management Market Share (%), by Service Type

- 4.1.5 Facility Management Market Share (%), by Hard Services

- 4.1.6 Facility Management Market Share (%), by Soft Services

- 4.1.7 Urbanization and Population Growth in Major Metros

- 4.1.8 Sector Investment Priorities in Italy's Infrastructure Pipeline

- 4.1.9 Regulatory Drivers Specific to Labour and Safety Standards

- 4.2 Market Drivers

- 4.2.1 Outsourcing Trend Among Public Sector Entities Expanding FM Market

- 4.2.2 Growth of Italy's Tourism and Hospitality Sector Boosts Demand for Soft FM Services

- 4.2.3 Increasing Adoption of Integrated Facility Management Contracts for Cost Optimization

- 4.2.4 Aging Building Stock Requiring Predictive Maintenance and Retrofit Services

- 4.2.5 EU Recovery and Resilience Facility Funds Earmarked for School Renovation Projects Catalyze Regional FM Opportunities

- 4.2.6 Expansion of Data Center Industry in Northern Italy Spurs Specialized Technical FM Demand

- 4.3 Market Restraints

- 4.3.1 Fragmented Regulatory Framework Across Italian Regions Complicates Compliance Costs

- 4.3.2 Rising Costs of Skilled Technical Labor Squeeze FM Provider Margins

- 4.3.3 Slow Roll-out of 5G Infrastructure Delays Smart Building FM Deployments

- 4.3.4 Municipal Budget Constraints Post-COVID Reduce Outsourcing of Public Facility Upkeep in Smaller Cities

- 4.4 Value Chain Analysis

- 4.5 PESTEL Analysis

- 4.6 Regulatory and Legislative Framework for Market Entrants

- 4.7 Impact of Macroeconomic Indicators on FM Demand

- 4.8 Porter's Five Forces Analysis

- 4.8.1 Bargaining Power of Suppliers

- 4.8.2 Bargaining Power of Buyers

- 4.8.3 Threat of New Entrants

- 4.8.4 Threat of Substitute Services

- 4.8.5 Intensity of Competitive Rivalry

- 4.9 Investment and Funding Analysis

5 MARKET SIZE AND GROWTH FORECASTS (VALUE)

- 5.1 By Service Type

- 5.1.1 Hard Services

- 5.1.1.1 Asset Management

- 5.1.1.2 MEP and HVAC Services

- 5.1.1.3 Fire Systems and Safety

- 5.1.1.4 Other Hard FM Services

- 5.1.2 Soft Services

- 5.1.2.1 Office Support and Security

- 5.1.2.2 Cleaning Services

- 5.1.2.3 Catering Services

- 5.1.2.4 Other Soft FM Services

- 5.1.1 Hard Services

- 5.2 By Offering Type

- 5.2.1 In-house

- 5.2.2 Outsourced

- 5.2.2.1 Single FM

- 5.2.2.2 Bundled FM

- 5.2.2.3 Integrated FM

- 5.3 By End-user Industry

- 5.3.1 Commercial (IT and Telecom, Retail and Warehouses, etc.)

- 5.3.2 Hospitality (Hotels, Eateries, Large-scale Restaurants)

- 5.3.3 Institutional and Public Infrastructure (Government, Education, Transportation)

- 5.3.4 Healthcare (Public and Private Facilities)

- 5.3.5 Industrial and Process (Manufacturing, Energy, Mining)

- 5.3.6 Other End-user Industries (Multi-housing, Entertainment, Sports and Leisure)

6 COMPETITIVE LANDSCAPE

- 6.1 Market Concentration

- 6.2 Strategic Moves and Partnerships

- 6.3 Market Share Analysis

- 6.4 Company Profiles (includes Global level Overview, Market level overview, Core Segments, Financials as available, Strategic Information, Market Rank/Share for key companies, Products and Services, and Recent Developments)

- 6.4.1 ATLAS I.F.M. SRL

- 6.4.2 Sodexo Facilities Management Services (SODEXO GROUP)

- 6.4.3 Compass Group PLC

- 6.4.4 Euro & Promos Facility Management SPA (EURO & PROMOS)

- 6.4.5 Rekeep SpA

- 6.4.6 Olly Services SRL

- 6.4.7 NAZCA

- 6.4.8 Elmet SRL

- 6.4.9 Apleona GmbH

- 6.4.10 SGI Srl

- 6.4.11 CNS Consorzio Nazionale Servizi

- 6.4.12 Siram SpA

- 6.4.13 BumaQ S.r.l.

- 6.4.14 Ares Facility Management

- 6.4.15 P&P Spa

7 MARKET OPPORTUNITIES AND FUTURE OUTLOOK

- 7.1 White-space and Unmet-Need Assessment

- 7.2 Technology-led Integrated FM (IoT, BMS, AI-based Predictive Maintenance)

- 7.3 ESG-compliant FM Solutions Demand

- 7.4 Future Service-Model Shifts (Outcome-based Contracts)