|

市场调查报告书

商品编码

1885813

肾臟饮食蛋白水解物市场机会、成长驱动因素、产业趋势分析及预测(2025-2034年)Renal Diet Protein Hydrolysates Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2025 - 2034 |

||||||

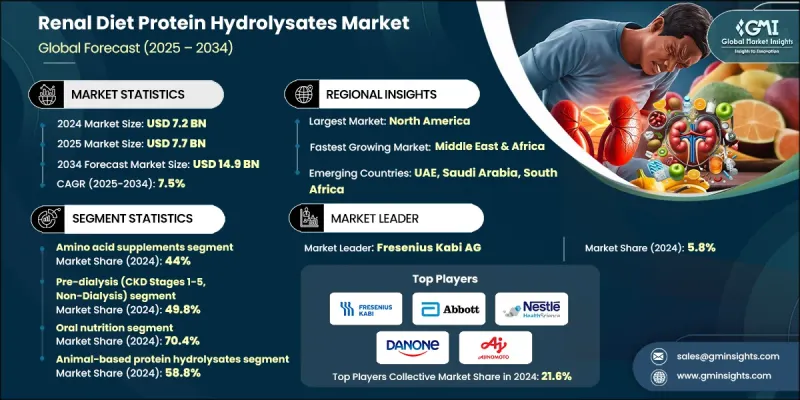

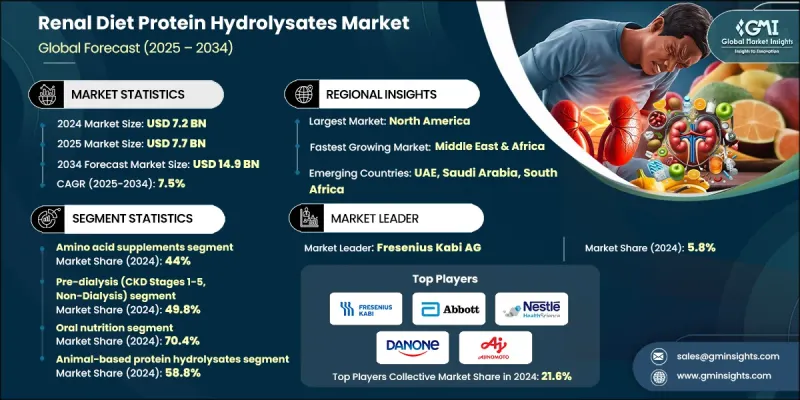

2024 年全球肾臟饮食蛋白水解物市场价值为 72 亿美元,预计到 2034 年将以 7.5% 的复合年增长率增长至 149 亿美元。

这一增长主要受全球慢性肾臟病负担加重以及人们对肾臟护理中特殊营养重要性认识不断提高的推动。医疗保健系统越来越重视蛋白质管理以支持肾功能,从而推动了对水解蛋白解决方案的需求,这类解决方案更易于加工,并能以更小的肾臟负担输送必需营养素。全球人口老化也显着促进了这一增长,因为与年龄相关的肾臟疾病日益普遍。研究不断强调蛋白质水解物在为肾功能受损患者提供标靶营养方面的临床益处。随着早期检测和个人化饮食干预的普及,预计对这些特殊配方的需求将进一步增强。酵素水解技术的改进提高了产品的一致性和生产效率,从而增加了全球供应量。不断增长的医疗保健支出以及对经济有效的营养疗法以帮助延缓疾病进展的需求,进一步巩固了市场的长期前景。

| 市场范围 | |

|---|---|

| 起始年份 | 2024 |

| 预测年份 | 2025-2034 |

| 起始值 | 72亿美元 |

| 预测值 | 149亿美元 |

| 复合年增长率 | 7.5% |

胺基酸补充剂市场在2024年占据44%的市场份额,预计到2034年将以7.5%的复合年增长率成长。这些补充剂在满足慢性肾臟病患者的营养需求方面发挥关键作用,同时最大限度地减少与摄取完整蛋白质相关的併发症。客製化的胺基酸配方对于遵循低蛋白饮食的患者至关重要,而配方科学的不断进步有望提高吸收率和精准输送营养。

透析前族群(涵盖慢性肾臟病1-5期,即非透析患者)在2024年占据了49.8%的市场份额,预计2025年至2034年将以7.4%的复合年增长率成长。此细分市场规模最大,主要原因是大量患者在进入透析阶段前需要早期营养介入。随着指南不断强调控制蛋白质摄取以延缓肾功能恶化,对特製水解蛋白产品的需求预计将保持强劲。

2024年,北美肾臟营养蛋白水解物市占率达到35.3%。该地区受益于先进的医疗保健体系、完善的医疗保险报销机制以及较高的慢性肾臟病发病率。医疗营养产品的广泛应用和健全的膳食管理临床框架是其在该领域保持领先地位的重要因素。

肾臟营养蛋白水解物市场的主要企业包括费森尤斯卡比股份公司 (Fresenius Kabi AG)、雅培实验室 (Abbott Laboratories)、雀巢健康科学 (Nestle Health Science)、达能纽迪希亚 (Danone Nutricia)、味之素株式会社 (Ajino B., Bjinomoto Co.)、贝特朗迪医疗 (B. Braunfolgen)、Gunfolgen SAs、G. (Baxter/Vantive)、阿旃陀製药有限公司 (Ajanta Pharma Limited) 和曼金製药有限公司 (Mankind Pharma Ltd.)。这些企业采取多种策略来增强其竞争优势。许多企业致力于开发生物利用度更高的配方,采用先进的酵素工艺,以提高营养吸收率并最大限度地减少肾臟的代谢负荷。拓展针对不同慢性肾臟病 (CKD) 阶段的产品组合,有助于品牌接触到更广泛的患者群。对临床研究的投资支持实证营养解决方案的开发,并改善医生的推荐建议。企业与医疗保健提供者和营养师合作,以提高医用营养产品的普及率。透过合作、分销网络和本地化生产进行地域扩张,增强了市场可及性。

目录

第一章:方法论与范围

第一章:执行概要

第二章:行业洞察

- 产业生态系分析

- 供应商格局

- 利润率

- 每个阶段的价值增加

- 影响价值链的因素

- 中断

- 产业影响因素

- 成长驱动因素

- 慢性肾臟病盛行率上升和人口老化

- 支持植物性蛋白质水解物的临床证据

- 酶水解技术进步

- 产业陷阱与挑战

- 生产成本高且监管复杂

- 特定水解物的临床证据有限

- 市场机会

- 个人化营养与精准医疗

- 植物基创新与永续性

- 成长驱动因素

- 成长潜力分析

- 监管环境

- 北美洲

- 欧洲

- 亚太地区

- 拉丁美洲

- 中东和非洲

- 波特的分析

- PESTEL 分析

- 价格趋势

- 按地区

- 依产品类型

- 未来市场趋势

- 技术与创新格局

- 当前技术趋势

- 新兴技术

- 专利格局

- 贸易统计(HS编码)(註:仅提供重点国家的贸易统计资料)

- 主要进口国

- 主要出口国

- 永续性和环境方面

- 永续实践

- 减少废弃物策略

- 生产中的能源效率

- 环保倡议

- 碳足迹考量

第三章:竞争格局

- 介绍

- 公司市占率分析

- 按地区

- 北美洲

- 欧洲

- 亚太地区

- 拉丁美洲

- MEA

- 按地区

- 公司矩阵分析

- 主要市场参与者的竞争分析

- 竞争定位矩阵

- 关键进展

- 併购

- 合作伙伴关係与合作

- 新产品发布

- 扩张计划

第四章:市场估算与预测:依产品类型划分,2021-2034年

- 主要趋势

- 胺基酸补充剂

- α-酮类似物

- 支链胺基酸(BCAAs)

- 完全蛋白质水解物

- 维生素和矿物质补充剂

- 水溶性维生素

- 维生素D类似物

- 受控矿物配方

- 矿物质补充剂

- 铁补充剂

- 钙基产品

- 限磷配方

- 益生菌

- 单菌株配方

- 多菌株组合

- 益生菌产品

第五章:市场估算与预测:依CKD阶段划分,2021-2034年

- 主要趋势

- 透析前(CKD 1-5期,非透析)

- 早期慢性肾臟病(1-2期)

- 中度慢性肾病(3期)

- 晚期慢性肾臟病(4-5期)

- 血液透析患者

- 传统血液透析

- 高通量血液透析

- 血液透析滤过

- 腹膜透析患者

- 持续性非卧床腹膜透析(CAPD)

- 自动腹膜透析(APD)

- 末期肾病(ESRD)

- 移植前患者

- 保守管理

- 急性肾损伤(AKI)恢復

第六章:市场估算与预测:依管理模式划分,2021-2034年

- 主要趋势

- 口服营养

- 即饮配方

- 粉状补充剂

- 固体剂型

- 肠内营养

- 管饲配方

- 口服营养补充品(ONS)

- 模组化产品

- 肠外营养

- 全肠外营养(TPN)

- 週边肠外营养(PPN)

第七章:市场估算与预测:依蛋白质来源划分,2021-2034年

- 主要趋势

- 动物性蛋白质水解物

- 乳清蛋白水解物

- 酪蛋白水解物

- 蛋清蛋白水解物

- 鱼蛋白水解物

- 植物性蛋白质水解物

- 豌豆蛋白水解物

- 大豆蛋白水解物

- 米蛋白水解物

- 大麻蛋白水解物

第八章:市场估算与预测:依地区划分,2021-2034年

- 主要趋势

- 北美洲

- 我们

- 加拿大

- 欧洲

- 德国

- 英国

- 法国

- 西班牙

- 义大利

- 欧洲其他地区

- 亚太地区

- 中国

- 印度

- 日本

- 澳洲

- 韩国

- 亚太其他地区

- 拉丁美洲

- 巴西

- 墨西哥

- 阿根廷

- 拉丁美洲其他地区

- 中东和非洲

- 沙乌地阿拉伯

- 南非

- 阿联酋

- 中东和非洲其他地区

第九章:公司简介

- Fresenius Kabi AG

- Abbott Laboratories

- Nestle Health Science

- Danone Nutricia

- Ajinomoto Co.

- B. Braun Melsungen

- Grifols SA

- Baxter/Vantive

- Ajanta Pharma Limited

- Mankind Pharma Ltd.

The Global Renal Diet Protein Hydrolysates Market was valued at USD 7.2 billion in 2024 and is estimated to grow at a CAGR of 7.5% to reach USD 14.9 billion by 2034.

This growth is driven by the increasing global burden of chronic kidney disease and rising awareness of the importance of specialized nutrition in kidney care. Healthcare systems are placing greater emphasis on protein management to support kidney function, pushing demand for hydrolyzed protein solutions that are easier to process and deliver essential nutrients with reduced strain on the kidneys. An aging global population has also contributed significantly, as age-related kidney conditions become more widespread. Research continues to highlight the clinical benefits of protein hydrolysates in providing targeted nutrition for kidney-impaired individuals. With early detection and personalized dietary interventions gaining traction, demand for these specialized formulations is expected to intensify. Improvements in enzymatic hydrolysis technologies have enhanced product consistency and production efficiency, increasing availability worldwide. Rising healthcare expenditures and the need for cost-effective nutritional therapies to help slow disease progression further reinforce the market's long-term outlook.

| Market Scope | |

|---|---|

| Start Year | 2024 |

| Forecast Year | 2025-2034 |

| Start Value | $7.2 Billion |

| Forecast Value | $14.9 Billion |

| CAGR | 7.5% |

The amino acid supplements segment held a 44% share in 2024 and is projected to grow at a CAGR of 7.5% through 2034. These supplements play a key role in meeting nutrient requirements for individuals with chronic kidney disease while minimizing the complications associated with intact protein intake. Tailored amino acid formulations are essential for patients following protein-limited diets, and ongoing progress in formulation science is expected to support better absorption and precise nutrient delivery.

The pre-dialysis category, covering CKD Stages 1-5 (non-dialysis), accounted for a 49.8% share in 2024 and is anticipated to grow at a CAGR of 7.4% from 2025 to 2034. This segment is the largest due to the substantial number of patients who require early nutritional intervention before reaching dialysis. As guidelines continue to emphasize controlled protein intake to slow kidney deterioration, demand for specialized hydrolysate-based products is expected to remain strong.

North America Renal Diet Protein Hydrolysates Market held a 35.3% share in 2024. The region benefits from advanced healthcare systems, established reimbursement structures, and a high incidence of chronic kidney disease. Widespread adoption of medical nutrition products and strong clinical frameworks for dietary management contribute significantly to regional leadership.

Key companies in the Renal Diet Protein Hydrolysates Market include Fresenius Kabi AG, Abbott Laboratories, Nestle Health Science, Danone Nutricia, Ajinomoto Co., B. Braun Melsungen, Grifols S.A., Baxter/Vantive, Ajanta Pharma Limited, and Mankind Pharma Ltd. Companies operating in the Renal Diet Protein Hydrolysates Market follow several strategies to strengthen their competitive position. Many focus on developing more bioavailable formulations using advanced enzymatic processes that improve nutrient absorption and minimize metabolic load on the kidneys. Expanding product portfolios tailored to different CKD stages helps brands reach a broader patient base. Investments in clinical research support evidence-backed nutritional solutions and improve physician recommendations. Firms collaborate with healthcare providers and dietitians to increase the adoption of medical nutrition products. Geographic expansion through partnerships, distribution networks, and localized manufacturing enhances market accessibility.

Table of Contents

Chapter 1 Methodology & Scope

- 1.1 Market scope and definition

- 1.2 Research design

- 1.2.1 Research approach

- 1.2.2 Data collection methods

- 1.3 Data mining sources

- 1.3.1 Global

- 1.3.2 Regional/Country

- 1.4 Base estimates and calculations

- 1.4.1 Base year calculation

- 1.4.2 Key trends for market estimation

- 1.5 Primary research and validation

- 1.5.1 Primary sources

- 1.6 Forecast model

- 1.7 Research assumptions and limitations

Chapter 1 Executive Summary

- 2.1 Industry 3600 synopsis

- 2.2 Key market trends

- 2.2.1 Regional trends

- 2.2.2 Product type trends

- 2.2.3 CKD stage trends

- 2.2.4 Administration mode trends

- 2.2.5 Protein source trends

- 2.3 TAM Analysis, 2025-2034

- 2.4 CXO perspectives: Strategic imperatives

- 2.4.1 Executive decision points

- 2.4.2 Critical success factors

- 2.5 Future Outlook and Strategic Recommendations

Chapter 2 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.1.1 Supplier landscape

- 3.1.2 Profit margin

- 3.1.3 Value addition at each stage

- 3.1.4 Factor affecting the value chain

- 3.1.5 Disruptions

- 3.2 Industry impact forces

- 3.2.1 Growth drivers

- 3.2.1.1 Rising CKD prevalence & aging demographics

- 3.2.1.2 Clinical evidence supporting plant-based protein hydrolysates

- 3.2.1.3 Technological advances in enzymatic hydrolysis

- 3.2.2 Industry pitfalls and challenges

- 3.2.2.1 High production costs & regulatory complexity

- 3.2.2.2 Limited clinical evidence for specific hydrolysates

- 3.2.3 Market opportunities

- 3.2.3.1 Personalized nutrition & precision medicine

- 3.2.3.2 Plant-based innovation & sustainability

- 3.2.1 Growth drivers

- 3.3 Growth potential analysis

- 3.4 Regulatory landscape

- 3.4.1 North America

- 3.4.2 Europe

- 3.4.3 Asia Pacific

- 3.4.4 Latin America

- 3.4.5 Middle East & Africa

- 3.5 Porter's analysis

- 3.6 PESTEL analysis

- 3.7 Price trends

- 3.7.1 By region

- 3.7.2 By product type

- 3.8 Future market trends

- 3.9 Technology and Innovation landscape

- 3.9.1 Current technological trends

- 3.9.2 Emerging technologies

- 3.10 Patent Landscape

- 3.11 Trade statistics (HS code) (Note: the trade statistics will be provided for key countries only)

- 3.11.1 Major importing countries

- 3.11.2 Major exporting countries

- 3.12 Sustainability and environmental aspects

- 3.12.1 Sustainable practices

- 3.12.2 Waste reduction strategies

- 3.12.3 Energy efficiency in production

- 3.12.4 Eco-friendly initiatives

- 3.13 Carbon footprint consideration

Chapter 3 Competitive Landscape, 2024

- 4.1 Introduction

- 4.2 Company market share analysis

- 4.2.1 By region

- 4.2.1.1 North America

- 4.2.1.2 Europe

- 4.2.1.3 Asia Pacific

- 4.2.1.4 LATAM

- 4.2.1.5 MEA

- 4.2.1 By region

- 4.3 Company matrix analysis

- 4.4 Competitive analysis of major market players

- 4.5 Competitive positioning matrix

- 4.6 Key developments

- 4.6.1 Mergers & acquisitions

- 4.6.2 Partnerships & collaborations

- 4.6.3 New Product Launches

- 4.6.4 Expansion Plans

Chapter 4 Market Estimates and Forecast, By Product Type, 2021-2034 (USD Billion) (Kilo Tons)

- 5.1 Key trends

- 5.2 Amino acid supplements

- 5.2.1 Alpha-ketoanalogues

- 5.2.2 Branched-chain amino acids (BCAAS)

- 5.2.3 Complete protein hydrolysates

- 5.3 Vitamin & mineral supplements

- 5.3.1 Water-soluble vitamins

- 5.3.2 Vitamin D analogues

- 5.3.3 Controlled mineral formulations

- 5.4 Mineral supplements

- 5.4.1 Iron supplements

- 5.4.2 Calcium-based products

- 5.4.3 Phosphorus-restricted formulations

- 5.5 Probiotics

- 5.5.1 Single-strain formulations

- 5.5.2 Multi-strain combinations

- 5.5.3 Synbiotic products

Chapter 5 Market Estimates and Forecast, By CKD Stage, 2021-2034 (USD Billion) (Kilo Tons)

- 6.1 Key trends

- 6.2 Pre-dialysis (CKD stages 1-5, non-dialysis)

- 6.2.1 Early-stage CKD (stages 1-2)

- 6.2.2 Moderate CKD (stage 3)

- 6.2.3 Advanced CKD (stages 4-5)

- 6.3 Hemodialysis patients

- 6.3.1 Conventional hemodialysis

- 6.3.2 High-flux hemodialysis

- 6.3.3 Hemodiafiltration

- 6.4 Peritoneal dialysis patients

- 6.4.1 Continuous ambulatory peritoneal dialysis (CAPD)

- 6.4.2 Automated peritoneal dialysis (APD)

- 6.5 End-stage renal disease (ESRD)

- 6.5.1 Pre-transplant patients

- 6.5.2 Conservative management

- 6.5.3 Acute kidney injury (AKI) recovery

Chapter 6 Market Estimates and Forecast, By Administration Mode, 2021-2034 (USD Billion) (Kilo Tons)

- 7.1 Key trends

- 7.2 Oral nutrition

- 7.2.1 Ready-to-drink formulations

- 7.2.2 Powder supplements

- 7.2.3 Solid dosage forms

- 7.3 Enteral nutrition

- 7.3.1 Tube feeding formulations

- 7.3.2 Oral nutritional supplements (ONS)

- 7.3.3 Modular products

- 7.4 Parenteral nutrition

- 7.4.1 Total parenteral nutrition (TPN)

- 7.4.2 Peripheral parenteral nutrition (PPN)

Chapter 7 Market Estimates and Forecast, By Protein Source, 2021-2034 (USD Billion) (Kilo Tons)

- 8.1 Key trends

- 8.2 Animal-based protein hydrolysates

- 8.2.1 Whey protein hydrolysates

- 8.2.2 Casein hydrolysates

- 8.2.3 Egg white protein hydrolysates

- 8.2.4 Fish protein hydrolysates

- 8.3 Plant-based protein hydrolysates

- 8.3.1 Pea protein hydrolysates

- 8.3.2 Soy protein hydrolysates

- 8.3.3 Rice protein hydrolysates

- 8.3.4 Hemp protein hydrolysates

Chapter 8 Market Estimates and Forecast, By Region, 2021-2034 (USD Billion) (Kilo Tons)

- 9.1 Key trends

- 9.2 North America

- 9.2.1 U.S.

- 9.2.2 Canada

- 9.3 Europe

- 9.3.1 Germany

- 9.3.2 UK

- 9.3.3 France

- 9.3.4 Spain

- 9.3.5 Italy

- 9.3.6 Rest of Europe

- 9.4 Asia Pacific

- 9.4.1 China

- 9.4.2 India

- 9.4.3 Japan

- 9.4.4 Australia

- 9.4.5 South Korea

- 9.4.6 Rest of Asia Pacific

- 9.5 Latin America

- 9.5.1 Brazil

- 9.5.2 Mexico

- 9.5.3 Argentina

- 9.5.4 Rest of Latin America

- 9.6 Middle East and Africa

- 9.6.1 Saudi Arabia

- 9.6.2 South Africa

- 9.6.3 UAE

- 9.6.4 Rest of Middle East and Africa

Chapter 9 Company Profiles

- 10.1 Fresenius Kabi AG

- 10.2 Abbott Laboratories

- 10.3 Nestle Health Science

- 10.4 Danone Nutricia

- 10.5 Ajinomoto Co.

- 10.6 B. Braun Melsungen

- 10.7 Grifols S.A.

- 10.8 Baxter/Vantive

- 10.9 Ajanta Pharma Limited

- 10.10 Mankind Pharma Ltd.