|

市场调查报告书

商品编码

1440381

2.5D 和 3D 半导体封装 - 市场占有率分析、产业趋势与统计、成长预测(2024 - 2029)2.5D & 3D Semiconductor Packaging - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2024 - 2029) |

||||||

※ 本网页内容可能与最新版本有所差异。详细情况请与我们联繫。

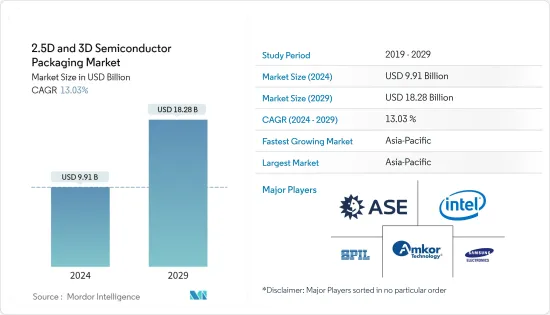

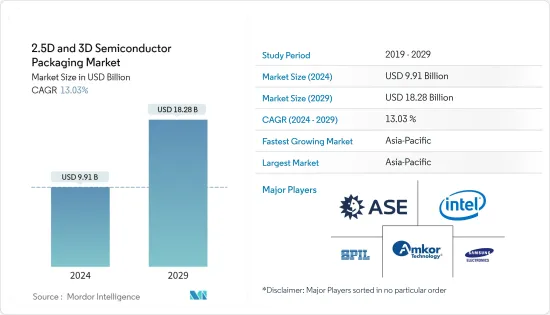

2024年2.5D和3D半导体封装市场规模预计为99.1亿美元,预计到2029年将达到182.8亿美元,在预测期内(2024-2029年)CAGR为13.03%。

主要亮点

- 2.5D 和 3D 是在同一封装内包含多个 IC 的封装方法。在 2.5D 结构中,两个或多个主动半导体晶片并排放置在硅中介层上,以实现极高的晶片间互连密度。在 3D 结构中,主动晶片透过晶片堆迭进行集成,以实现最短的互连和最小的封装尺寸。近年来,2.5D和3D因其实现极高封装密度和高能源效率的优点而成为理想的晶片组整合平台。

- 高效能运算、资料中心网路和自动驾驶汽车正在推动所研究市场的采用率,以及从技术角度来看的演变。如今的趋势是在云端、边缘运算和设备层面拥有大量的运算资源。

- 此外,由于技术突破带来的电子产品尺寸缩小等趋势以及对具有更高频宽和功率效率的消费性电子产品的需求不断增长,所研究的市场一直在扩大。透过利用动态热管理、高速资料管理、低功耗、高储存容量等特性,用于半导体晶片先进封装的 3DIC 和 2.5D TSV 互连可改善使用者体验。这是其消费性电子应用市场扩张的关键驱动力之一。

- 半导体 IC 设计的高初始投资和不断增加的复杂性是所研究市场的限制因素。设计人员必须克服严峻的技术和组织挑战,才能获得 2.5D/3D 封装的优势并获得竞争优势。

- COVID-19大流行造成的全球半导体短缺促使厂商专注于提高产能。例如,中芯国际宣布了雄心勃勃的计划,透过在多个城市建设新的晶片製造工厂,到 2025 年将产能翻一番,其中包括 2021 年 9 月宣布在上海自贸区建立新工厂。半导体产能的这种成长可能有利于所研究的市场。

2.5D & 3D半导体封装市场趋势

各行业半导体装置消费不断成长,推动市场发展

- 数位化的不断发展、远端工作和远端操作的趋势日益增强,以及消费者对电子产品的需求不断增加,引发了对能够实现各种新功能的先进半导体设备的需求。随着对半导体装置的需求不断增强,先进的封装技术提供了当今数位化世界所需的外形尺寸和处理能力。

- 例如,根据半导体产业协会的数据,2022年8月,全球半导体产业销售额为474亿美元,比2021年8月的473亿美元总额小幅成长0.1%。

- 2.5D 和 3D 封装技术因其众多优势而在半导体产业迅速普及。例如,半导体晶片的 3D 整合提供了一种灵活的方法,透过整合不同的技术,如混合讯号和射频 (RF) 元件、记忆体和逻辑电路、光电器件来执行异构片上系统 (SoC) 设计。等到3D 积体电路(IC) 的不同晶片上。

- 消费性电子产品是半导体供应商最重要的最终用户产业之一。智慧型手机产业的成长、智慧型装置和穿戴式装置的日益普及,以及消费性物联网设备在智慧家庭等应用中的渗透率不断上升,正在推动半导体设备的成长,从而对市场产生积极影响。

- 此外,由于5G商业化在全球范围内的快速成长,预计5G相关设备将涌入全球市场,包括网路基础设施、网路设备、节点和行动终端。例如,爱立信表示,智慧型手机用户预计将从 2021 年的 62.59 亿户增至 2027 年的 78.4 亿户。

- 此外,不断增加的资料中心扩建以及电动车和自动驾驶汽车的使用增加也增加了对先进半导体的需求,进一步支持了所研究市场的成长。例如,根据 IEA 的数据,2021 年电动车 (EV) 销量比前一年翻了一番,达到 660 万辆的新纪录。此外,到 2021 年,全球汽车销量的近 10% 是电动车。随着功率半导体装置成为此类汽车的关键元件,近年来该领域对这些装置的需求显着增长。

- 这些趋势描绘了不同最终用户产业对半导体装置的巨大需求。随着半导体封装製程在半导体製造和设计中发挥关键作用,半导体装置消耗的不断增长将同时增加对半导体封装解决方案的需求。

中国占有重要的市场份额

- 先进技术一直为各种消费性电子产品、医疗设备、电信和通讯设备以及汽车等的发展做出了贡献。随着5G服务在该国的推出,对智慧型手机等的需求不断增加。

- 据工业和资讯化部 (MIIT) 称,中国的目标是到 2022 年安装 200 万个 5G 基地台,以扩展该国的下一代行动网路。根据工信部的数据,中国大陆目前已安装 142.5 万个 5G 基地台,支援全国超过 5 亿的 5G 用户,使其成为全球最广泛的网路。该地区5G的不断普及预计也将促进对5G设备的需求,从而增加中国对2.5D和3D半导体封装的需求。

- 同样,根据中国资讯通讯研究院(CAICT)的数据,2021年中国相容5G网路的智慧型手机出货量成长63.5%,达到2.66亿部。此外,5G智慧型手机出货量占国内出货量的75.9 %,高于全球平均40.7%。到2022年7月,5G智慧型手机将占中国所有手机出货量的74%。截至2022年7月,5G智慧型手机总出货量为1.24亿台,中国推出121款新5G手机型号。这些趋势将加速国内对2.5D和3D半导体封装解决方案的需求。

- 随着2.5D和3D半导体封装解决方案的需求不断增加,许多公司一直在市场上进行各种活动。主要厂商在该国的投资将推动 2.5D 和 3D 半导体封装市场的发展。

- 2022年10月,台积电在2022开放创新平台生态系统论坛上推出开放创新平台(OIP)3DFabric联盟。新的台积电3DFabric 联盟将是台积电的第六个OIP 联盟,也是半导体产业中的第一个此类联盟,旨在与各个合作伙伴合作,加速3D IC 生态系统的准备和创新,并为半导体提供全方位的一流服务和解决方案设计、基板技术、记忆体模组、测试、封装和製造。

2.5D & 3D半导体封装产业概况

2.5D 和 3D 半导体封装市场适度分散,其中包括日月光集团、Amkor Technology Inc.、英特尔公司、三星电子和 Siliconware Precision Industries 等各种重要参与者。主要参与者不断努力在市场上进行合作、併购、收购、创新和投资,以维持其市场地位。

2022 年 8 月,英特尔展示了最新的架构和封装突破,可实现 2.5D 和 3D 基于区块的晶片设计,开创了晶片製造技术及其重要性的新时代。英特尔的系统代工厂模型具有改进的封装。该公司计划到 2030 年将封装上的电晶体数量从 1,000 亿个增加到 1 兆个。

2022 年 6 月,日月光集团宣布推出 VIPack,这是一个先进的封装平台,旨在实现垂直整合的封装解决方案。 VIPack 代表了 ASE 的下一代 3D 异质整合架构,可扩展设计规则并提供超高密度和效能。

额外的好处:

- Excel 格式的市场估算 (ME) 表

- 3 个月的分析师支持

目录

第 1 章:简介

- 研究假设和市场定义

- 研究范围

第 2 章:研究方法

第 3 章:执行摘要

第 4 章:市场洞察

- 市场概况

- 产业吸引力-波特五力分析

- 供应商的议价能力

- 买家的议价能力

- 新进入者的威胁

- 替代品的威胁

- 竞争激烈程度

- 价值链分析

- 评估 COVID-19 对市场的影响

第 5 章:市场动态

- 市场驱动因素

- 多个行业对半导体装置的消费不断增长

- 对紧凑型、高性能电子设备的需求不断增长

- 市场限制

- 半导体 IC 设计的初始投资高且复杂性不断增加

- 机会

- 高阶运算、伺服器和资料中心的采用不断增加

第 6 章:市场细分

- 依封装技术

- 3D

- 2.5D

- 3D 晶圆级晶片级封装 (WLCSP) - 定性分析

- 按最终用户产业

- 消费性电子产品

- 医疗设备

- 通讯和电信

- 汽车

- 其他最终用户产业

- 按地理

- 美国

- 中国

- 台湾

- 韩国

- 日本

- 世界其他地区

- 欧洲

第 7 章:竞争格局

- 公司简介

- ASE Group

- Amkor Technology Inc.

- Intel Corporation

- Samsung Electronics Co. Ltd

- Siliconware Precision Industries Co. Ltd (SPIL)

- Powertech Technology Inc.

- Jiangsu Changjiang Electronics Technology Co. Ltd.

- TSMC Limited

- GlobalFoundries Inc.

- Tezzaron Semiconductor Corp.

第 8 章:投资分析

第 9 章:市场的未来

The 2.5D & 3D Semiconductor Packaging Market size is estimated at USD 9.91 billion in 2024, and is expected to reach USD 18.28 billion by 2029, growing at a CAGR of 13.03% during the forecast period (2024-2029).

Key Highlights

- 2.5D and 3D are packaging methodologies for including multiple IC inside the same package. In a 2.5D structure, two or more active semiconductor chips are placed side-by-side on a silicon interposer to achieve extremely high die-to-die interconnect density. In a 3D structure, active chips are integrated by die stacking for the shortest interconnect and smallest package footprint. In recent years, 2.5D and 3D have gained momentum as ideal chipset integration platforms due to their merits in achieving extremely high packaging density and high energy efficiency.

- High-performance computing, data center networking, and autonomous vehicles are pushing the adoption rates for the studied market, along with its evolution from a technology point of view. Today, the trend is to have enormous computing resources at the cloud, edge computing, and device levels.

- Further, the studied market has been expanding due to trends like the downsizing of electronic items brought on by technological breakthroughs and growing demand for consumer electronics with higher bandwidth and power efficiency. By utilizing dynamic heat management, high-speed data management, low power consumption, high memory capability, and other features, 3DIC and 2.5D TSV interconnect for advanced packaging in semiconductor chips refine the user experience. This serves as one of the key driving forces behind the market expansion of its consumer electronic applications.

- High initial investment and increasing complexity of semiconductor IC designs act as restraining factors for the studied market. The designers must overcome serious technical and organizational challenges before capturing the benefits of 2.5D/3D packaging and achieving a competitive edge.

- The worldwide semiconductor shortage caused by the COVID-19 pandemic prompted players to focus on increasing production capacity. For instance, the Semiconductor Manufacturing International Corp (SMIC) announced aggressive plans to double its production capacity by 2025, by constructing new chip fabrication plants in various cities, including a September 2021 announcement to establish a new factory in Shanghai's free trade zone. Such an increase in semiconductor production capacities is likely to benefit the studied market.

2.5D & 3D Semiconductor Packaging Market Trends

Growing Consumption of Semiconductor Devices Across Industries to Drive the Market

- Rising digitization, increasing trends of remote work and remote operations, and increasing consumer demand for electronics have sparked the need for advanced semiconductor devices that enable various new capabilities. As the demands for semiconductor devices intensify consistently, advanced packaging techniques provide the form factor and processing power required for today's digitized world.

- For instance, according to the Semiconductor Industry Association, during August 2022, global semiconductor industry sales were USD 47.4 billion, a slight increase of 0.1% over the August 2021 total of USD 47.3 billion.

- 2.5D and 3D packaging technology is quickly gaining popularity in the semiconductor industry owing to its numerous benefits. For instance, 3D integration of semiconductor chips provides a flexible way to carry out the heterogeneous system-on-chip (SoC) design by integrating disparate technologies, such as mixed signal and radio frequency (RF) components, memory and logic circuits, optoelectronic devices, etc., onto different dies of a 3D integrated circuit (IC).

- Consumer electronics is one of semiconductor vendors' most prominent end-user industries. Growth in the smartphone industry, increasing adoption of smart devices and wearables, and rising penetration of consumer IoT devices in applications like intelligent homes are driving the growth of semiconductor devices, thereby positively impacting the market.

- Further, owing to the soaring growth pushed by 5G commercialization around the world, 5G-relevant devices are expected to flood global markets, including network infrastructure, networking equipment, nodes, and mobile terminals. For instance, according to Ericsson, smartphone subscription is expected to reach 7,840 million in 2027, from 6,259 million in 2021.

- Moreover, rising data center build-outs and the increasing use of electric and autonomous vehicles have also increased the demand for advanced semiconductors, further supporting the studied market's growth. For instance, as per IEA, sales of electric vehicles (EVs) doubled in 2021 from the previous year to reach a new record of 6.6 million. Also, nearly 10% of global car sales were electric in 2021. With power semiconductor devices forming a key element in such vehicles, the demand for these devices has witnessed remarkable growth from this segment in recent years.

- Such trends depict the huge demand for semiconductor devices across different end-user industries. With the semiconductor packaging process playing a critical role in semiconductor manufacturing and design, the rising consumption of semiconductor devices will increase the demand for semiconductor packaging solutions simultaneously.

China Holds Significant Market Share

- Advancing technologies have been contributing to the development of various consumer electronics, medical devices, telecom and communication devices, and automotives, among others. With the launch of 5G services in the country, the demand for smartphones, among other things, has been increasing.

- According to the Ministry of Industry and Information Technology (MIIT), China aims to have 2 million installed 5G base stations in 2022 to expand the country's next-generation mobile network. The Chinese mainland currently has 1.425 million installed 5G base stations that support more than 500 million 5G users nationwide, making it the most extensive network in the world, as per MIIT. The growing implementation of 5G in the region is also expected to promote the demand for 5G-enabled devices, thereby increasing the need for 2.5D and 3D semiconductor packaging in China.

- Similarly, as per the China Academy of Information and Communications (CAICT), China's shipments of smartphones compatible with 5G networks rose by 63.5% to 266 million in 2021. Further, 5G smartphone shipments accounted for 75.9% of domestic shipments, higher than a global average of 40.7%. By July 2022, 5G smartphones would have accounted for 74% of all mobile phone shipments in China. The total number of 5G smartphone shipments by July 2022 was 124 million units, and China introduced 121 new 5G mobile phone models. Such trends will accelerate the demand for 2.5D and 3D semiconductor packaging solutions in the country.

- With the increasing demand for 2.5D and 3D semiconductor packaging solutions, many companies have been carrying out various activities in the market. Major players' investments in the country are set to fuel the 2.5D & 3D semiconductor packaging market.

- In October 2022, TSMC launched its Open Innovation Platform (OIP) 3DFabric Alliance at the 2022 Open Innovation Platform Ecosystem Forum. The new TSMC 3DFabric Alliance would be TSMC's sixth OIP Alliance and the first of its kind in the semiconductor industry for collaborating with various partners to accelerate 3D IC ecosystem readiness and innovation, with a full spectrum of best-in-class services and solutions for semiconductor design, substrate technology, memory modules, testing, packaging, and manufacturing.

2.5D & 3D Semiconductor Packaging Industry Overview

The 2.5D & 3D semiconductor packaging market is moderately fragmented, with the presence of various significant players like ASE Group, Amkor Technology Inc., Intel Corporation, Samsung Electronics Co. Ltd, and Siliconware Precision Industries Co. Ltd., among others. The key players are continuously making efforts for partnerships, mergers, acquisitions, innovations, and investments in the market to retain their market positions.

In August 2022, Intel showcased the most recent architectural and packaging breakthroughs that enable 2.5D and 3D tile-based chip designs, ushering in a new era in chipmaking technologies and their significance. Intel's system foundry model features improved packaging. The company intends to increase the number of transistors on a package from 100 billion to 1 trillion by 2030.

In June 2022, ASE Group announced VIPack, an advanced packaging platform designed to enable vertically integrated packaging solutions. The VIPack represents ASE's next-generation 3D heterogeneous integration architecture that expands design rules and delivers ultra-high density and performance.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET INSIGHTS

- 4.1 Market Overview

- 4.2 Industry Attractiveness - Porter's Five Forces Analysis

- 4.2.1 Bargaining Power of Suppliers

- 4.2.2 Bargaining Power of Buyers

- 4.2.3 Threat of New Entrants

- 4.2.4 Threat of Substitutes

- 4.2.5 Intensity of Competitive Rivalry

- 4.3 Value Chain Analysis

- 4.4 Assessment of the Impact of COVID-19 on the Market

5 MARKET DYNAMICS

- 5.1 Market Drivers

- 5.1.1 Growing Consumption of Semiconductor Devices Across Several Industries

- 5.1.2 Increasing Demand for Compact, High Functionality Electronic Devices

- 5.2 Market Restraints

- 5.2.1 High Initial Investment and Increasing Complexity of Semiconductor IC Designs

- 5.3 Opportunities

- 5.3.1 Growing Adoption of High-End Computing, Servers, and Data Centers

6 MARKET SEGMENTATION

- 6.1 By Packaging Technology

- 6.1.1 3D

- 6.1.2 2.5D

- 6.1.3 3D Wafer-level Chip-scale Packaging (WLCSP) - Qualitative Analysis

- 6.2 By End-User Industry

- 6.2.1 Consumer Electronics

- 6.2.2 Medical Devices

- 6.2.3 Communications and Telecom

- 6.2.4 Automotive

- 6.2.5 Other End-User Industries

- 6.3 By Geography

- 6.3.1 United States

- 6.3.2 China

- 6.3.3 Taiwan

- 6.3.4 Korea

- 6.3.5 Japan

- 6.3.6 Rest of the World

- 6.3.7 Europe

7 COMPETITIVE LANDSCAPE

- 7.1 Company Profiles

- 7.1.1 ASE Group

- 7.1.2 Amkor Technology Inc.

- 7.1.3 Intel Corporation

- 7.1.4 Samsung Electronics Co. Ltd

- 7.1.5 Siliconware Precision Industries Co. Ltd (SPIL)

- 7.1.6 Powertech Technology Inc.

- 7.1.7 Jiangsu Changjiang Electronics Technology Co. Ltd.

- 7.1.8 TSMC Limited

- 7.1.9 GlobalFoundries Inc.

- 7.1.10 Tezzaron Semiconductor Corp.