|

市场调查报告书

商品编码

1911389

菲律宾设施管理:市场占有率分析、产业趋势与统计、成长预测(2026-2031)Philippines Facility Management - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2026 - 2031) |

||||||

※ 本网页内容可能与最新版本有所差异。详细情况请与我们联繫。

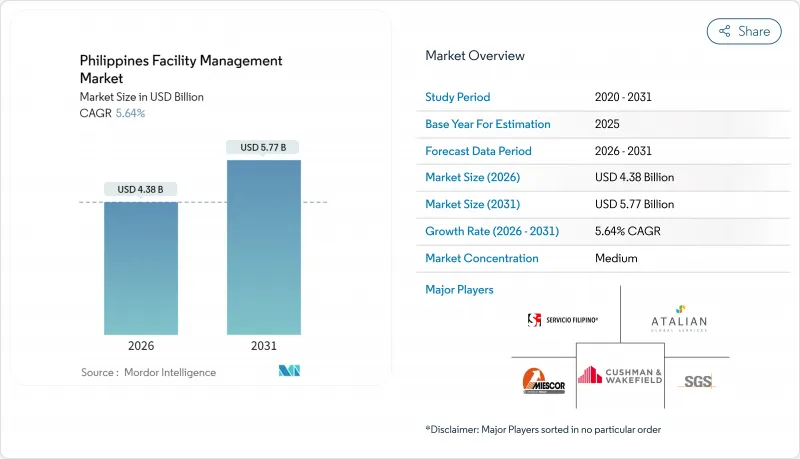

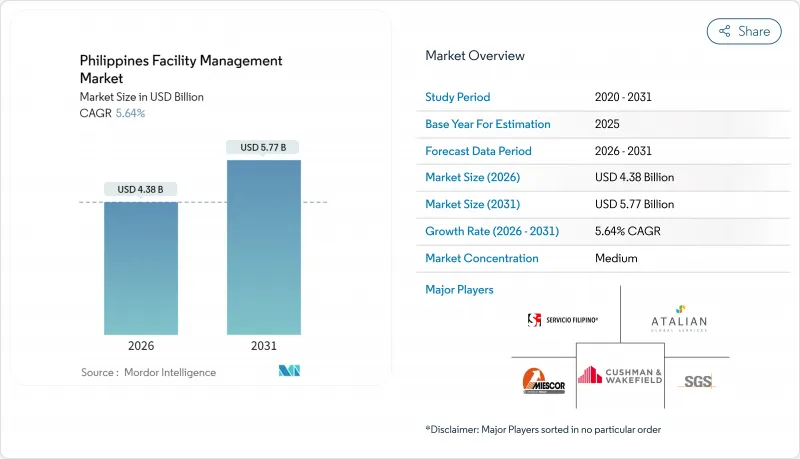

预计菲律宾设施管理 (FM) 市场将从 2025 年的 41.5 亿美元成长到 2026 年的 43.8 亿美元,预计到 2031 年将达到 57.7 亿美元,2026 年至 2031 年的复合年增长率为 5.64%。

菲律宾群岛各地超过3700个公共产业计画的资本支出不断增长,380亿美元的业务流程外包(BPO)行业对办公空间的强劲需求,以及2026年起强制性的永续性报告製度,都在推动外包和技术赋能型建筑服务支出的增长。目前,硬性服务收入占主导地位,因为老化的交通网络、能源资产和商业建筑需要持续的机械、电气和管道维护工作。然而,随着企业认识到职场卫生与生产力之间的联繫,对软性服务的需求也在增长。由于跨国客户寻求整合硬性、软性和数位化解决方案的合同,行业整合的压力日益增大。区域需求也在变化,宿雾、达沃和克拉克经历了最高的投资成长,迫使服务供应商建立本地服务中心。

菲律宾设施管理市场趋势与洞察

基础建设推动需求成长

在「建设更多、更好」倡议下,诸如披索的巴丹-甲米地连接桥和披索亿比索的帕奈-吉马拉斯-内格罗斯连接桥等公共工程项目,正在推动菲律宾设施管理市场的扩张。从2022年起,1,200公里道路和同等数量桥樑的竣工将进一步增加桥面检测、隧道通风维护和路边资产管理的需求。医疗设施的建设,例如耗资披索亿比索的菲律宾总医院癌症中心和多家区域医院,为目标基础设施增添了专业的临床环境。因此,承包商需要能够在区域城市快速部署并管理单一特许特许经营内各种资产的供应商。这些综合用途走廊融合了交通、零售和住宅元素,使能够提供整合硬性、软性及节能服务包的服务供应商在竞标中拥有竞争优势。

技术整合改变了服务交付方式

物联网平台正在重塑菲律宾设施管理市场的服务格局。人工智慧驱动的占用感测器,例如Milesight公司的感测器,正在马尼拉大都会区的办公室中部署,提供即时使用数据,用于指导预测性维护计划和空间优化策略。 PLDT Enterprise的智慧物联网套件将公用事业计量表和电梯控制系统连接到整合式仪表板,从而加快警报速度并降低能源成本。科技部在一家家禽加工厂开展的披索万比索ChicIoT试点项目,展示了基于感测器的监控技术在工业和农业综合企业设施中的应用。一项针对宿雾、巴科洛德、伊洛伊洛和达沃100个政府机构的500万美元智慧城市计划,显示整合平台如今已变得经济实惠。能够将分析引擎嵌入楼宇管理系统并将警报转化为可量化节省的供应商,正在获得更长的合约期限。

劳动力短缺限制了市场成长

据估计,建筑业劳动力短缺约30万人,加上首都地区薪资上涨,推高了设施技术人员和现场主管的薪资预期。国际上对职业学校毕业生的竞争也进一步减少了国内劳动力。在伊罗戈斯地区和宿务,雇主已开始提高工资水平以留住电工和暖通空调专家,这挤压了以固定价格合约运作的服务承包商的利润空间。因此,服务提供者必须投资奖学金计画和数位化工单平台,以最大限度地提高技术人员的工作效率。

细分市场分析

截至2025年,硬性服务将占菲律宾设施管理市场的63.12%,这反映出在热带颱风多发地区维护机械、电气、管道和消防系统的重要性。交通走廊的持续维修和90年代办公大楼的整修需要全天候的资产管理方案。同时,预测分析正在减少停机时间。马尼拉大都会的物联网冷却装置能够在效率低下问题发生之前提醒技术人员,将每个设施的能耗降低8-10%。软性服务领域预计将快速成长,到2031年复合年增长率将达到6.71%,因为租户越来越将清洁和门房服务视为员工留任和品牌声誉的重要因素。疫情后政府关于室内空气品质监测的法规也扩大了清洁团队的工作范围。

随着越来越多的建筑部署人员占用感测器和访客管理应用程序,硬性服务和软性服务之间的界限正变得日益模糊。例如,空间预约资料使清洁团队能够专注于人流量高的区域,而暖通空调系统的设定则可根据人流即时调整。这种融合趋势促使供应商提供整合这两个领域的提案包,预计这种组合将占据菲律宾设施管理市场更大的份额。

菲律宾设施管理市场报告按类型(内部设施管理与外包设施管理(独立设施管理、捆绑式设施管理、整合式设施管理))、交付模式(硬体维修与软性设施管理)以及最终用户产业(商业、机构、公共/基础设施、工业及其他)进行细分。以上所有细分市场的市场规模和预测均以美元计价。

其他福利

- Excel格式的市场预测(ME)表

- 3个月的分析师支持

目录

第一章 引言

- 研究假设和市场定义

- 调查范围

第二章调查方法

第三章执行摘要

第四章 市场情势

- 市场概览

- 目前运转率

- 主要FM业者的盈利能力

- 劳动指标 - 劳动参与率

- 按服务类型分類的设施管理市场占有率(%)

- 以硬性服务分類的设施管理市场占有率(%)

- 软服务设施管理市场占有率(%)

- 主要都会区的都市化和人口成长

- 菲律宾基础建设发展各领域的投资重点

- 与劳动和安全标准相关的监管因素

- 市场驱动因素

- 基础建设推动需求成长

- 透过技术整合转变服务交付方式

- 透过永续设施管理增强竞争优势

- 外包趋势持续升温

- BPO产业对综合设施管理合约的需求不断增长

- 政府的绿建筑政策推动了设施管理业务范围的扩大。

- 市场限制

- 劳动力短缺限制了市场成长

- 监管合规性增加了营运的复杂性。

- 成本敏感度高,导致价格竞争

- 供应链分散导致服务标准化程度降低

- 价值链分析

- PESTEL 分析

- 新进入者的监管和法律体制

- 宏观经济指标对FM需求的影响

- 波特五力分析

- 供应商的议价能力

- 买方的议价能力

- 新进入者的威胁

- 替代品的威胁

- 竞争对手之间的竞争

- 投资与资金筹措分析

第五章 市场规模与成长预测

- 按服务类型

- 硬服务

- 资产管理

- 机电及暖通空调服务

- 消防设备和安全措施

- 其他硬体维修服务

- 软服务

- 办公室支援与安全

- 清洁服务

- 餐饮服务

- 其他软性调频服务

- 硬服务

- 以规定形式

- 内部管理

- 外包

- 单频调频

- 综合调频

- 整合调频

- 按最终用户行业划分

- 商业设施(IT/通讯、零售/仓储等)

- 餐饮服务业(饭店、餐厅、大型餐厅)

- 公共及公共基础设施(政府机构、教育机构、交通运输)

- 医疗保健(公立和私立机构)

- 工业流程(製造业、能源业、采矿业)

- 其他终端用户产业(多用户住宅、娱乐、运动和休閒)

第六章 竞争情势

- 市场集中度

- 策略发展与伙伴关係

- 市占率分析

- 公司简介

- CBRE Philippines

- Servicio Filipino Inc.

- Meralco Industrial Engineering Services Corporation

- SGS Philippines Inc.

- Santos Knight Frank Inc.(Knight Frank LLP)

- Century Properties Management Inc.

- Mansion Maintenance Co. Inc.

- Kontrac Facilities Management Services Inc.

- Jones Lang LaSalle Inc.

- Artelia Group

- WeCare Facility Management Services Inc.

- Hydron Corporation

- Atalian Global Services Philippines Inc.

- Kabraso

- CPMGI

- Cushman & Wakefield Debenham Tie Leung Limited

第七章 市场机会与未来展望

The Philippines facility management market is expected to grow from USD 4.15 billion in 2025 to USD 4.38 billion in 2026 and is forecast to reach USD 5.77 billion by 2031 at 5.64% CAGR over 2026-2031.

Rising capital expenditure on more than 3,700 public-works schemes, buoyant office demand from the USD 38 billion business-process-outsourcing (BPO) sector and mandatory sustainability reporting from 2026 are combining to lift spending on outsourced and technology-enabled building services across the archipelago. Hard services dominate present revenue because ageing transport links, energy assets and commercial towers require continuous mechanical, electrical and plumbing work, yet soft services are gaining traction as employers link workplace hygiene with productivity. Consolidation pressures are intensifying as multinational customers ask for integrated contracts that blend hard, soft and digital solutions. Regional demand is shifting: Cebu, Davao and Clark are registering the fastest investment growth and forcing service providers to build local delivery hubs.

Philippines Facility Management Market Trends and Insights

Infrastructure development fueling demand

Public works under the Build Better More portfolio, including the PHP 219 billion Bataan-Cavite Interlink Bridge and PHP 187.5 billion Panay-Guimaras-Negros crossings, are broadening the footprint of the Philippines facility management market. Completion of 1,200 km of roads and an equal number of bridges since 2022 has intensified the need for bridge-deck inspections, tunnel ventilation upkeep and roadside asset management. Healthcare builds such as the PHP 6 billion PGH Cancer Center and several regional hospitals add specialist clinical environments to the addressable base. Contractors therefore require suppliers able to mobilise quickly in provincial locations and manage multiform assets within single concessions. As these mixed-use corridors combine transport, retail and residential elements, service providers that offer integrated hard, soft and energy-efficiency packages are gaining bid advantages.

Technology integration transforming service delivery

IoT-enabled platforms are reshaping service scopes throughout the Philippines facility management market. Deployments of AI-powered occupancy sensors, such as Milesight's roll-out in Metro Manila offices, are providing live utilisation data that feeds predictive maintenance schedules and space optimisation strategies. PLDT Enterprise's Smart IoT suite is linking utilities meters and lift controls to unified dashboards, cutting response times and lowering energy bills. The Department of Science and Technology's PHP 4.7 million ChicIoT pilot in poultry facilities shows that sensor-based monitoring is also moving into industrial and agri-business estates. A USD 5 million smart-city programme across 100 government units in Cebu, Bacolod, Iloilo and Davao is demonstrating the scale at which integrated platforms can now be procured. Providers that can embed analytics engines within building-management systems and translate alerts into quantifiable savings are securing longer contract tenures.

Labor shortages constraining market growth

An estimated deficit of 300,000 construction workers, coupled with wage hikes in the National Capital Region, is pushing up salary expectations for facility technicians and site supervisors. Competition from overseas placements for Technical and Vocational Education Training graduates is further thinning the local labour pool. Employers in Ilocos and Cebu have started raising pay scales to secure electricians and HVAC specialists, eroding margins for service contractors that operate fixed-price agreements. Providers must therefore invest in scholarship schemes and digital work-order platforms that maximise technician productivity.

Other drivers and restraints analyzed in the detailed report include:

- Sustainable facility management bolstering competitive advantage

- Outsourcing trend gaining momentum

- Regulatory compliance increasing operational complexity

For complete list of drivers and restraints, kindly check the Table Of Contents.

Segment Analysis

Hard services accounted for 63.12% of the Philippines facility management market share in 2025, reflecting the criticality of mechanical, electrical, plumbing and fire-safety upkeep in a tropical, typhoon-prone environment. Ongoing rehabilitation of transport corridors and the refurbishing of 1990s-era office towers require round-the-clock asset management programmes. In parallel, predictive analytics is reducing downtime: IoT-enabled chillers in Metro Manila now alert engineers before efficiency drifts occur, lowering energy draw by 8-10% per site. Soft services are on a faster 6.71% CAGR route to 2031 because occupants increasingly view cleaning, security and concierge support as levers for employee retention and brand reputation. Government mandates on indoor-air-quality monitoring post-pandemic are also broadening the duty scope of janitorial teams.

As more buildings embed occupancy sensors and visitor-management apps, distinctions between hard and soft services are blurring. For example, space-booking data enables housekeeping crews to focus on high-traffic zones, while HVAC set-points are adjusted in real time based on footfall. This convergence is prompting suppliers to package both domains into single integrated proposals, a configuration expected to command a rising share of the Philippines facility management market.

The Philippine Facility Management Market Report is Segmented by Type (In-House Facility Management and Outsourced Facility Management (single FM, Bundled FM, and Integrated FM)), Offering Type (Hard FM and Soft FM), and End-User Industry (Commercial, Institutional, Public/Infrastructure, Industrial, and More). The Market Size and Forecasts are Provided in Terms of Value in (USD) for all the Above Segments.

List of Companies Covered in this Report:

- CBRE Philippines

- Servicio Filipino Inc.

- Meralco Industrial Engineering Services Corporation

- SGS Philippines Inc.

- Santos Knight Frank Inc. (Knight Frank LLP)

- Century Properties Management Inc.

- Mansion Maintenance Co. Inc.

- Kontrac Facilities Management Services Inc.

- Jones Lang LaSalle Inc.

- Artelia Group

- WeCare Facility Management Services Inc.

- Hydron Corporation

- Atalian Global Services Philippines Inc.

- Kabraso

- CPMGI

- Cushman & Wakefield Debenham Tie Leung Limited

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET LANDSCAPE

- 4.1 Market Overview

- 4.1.1 Current Occupancy Rates

- 4.1.2 Profitability Rates of Major FM Players

- 4.1.3 Workforce Indicators - Labor Participation

- 4.1.4 Facility Management Market Share (%), by Service Type

- 4.1.5 Facility Management Market Share (%), by Hard Services

- 4.1.6 Facility Management Market Share (%), by Soft Services

- 4.1.7 Urbanization and Population Growth in Major Metros

- 4.1.8 Sector Investment Priorities in Philippines's Infrastructure Pipeline

- 4.1.9 Regulatory Drivers Specific to Labour and Safety Standards

- 4.2 Market Drivers

- 4.2.1 Infrastructure Development Fueling Demand

- 4.2.2 Technology Integration Transforming Service Delivery

- 4.2.3 Sustainable Facility Management Bolstering Competitive Advantage

- 4.2.4 Outsourcing Trend Gaining Momentum

- 4.2.5 Rising Demand for Integrated FM Contracts in BPO Sector

- 4.2.6 Government Green Building Mandates Driving FM Scope Expansion

- 4.3 Market Restraints

- 4.3.1 Labor Shortages Constraining Market Growth

- 4.3.2 Regulatory Compliance Increasing Operational Complexity

- 4.3.3 High Cost Sensitivity Leading to Price-based Competition

- 4.3.4 Fragmented Supplier Base Diluting Service Standardization

- 4.4 Value Chain Analysis

- 4.5 PESTEL Analysis

- 4.6 Regulatory and Legislative Framework for Market Entrants

- 4.7 Impact of Macroeconomic Indicators on FM Demand

- 4.8 Porter's Five Forces Analysis

- 4.8.1 Bargaining Power of Suppliers

- 4.8.2 Bargaining Power of Buyers

- 4.8.3 Threat of New Entrants

- 4.8.4 Threat of Substitute Services

- 4.8.5 Intensity of Competitive Rivalry

- 4.9 Investment and Funding Analysis

5 MARKET SIZE AND GROWTH FORECASTS (VALUE)

- 5.1 By Service Type

- 5.1.1 Hard Services

- 5.1.1.1 Asset Management

- 5.1.1.2 MEP and HVAC Services

- 5.1.1.3 Fire Systems and Safety

- 5.1.1.4 Other Hard FM Services

- 5.1.2 Soft Services

- 5.1.2.1 Office Support and Security

- 5.1.2.2 Cleaning Services

- 5.1.2.3 Catering Services

- 5.1.2.4 Other Soft FM Services

- 5.1.1 Hard Services

- 5.2 By Offering Type

- 5.2.1 In-house

- 5.2.2 Outsourced

- 5.2.2.1 Single FM

- 5.2.2.2 Bundled FM

- 5.2.2.3 Integrated FM

- 5.3 By End-user Industry

- 5.3.1 Commercial (IT and Telecom, Retail and Warehouses, etc.)

- 5.3.2 Hospitality (Hotels, Eateries, Large-scale Restaurants)

- 5.3.3 Institutional and Public Infrastructure (Govt, Education, Transportation)

- 5.3.4 Healthcare (Public and Private Facilities)

- 5.3.5 Industrial and Process (Manufacturing, Energy, Mining)

- 5.3.6 Other End-user Industries (Multi-housing, Entertainment, Sports and Leisure)

6 COMPETITIVE LANDSCAPE

- 6.1 Market Concentration

- 6.2 Strategic Moves and Partnerships

- 6.3 Market Share Analysis

- 6.4 Company Profiles (includes Global level Overview, Market level overview, Core Segments, Financials as available, Strategic Information, Market Rank/Share for key companies, Products and Services, and Recent Developments)

- 6.4.1 CBRE Philippines

- 6.4.2 Servicio Filipino Inc.

- 6.4.3 Meralco Industrial Engineering Services Corporation

- 6.4.4 SGS Philippines Inc.

- 6.4.5 Santos Knight Frank Inc. (Knight Frank LLP)

- 6.4.6 Century Properties Management Inc.

- 6.4.7 Mansion Maintenance Co. Inc.

- 6.4.8 Kontrac Facilities Management Services Inc.

- 6.4.9 Jones Lang LaSalle Inc.

- 6.4.10 Artelia Group

- 6.4.11 WeCare Facility Management Services Inc.

- 6.4.12 Hydron Corporation

- 6.4.13 Atalian Global Services Philippines Inc.

- 6.4.14 Kabraso

- 6.4.15 CPMGI

- 6.4.16 Cushman & Wakefield Debenham Tie Leung Limited

7 MARKET OPPORTUNITIES AND FUTURE OUTLOOK

- 7.1 White-space and Unmet-Need Assessment

- 7.2 Technology-led Integrated FM (IoT, BMS, AI-based Predictive Maintenance)

- 7.3 ESG-compliant FM Solutions Demand

- 7.4 Future Service-Model Shifts (Outcome-based Contracts)