|

市场调查报告书

商品编码

1885837

藻类蛋白水解物市场机会、成长驱动因素、产业趋势分析及预测(2025-2034年)Algae Protein Hydrolysates Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2025 - 2034 |

||||||

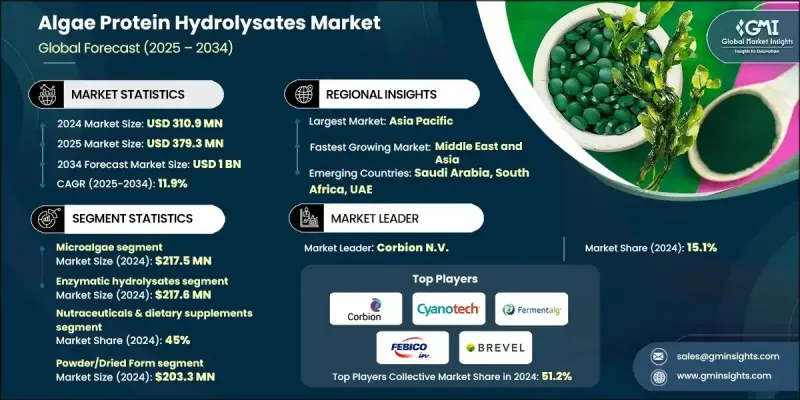

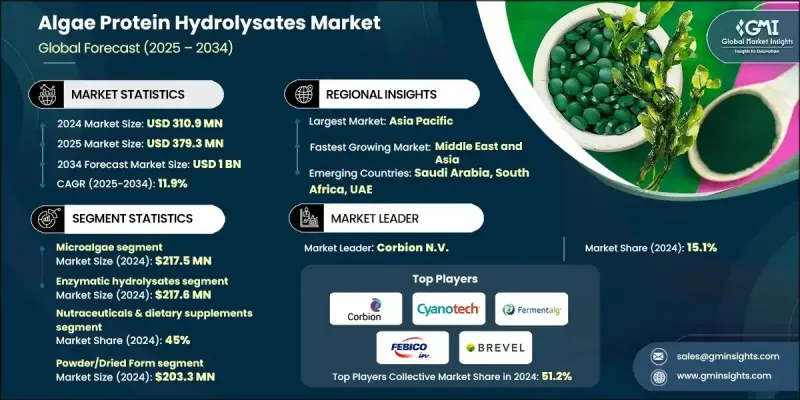

2024 年全球藻类蛋白水解物市值为 3.109 亿美元,预计到 2034 年将以 11.9% 的复合年增长率增长至 10 亿美元。

随着生物加工技术的创新加速产品开发和商业化,人们对营养丰富、可持续来源的蛋白质原料的兴趣日益浓厚,正在重塑产业格局。藻类水解物因其更高的消化率、更好的溶解性和更优的氨基酸组成而备受青睐。酵素法加工技术的进步、反应参数的最佳化以及现代过滤技术的进步显着提高了藻类胜肽的纯度、产量和性能。先进的培养系统、生物反应器和环保萃取方法的整合,推动了清洁标籤和环境友善蛋白质生产的转型。上游和下游製程效率的提升增强了藻类原料的规模化生产能力,同时降低了整体环境负荷。藻类作为一种可再生资源,其日益增长的吸引力,以及其只需少量淡水且无需占用传统耕地即可生长的特性,正进一步加速其在食品、营养、美容和饲料等领域的应用。人们对藻类在碳捕获方面作用的认识不断提高,也促进了其在消费者和工业领域的广泛接受和关注。

| 市场范围 | |

|---|---|

| 起始年份 | 2024 |

| 预测年份 | 2025-2034 |

| 起始值 | 3.109亿美元 |

| 预测值 | 10亿美元 |

| 复合年增长率 | 11.9% |

由于微藻具有卓越的营养密度和加工弹性,预计到2024年,微藻市场规模将达到2.175亿美元。微藻富含蛋白质和高价值的生物活性化合物,因此在膳食补充剂、功能性食品和个人护理产品领域持续受到青睐。微藻全年可培养且资源需求低,这满足了全球对可持续、高效蛋白质替代品日益增长的需求。

2024年,酶解水解物市场规模达2.176亿美元,仍是市场上领先的加工方法。酶解转化因其能够生产具有优异生物活性、易消化性和溶解性的高品质水解物而备受认可,这些特性对于食品、保健品和化妆品应用至关重要。此製程最大限度地减少了化学废弃物的产生,符合日益增长的环保生产需求,使其成为生产清洁功能性成分的首选技术。

2024年,美国藻类蛋白水解物市场规模预估为6,200万美元。北美市场持续成长,主要得益于消费者对植物性和替代蛋白的浓厚兴趣,尤其是在健康产品领域。该地区拥有完善的监管框架和成熟的消费群体,这为藻类营养和功能性成分的成长提供了有力支撑。加拿大和墨西哥透过扩大研究计画和在饲料应用领域的创新,进一步巩固了该地区的整体市场地位。

藻类蛋白水解物市场的主要企业包括Algama Foods、Corbion NV、A4F AlgaFuel SA、Fermentalg SA、Brevel Ltd.、Necton SA、Algalif Iceland ehf.、Microphyt SAS、Fitoplancton Marino SL、Solar Foods Oy、Algo Technologies Technologies SAS、Oceanitt, N硬.5.B5.B5 公司/59699969999969999933333人 Ltd)。这些领先企业透过扩大产能、提高培养效率以及大力投资先进的生物加工技术来增强自身竞争力。许多企业采用可持续的萃取方法,并开发优化的酵素系统,以生产具有卓越营养和功能特性的水解物。策略联盟、合资企业和长期供应协议有助于拓展市场准入并确保稳定的原材料供应。此外,各企业也优先考虑合规性、品质认证和透明的采购流程,以满足市场对清洁标籤成分日益增长的需求。针对食品、营养保健品、化妆品和饲料领域的多元化产品策略增强了收入来源。

目录

第一章:方法论与范围

第二章:执行概要

第三章:行业洞察

- 产业生态系分析

- 供应商格局

- 利润率

- 每个阶段的价值增加

- 影响价值链的因素

- 中断

- 产业影响因素

- 成长驱动因素

- 对可持续蛋白质的需求不断增长

- 营养与功能优势

- 生产技术进步

- 产业陷阱与挑战

- 高昂的生产和加工成本

- 可扩展性和供应链问题

- 市场机会

- 功能性食品和饮料的成长

- 拓展化妆品和个人护理业务

- 农业和水产饲料应用

- 成长驱动因素

- 成长潜力分析

- 监管环境

- 北美洲

- 欧洲

- 亚太地区

- 拉丁美洲

- 中东和非洲

- 波特的分析

- PESTEL 分析

- 技术与创新格局

- 当前技术趋势

- 新兴技术

- 价格趋势

- 按地区

- 来源

- 未来市场趋势

- 技术与创新格局

- 当前技术趋势

- 新兴技术

- 专利格局

- 贸易统计(HS编码)(註:仅提供重点国家的贸易统计资料)

- 主要进口国

- 主要出口国

- 永续性和环境方面

- 永续实践

- 减少废弃物策略

- 生产中的能源效率

- 环保倡议

- 碳足迹考量

第四章:竞争格局

- 介绍

- 公司市占率分析

- 按地区

- 北美洲

- 欧洲

- 亚太地区

- 拉丁美洲

- MEA

- 按地区

- 公司矩阵分析

- 主要市场参与者的竞争分析

- 竞争定位矩阵

- 关键进展

- 併购

- 合作伙伴关係与合作

- 新产品发布

- 扩张计划

第五章:市场估算与预测:依来源划分,2021-2034年

- 主要趋势

- 微藻水解物

- 螺旋藻(钝顶螺旋藻)水解物

- 小球藻水解物

- 拟球藻水解物

- 雨生红球藻水解物

- 其他微藻种类

- 大型藻类水解物

- 褐藻水解物

- 红藻水解物

- 绿藻水解物

- 混合藻类水解物

- 微型藻类与大型藻类的组合

- 多物种混合物

第六章:市场估算与预测:以水解法计算,2021-2034年

- 主要趋势

- 酵素水解物

- 基于Alcalase的水解

- 基于胃蛋白酶的水解

- 胰蛋白酶水解

- 中性蛋白酶和其他蛋白酶

- 多酶系统

- 化学水解物

- 酸水解

- 碱性水解

- 联合化学过程

- 热解/物理解产物

- 高温水解

- 压力辅助水解

- 超音波辅助水解

- 微波辅助水解

- 新兴水解技术

- 脉衝电场(PEF)处理

- 超临界流体萃取

- 深共熔溶剂体系

第七章:市场估计与预测:依应用领域划分,2021-2034年

- 主要趋势

- 营养保健品和膳食补充剂

- 胶囊和片剂

- 粉末製剂

- 液体补充剂

- 专业保健产品

- 食品饮料应用

- 功能性食品和强化产品

- 蛋白质补充品和运动营养

- 饮料及液体配方

- 烘焙和糖果应用

- 乳製品替代品及植物性产品

- 动物饲料和水产养殖

- 水产养殖饲料添加剂

- 牲畜饲料添加剂

- 宠物食品应用

- 家禽和猪的营养

- 化妆品及个人护理

- 抗衰老配方

- 保养产品

- 护髮应用

- 功能性化妆品

第八章:市场估算与预测:依产品形式划分,2021-2034年

- 粉末/干燥水解物

- 喷雾干燥粉末

- 冻干产品

- 滚筒干燥製剂

- 液态水解物

- 水溶液

- 浓缩配方

- 稳定液体系统

- 胶囊/稳定形式

- 微胶囊产品

- 片剂和压缩剂型

- 涂层和保护系统

第九章:市场估计与预测:依地区划分,2021-2034年

- 主要趋势

- 北美洲

- 我们

- 加拿大

- 墨西哥

- 欧洲

- 德国

- 英国

- 法国

- 西班牙

- 义大利

- 欧洲其他地区

- 亚太地区

- 中国

- 印度

- 日本

- 澳洲

- 韩国

- 亚太其他地区

- 拉丁美洲

- 巴西

- 墨西哥

- 阿根廷

- 拉丁美洲其他地区

- 中东和非洲

- 沙乌地阿拉伯

- 南非

- 阿联酋

- 中东和非洲其他地区

第十章:公司简介

- A4F AlgaFuel SA

- Algaia Ltd.

- Algalif Iceland ehf.

- Algama Foods

- Algosource Technologies SAS

- Brevel Ltd.

- Corbion NV

- Cyanotech Corporation

- FEBICO (Far East Bio-Tec Co., Ltd.)

- Fermentalg SA

- Fitoplancton Marino SL

- Microphyt SAS

- Necton SA

- Ocean Rainforest Sp/F

- Solar Foods Oy

The Global Algae Protein Hydrolysates Market was valued at USD 310.9 million in 2024 and is estimated to grow at a CAGR of 11.9% to reach USD 1 billion by 2034.

Growing interest in nutrient-rich, sustainably sourced protein ingredients is reshaping industry dynamics as innovations in bioprocessing accelerate product development and commercialization. Algae-derived hydrolysates are becoming highly valued because they offer enhanced digestibility, improved solubility, and a strong amino acid profile. Advances in enzymatic processing, optimized reaction parameters, and modern filtration technologies have significantly improved the purity, yield, and performance of algae-based peptides. The integration of advanced cultivation systems, bioreactors, and eco-friendly extraction methods supports the shift toward clean-label and environmentally responsible protein production. Enhanced efficiency in upstream and downstream processes strengthens the scalability of algae-based ingredients while reducing overall environmental load. The rising appeal of algae as a renewable resource, combined with its ability to grow using minimal freshwater and without using traditional farming land, is further accelerating adoption across food, nutrition, beauty, and feed applications. Growing recognition of algae's role in carbon capture also contributes to broader acceptance and interest across consumer and industrial segments.

| Market Scope | |

|---|---|

| Start Year | 2024 |

| Forecast Year | 2025-2034 |

| Start Value | $310.9 Million |

| Forecast Value | $1 Billion |

| CAGR | 11.9% |

The microalgae segment accounted for USD 217.5 million in 2024, owing to superior nutrient density and processing versatility. Microalgae continue to be preferred for applications in supplements, functional foods, and personal care because of their substantial protein levels and high-value bioactive compounds. Their year-round cultivation potential and low resource requirements support increasing global demand for sustainable, efficient protein alternatives.

The enzymatic hydrolysates segment recorded USD 217.6 million in 2024 and remains the leading processing method in the market. Enzymatic conversion is recognized for delivering high-quality hydrolysates with excellent bioactivity, digestibility, and solubility, which are crucial for food, nutraceutical, and cosmetic applications. The process minimizes chemical waste and aligns with growing expectations for eco-conscious manufacturing, making it a preferred technology for producing clean and functional ingredients.

US Algae Protein Hydrolysates Market was valued at USD 62 million in 2024. North America continues to advance due to strong consumer interest in plant-derived and alternative proteins, especially within wellness-focused product categories. The region benefits from well-established regulatory frameworks and a mature consumer base that supports the growth of algae-derived nutritional and functional ingredients. Canada and Mexico further contribute through expanding research programs and innovation in feed applications, strengthening the region's overall market footprint.

Prominent businesses active in the Algae Protein Hydrolysates Market include Algama Foods, Corbion N.V., A4F AlgaFuel S.A., Fermentalg S.A., Brevel Ltd., Necton S.A., Algalif Iceland ehf., Microphyt SAS, Fitoplancton Marino S.L., Solar Foods Oy, Algosource Technologies SAS, Ocean Rainforest Sp/F, FEBICO, Cyanotech Corporation, and Algaia Ltd. Leading companies in the Algae Protein Hydrolysates Market enhance their competitiveness by expanding production capacity, improving cultivation efficiency, and investing heavily in advanced bioprocessing technologies. Many adopt sustainable extraction methods and develop optimized enzyme systems to create hydrolysates with superior nutritional and functional properties. Strategic alliances, joint ventures, and long-term supply agreements help broaden market access and secure consistent raw material availability. Firms also prioritize regulatory compliance, quality certification, and transparent sourcing to align with the growing demand for clean-label ingredients. Product diversification targeted at food, nutraceutical, cosmetic, and feed sectors strengthens revenue streams.

Table of Contents

Chapter 1 Methodology & Scope

- 1.1 Market scope and definition

- 1.2 Research design

- 1.2.1 Research approach

- 1.2.2 Data collection methods

- 1.3 Data mining sources

- 1.3.1 Global

- 1.3.2 Regional/Country

- 1.4 Base estimates and calculations

- 1.4.1 Base year calculation

- 1.4.2 Key trends for market estimation

- 1.5 Primary research and validation

- 1.5.1 Primary sources

- 1.6 Forecast model

- 1.7 Research assumptions and limitations

Chapter 2 Executive Summary

- 2.1 Industry 360° synopsis

- 2.2 Key market trends

- 2.2.1 Source

- 2.2.2 Hydrolysis method

- 2.2.3 Application

- 2.2.4 Product form

- 2.2.5 Regional

- 2.3 TAM Analysis, 2025-2034

- 2.4 CXO perspectives: Strategic imperatives

- 2.4.1 Executive decision points

- 2.4.2 Critical success factors

- 2.5 Future outlook and strategic recommendations

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.1.1 Supplier landscape

- 3.1.2 Profit margin

- 3.1.3 Value addition at each stage

- 3.1.4 Factor affecting the value chain

- 3.1.5 Disruptions

- 3.2 Industry impact forces

- 3.2.1 Growth drivers

- 3.2.1.1 Rising demand for sustainable proteins

- 3.2.1.2 Nutritional and functional advantages

- 3.2.1.3 Technological advancements in production

- 3.2.2 Industry pitfalls and challenges

- 3.2.2.1 High production and processing costs

- 3.2.2.2 Scalability and supply chain issues

- 3.2.3 Market opportunities

- 3.2.3.1 Growth in functional foods and beverages

- 3.2.3.2 Expansion in cosmetics and personal care

- 3.2.3.3 Agricultural and aquafeed applications

- 3.2.1 Growth drivers

- 3.3 Growth potential analysis

- 3.4 Regulatory landscape

- 3.4.1 North America

- 3.4.2 Europe

- 3.4.3 Asia Pacific

- 3.4.4 Latin America

- 3.4.5 Middle East & Africa

- 3.5 Porter's analysis

- 3.6 PESTEL analysis

- 3.7 Technology and innovation landscape

- 3.7.1 Current technological trends

- 3.7.2 Emerging technologies

- 3.8 Price trends

- 3.8.1 By region

- 3.8.2 By source

- 3.9 Future market trends

- 3.10 Technology and innovation landscape

- 3.10.1 Current technological trends

- 3.10.2 Emerging technologies

- 3.11 Patent landscape

- 3.12 Trade statistics (HS code)( Note: the trade statistics will be provided for key countries only)

- 3.12.1 Major importing countries

- 3.12.2 Major exporting countries

- 3.13 Sustainability and environmental aspects

- 3.13.1 Sustainable practices

- 3.13.2 Waste reduction strategies

- 3.13.3 Energy efficiency in production

- 3.13.4 Eco-friendly initiatives

- 3.14 Carbon footprint consideration

Chapter 4 Competitive Landscape, 2024

- 4.1 Introduction

- 4.2 Company market share analysis

- 4.2.1 By region

- 4.2.1.1 North America

- 4.2.1.2 Europe

- 4.2.1.3 Asia Pacific

- 4.2.1.4 LATAM

- 4.2.1.5 MEA

- 4.2.1 By region

- 4.3 Company matrix analysis

- 4.4 Competitive analysis of major market players

- 4.5 Competitive positioning matrix

- 4.6 Key developments

- 4.6.1 Mergers & acquisitions

- 4.6.2 Partnerships & collaborations

- 4.6.3 New product launches

- 4.6.4 Expansion plans

Chapter 5 Market Estimates and Forecast, By Source, 2021-2034 (USD Million) (Kilo Tons)

- 5.1 Key trends

- 5.2 Microalgae-derived hydrolysates

- 5.2.1 Spirulina (Arthrospira platensis) hydrolysates

- 5.2.2 Chlorella vulgaris hydrolysates

- 5.2.3 Nannochloropsis hydrolysates

- 5.2.4 Haematococcus pluvialis hydrolysates

- 5.2.5 Other microalgae species

- 5.3 Macroalgae-derived hydrolysates

- 5.3.1 Brown algae hydrolysates

- 5.3.2 Red algae hydrolysates

- 5.3.3 Green algae hydrolysates

- 5.4 Mixed algae hydrolysates

- 5.4.1 Micro-macroalgae combinations

- 5.4.2 Multi-species blends

Chapter 6 Market Estimates and Forecast, By Hydrolysis Method, 2021-2034 (USD Million) (Kilo Tons)

- 6.1 Key trends

- 6.2 Enzymatic hydrolysates

- 6.2.1 Alcalase-based hydrolysis

- 6.2.2 Pepsin-based hydrolysis

- 6.2.3 Trypsin-based hydrolysis

- 6.2.4 Neutrase & other proteases

- 6.2.5 Multi-enzyme systems

- 6.3 Chemical hydrolysates

- 6.3.1 Acid hydrolysis

- 6.3.2 Alkaline hydrolysis

- 6.3.3 Combined chemical processes

- 6.4 Thermal/physical hydrolysates

- 6.4.1 High temperature hydrolysis

- 6.4.2 Pressure-assisted hydrolysis

- 6.4.3 Ultrasonic-assisted hydrolysis

- 6.4.4 Microwave-assisted hydrolysis

- 6.5 Emerging hydrolysis technologies

- 6.5.1 Pulsed electric field (PEF) processing

- 6.5.2 Supercritical fluid extraction

- 6.5.3 Deep eutectic solvent systems

Chapter 7 Market Estimates and Forecast, By Application, 2021-2034 (USD Million) (Kilo Tons)

- 7.1 Key trends

- 7.2 Nutraceutical & dietary supplements

- 7.2.1 Capsules & tablets

- 7.2.2 Powder formulations

- 7.2.3 Liquid supplements

- 7.2.4 Specialized health products

- 7.3 Food & beverage applications

- 7.3.1 Functional foods & fortified products

- 7.3.2 Protein supplements & sports nutrition

- 7.3.3 Beverages & liquid formulations

- 7.3.4 Bakery & confectionery applications

- 7.3.5 Dairy alternatives & plant-based products

- 7.4 Animal feed & aquaculture

- 7.4.1 Aquaculture feed additives

- 7.4.2 Livestock feed supplements

- 7.4.3 Pet food applications

- 7.4.4 Poultry & swine nutrition

- 7.5 Cosmetics & personal care

- 7.5.1 Anti-aging formulations

- 7.5.2 Skin conditioning products

- 7.5.3 Hair care applications

- 7.5.4 Functional cosmetics

Chapter 8 Market Estimates and Forecast, By Product Form, 2021-2034 (USD Million) (Kilo Tons)

- 8.1 Powder/dried hydrolysates

- 8.1.1 Spray-dried powders

- 8.1.2 Freeze-dried products

- 8.1.3 Drum-dried formulations

- 8.2 Liquid hydrolysates

- 8.2.1 Aqueous solutions

- 8.2.2 Concentrated formulations

- 8.2.3 Stabilized liquid systems

- 8.3 Encapsulated/stabilized forms

- 8.3.1 Microencapsulated products

- 8.3.2 Tablet & compressed forms

- 8.3.3 Coated & protected systems

Chapter 9 Market Estimates and Forecast, By Region, 2021-2034 (USD Million) (Kilo Tons)

- 9.1 Key trends

- 9.2 North America

- 9.2.1 U.S.

- 9.2.2 Canada

- 9.2.3 Mexico

- 9.3 Europe

- 9.3.1 Germany

- 9.3.2 UK

- 9.3.3 France

- 9.3.4 Spain

- 9.3.5 Italy

- 9.3.6 Rest of Europe

- 9.4 Asia Pacific

- 9.4.1 China

- 9.4.2 India

- 9.4.3 Japan

- 9.4.4 Australia

- 9.4.5 South Korea

- 9.4.6 Rest of Asia Pacific

- 9.5 Latin America

- 9.5.1 Brazil

- 9.5.2 Mexico

- 9.5.3 Argentina

- 9.5.4 Rest of Latin America

- 9.6 Middle East and Africa

- 9.6.1 Saudi Arabia

- 9.6.2 South Africa

- 9.6.3 UAE

- 9.6.4 Rest of Middle East and Africa

Chapter 10 Company Profiles

- 10.1 A4F AlgaFuel S.A.

- 10.2 Algaia Ltd.

- 10.3 Algalif Iceland ehf.

- 10.4 Algama Foods

- 10.5 Algosource Technologies SAS

- 10.6 Brevel Ltd.

- 10.7 Corbion N.V.

- 10.8 Cyanotech Corporation

- 10.9 FEBICO (Far East Bio-Tec Co., Ltd.)

- 10.10 Fermentalg S.A.

- 10.11 Fitoplancton Marino S.L.

- 10.12 Microphyt SAS

- 10.13 Necton S.A.

- 10.14 Ocean Rainforest Sp/F

- 10.15 Solar Foods Oy