|

市场调查报告书

商品编码

1685749

法国货运与物流:市场占有率分析、产业趋势与统计、成长预测(2025-2030 年)France Freight and Logistics - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

价格

※ 本网页内容可能与最新版本有所差异。详细情况请与我们联繫。

简介目录

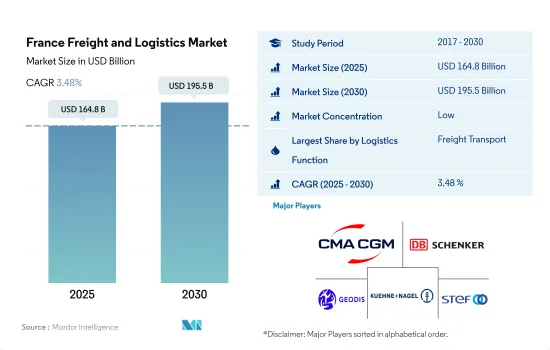

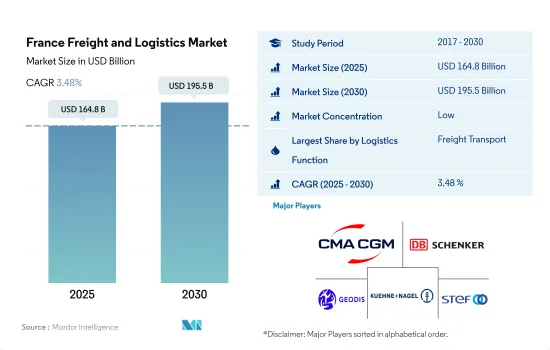

预计 2025 年法国货运代理和物流市场规模将达到 1,648 亿美元,到 2030 年预计将达到 1,955 亿美元,预测期内(2025-2030 年)的复合年增长率为 3.48%。

物流业的投资具有週期性,许多建设计划的计画都持续到2025年。

- 2024年6月,法国政府与位于法国西南部的奥克西塔尼大区签署了一项协议,涵盖2023年至2027年,该协议包含一项价值1.7658亿美元的货运专项投资计画。此外,法国国家铁路公司 Reseau Occitanie 将出资 3.3109 亿美元,用于振兴该地区的主要铁路网。国家和奥克西塔尼大区政府相关人员就加强基础设施的重要性达成共识,强调强大的铁路枢纽的重要角色。主要地点包括塞特港、佩皮尼昂-圣查尔斯港、勒布卢港和新港。

- 作为 2028 年的基础设施支出计画的一部分,法国政府已拨款 51 亿欧元(54.4 亿美元)用于高速公路的开发和建设。根据法国 2030 投资计划,政府已承诺投入 25 亿欧元(26.6 亿美元),到 2030 年将电动和混合动力汽车汽车的产量提高到 200 万辆左右。此外,从 2022 年开始,我们将开始呼吁开展计划,推动电动车高功率充电站的普及。法国政府的这些战略倡议将加强该国的短程货运情势。

法国货运及物流市场的趋势

法国正在投资 10.6 亿美元用于道路现代化,并投资 1,060 亿美元用于铁路基础建设,以促进其物流业的发展。

- 2023年,法国宣布了一项1,067.4亿美元的投资策略,预计在2040年完成。这项由政府主导的计划重点是加强和现代化该国的铁路基础设施。该计画的核心是引进高速通勤列车到各大城市,并效法巴黎着名的 RER 系统。该项目涉及法国国家铁路公司 SNCF、欧盟和地方当局之间的合作。

- 2024 年 7 月,Solaris订单。这些公车预计将于 2025 年初交付,将加强 Artois Mobility 减少二氧化碳排放的努力,特别是在兰斯和贝瑟讷地区。 Solaris Urbino 12 氢气公车的车顶配备了 70 kW 燃料电池,并配有 Solaris 高功率牵引电池,以便在电力需求高峰时提供额外支援。

俄罗斯将增加对法国的液化天然气供应,以因应俄乌战争造成的燃料短缺

- 截至 2024 年 7 月 12 日当週,法国柴油和超级无铅燃料的价格略有上涨。柴油价格为每公升 1.84 美元(含税)。 2024 年头三个月,与 2023 年相比,俄罗斯对法国的液化天然气供应量增加超过欧盟其他国家。 2024 年迄今,巴黎已向俄罗斯支付了超过 6.4049 亿美元的天然气供应,并敦促法国削减购买量。在俄罗斯入侵乌克兰两年后,马克宏寻求采取更强硬的立场支持基辅,乌克兰与俄罗斯的天然气贸易也随之成长。

- 2027年,欧盟将推出新的碳定价体系-排放交易体系2(ETS2)。欧盟立法者最初同意在 2023 年实现二氧化碳排放上限为每吨 48.03 美元,并对每公升柴油和汽油征收 10 美分的附加税。

法国货运及物流业概况

法国货运代理商和物流市场较为分散,主要有五家参与者:达飞集团(包括 CEVA Logistics)、德国铁路股份公司(包括 DB Schenker)、GEODIS、Kuehne+Nagel 和 STEF 集团(按字母顺序排列)。

其他福利:

- Excel 格式的市场预测 (ME) 表

- 3 个月的分析师支持

目录

第 1 章执行摘要和主要发现

第二章 报告要约

第 3 章 简介

- 研究假设和市场定义

- 研究范围

- 调查方法

第四章 产业主要趋势

- 人口统计

- 按经济活动分類的 GDP 分布

- 经济活动带来的 GDP 成长

- 通货膨胀率

- 经济表现及概况

- 电子商务产业趋势

- 製造业趋势

- 交通运输仓储业生产毛额

- 出口趋势

- 进口趋势

- 燃油价格

- 卡车运输成本

- 卡车持有量(依类型)

- 物流绩效

- 主要卡车供应商

- 模态共享

- 海运能力

- 班轮连结性

- 停靠港和演出

- 货运趋势

- 货物吨位趋势

- 基础设施

- 法律规范(公路和铁路)

- 法国

- 法律规范(海运和空运)

- 法国

- 价值链与通路分析

第五章 市场区隔

- 最终用户产业

- 农业、渔业和林业

- 建设业

- 製造业

- 石油和天然气、采矿和采石

- 批发和零售

- 其他的

- 物流功能

- 快递、快递和包裹 (CEP)

- 目的地

- 国内的

- 国际的

- 货物

- 按运输方式

- 航空

- 海上和内陆水道

- 其他的

- 货物

- 交通方式

- 航空

- 管道

- 铁路

- 路

- 海上和内陆水道

- 仓库存放

- 透过温度控制

- 无温度控制

- 温度管理

- 其他服务

- 快递、快递和包裹 (CEP)

第六章 竞争格局

- 主要策略趋势

- 市场占有率分析

- 业务状况

- 公司简介.

- Balguerie Group

- CLASQUIN

- CMA CGM Group(including CEVA Logistics)

- Deutsche Bahn AG(including DB Schenker)

- DHL Group

- DIMOTRANS Group

- DSV A/S(De Sammensluttede Vognmaend af Air and Sea)

- FedEx

- GEODIS

- Kuehne+Nagel

- Savino Del Bene SpA

- SEKO Bansard

- STEF Group

第七章:执行长的关键策略问题

第 8 章 附录

- 世界概况

- 概述

- 五力分析框架

- 全球价值链分析

- 市场动态(市场驱动因素、限制因素、机会)

- 技术进步

- 资讯来源和进一步阅读

- 图表清单

- 关键见解

- 资料包

- 词彙表

- 外汇

简介目录

Product Code: 46912

The France Freight and Logistics Market size is estimated at 164.8 billion USD in 2025, and is expected to reach 195.5 billion USD by 2030, growing at a CAGR of 3.48% during the forecast period (2025-2030).

A wave pattern has been followed in investments for the logistics sector, with many construction projects lined up till 2025

- In June 2024, the French State inked a deal with the Occitanie region, located in the southwest of France, spanning the years 2023 to 2027. The agreement featured a dedicated investment package of USD 176.58 million, exclusively earmarked for freight. Additionally, SNCF Reseau Occitanie is contributing a substantial USD 331.09 million to rejuvenate the core rail network of the region. Officials from the State and the Occitanie region have reached a consensus on the importance of bolstering infrastructures, emphasizing the pivotal role of robust rail hubs. Key locations identified include the port of Sete, Perpignan Saint-Charles, Le Boulou, and Port-la-Nouvelle.

- As part of its infrastructure spending initiatives through 2028, the French government designated EUR 5.1 billion (USD 5.44 billion) for highway maintenance and construction. Under the France 2030 investment plan, the government committed EUR 2.5 billion (USD 2.66 billion) to bolster the production of nearly two million electric and hybrid vehicles by 2030. Additionally, in 2022, the government issued a call for projects to facilitate the rollout of high-power charging stations for electric vehicles. These strategic moves by the French government are set to fortify the landscape of short-haul trucking in the country.

France Freight and Logistics Market Trends

France is boosting its logistics industry with USD 1.06 billion investments toward road modernization and USD 106 billion towards rail infrastructure

- In 2023, France unveiled a USD 106.74 billion investment strategy slated for completion by 2040, aligning with its commitment to slash carbon emissions. The initiative, spearheaded by the government, focuses on bolstering and modernizing the nation's rail infrastructure. Central to the plan is the introduction of high-speed commuter trains, mirroring Paris's renowned RER system, in key urban centers. Collaborating on this endeavor are France's national rail entity, SNCF, alongside the European Union and regional administrations.

- In July 2024, Solaris secured an order from Artois Mobilites, part of the TADAO transport network in northern France, for four 12-meter Urbino hydrogen buses. These buses, slated for delivery in early 2025, will bolster Artois Mobilites' efforts to reduce carbon emissions, particularly in the Lens and Bethune regions. The Solaris Urbino 12 hydrogen buses will boast 70 kW fuel cells on their roofs and will be complemented by Solaris High Power traction batteries, providing additional support during peak electricity demand.

Increase in Russian LNG deliveries to France catering to fuel shortages caused by Russia-Ukraine war

- For the week ending July 12, 2024, diesel and super unleaded motor fuel prices in France saw a modest uptick. Diesel was priced at USD 1.84 per liter, inclusive of all taxes. In the first three months of 2024, Russian LNG deliveries to France increased more than to any other EU country compared to 2023. Paris has paid over USD 640.49 million to Russia for gas supplies since the start of 2024, prompting calls for France to reduce its purchases. This growing gas trade with Russia occurs as Macron aims to take a tougher stance in support of Kyiv, two years after Russia's full-scale invasion of Ukraine.

- In 2027, the EU is set to implement a new carbon pricing scheme, the Emissions Trading System 2 (ETS2), targeting CO2 emissions from buildings and road transport. Initially agreed upon in 2023, EU legislators assured that the pricing would cap at USD 48.03 per tonne of CO2, translating to an estimated 10-cent surcharge on each liter of diesel or petrol.

France Freight and Logistics Industry Overview

The France Freight and Logistics Market is fragmented, with the major five players in this market being CMA CGM Group (including CEVA Logistics), Deutsche Bahn AG (including DB Schenker), GEODIS, Kuehne+Nagel and STEF Group (sorted alphabetically).

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 EXECUTIVE SUMMARY & KEY FINDINGS

2 REPORT OFFERS

3 INTRODUCTION

- 3.1 Study Assumptions & Market Definition

- 3.2 Scope of the Study

- 3.3 Research Methodology

4 KEY INDUSTRY TRENDS

- 4.1 Demographics

- 4.2 GDP Distribution By Economic Activity

- 4.3 GDP Growth By Economic Activity

- 4.4 Inflation

- 4.5 Economic Performance And Profile

- 4.5.1 Trends in E-Commerce Industry

- 4.5.2 Trends in Manufacturing Industry

- 4.6 Transport And Storage Sector GDP

- 4.7 Export Trends

- 4.8 Import Trends

- 4.9 Fuel Price

- 4.10 Trucking Operational Costs

- 4.11 Trucking Fleet Size By Type

- 4.12 Logistics Performance

- 4.13 Major Truck Suppliers

- 4.14 Modal Share

- 4.15 Maritime Fleet Load Carrying Capacity

- 4.16 Liner Shipping Connectivity

- 4.17 Port Calls And Performance

- 4.18 Freight Pricing Trends

- 4.19 Freight Tonnage Trends

- 4.20 Infrastructure

- 4.21 Regulatory Framework (Road and Rail)

- 4.21.1 France

- 4.22 Regulatory Framework (Sea and Air)

- 4.22.1 France

- 4.23 Value Chain & Distribution Channel Analysis

5 MARKET SEGMENTATION (includes 1. Market value in USD for all segments 2. Market volume for select segments viz. freight transport, CEP (courier, express, and parcel) and warehousing & storage 3. Forecasts up to 2030 and analysis of growth prospects)

- 5.1 End User Industry

- 5.1.1 Agriculture, Fishing, and Forestry

- 5.1.2 Construction

- 5.1.3 Manufacturing

- 5.1.4 Oil and Gas, Mining and Quarrying

- 5.1.5 Wholesale and Retail Trade

- 5.1.6 Others

- 5.2 Logistics Function

- 5.2.1 Courier, Express, and Parcel (CEP)

- 5.2.1.1 By Destination Type

- 5.2.1.1.1 Domestic

- 5.2.1.1.2 International

- 5.2.2 Freight Forwarding

- 5.2.2.1 By Mode Of Transport

- 5.2.2.1.1 Air

- 5.2.2.1.2 Sea and Inland Waterways

- 5.2.2.1.3 Others

- 5.2.3 Freight Transport

- 5.2.3.1 By Mode Of Transport

- 5.2.3.1.1 Air

- 5.2.3.1.2 Pipelines

- 5.2.3.1.3 Rail

- 5.2.3.1.4 Road

- 5.2.3.1.5 Sea and Inland Waterways

- 5.2.4 Warehousing and Storage

- 5.2.4.1 By Temperature Control

- 5.2.4.1.1 Non-Temperature Controlled

- 5.2.4.1.2 Temperature Controlled

- 5.2.5 Other Services

- 5.2.1 Courier, Express, and Parcel (CEP)

6 COMPETITIVE LANDSCAPE

- 6.1 Key Strategic Moves

- 6.2 Market Share Analysis

- 6.3 Company Landscape

- 6.4 Company Profiles (includes Global Level Overview, Market Level Overview, Core Business Segments, Financials, Headcount, Key Information, Market Rank, Market Share, Products and Services, and Analysis of Recent Developments).

- 6.4.1 Balguerie Group

- 6.4.2 CLASQUIN

- 6.4.3 CMA CGM Group (including CEVA Logistics)

- 6.4.4 Deutsche Bahn AG (including DB Schenker)

- 6.4.5 DHL Group

- 6.4.6 DIMOTRANS Group

- 6.4.7 DSV A/S (De Sammensluttede Vognmaend af Air and Sea)

- 6.4.8 FedEx

- 6.4.9 GEODIS

- 6.4.10 Kuehne+Nagel

- 6.4.11 Savino Del Bene SpA

- 6.4.12 SEKO Bansard

- 6.4.13 STEF Group

7 KEY STRATEGIC QUESTIONS FOR FREIGHT AND LOGISTICS CEOS

8 APPENDIX

- 8.1 Global Overview

- 8.1.1 Overview

- 8.1.2 Porter's Five Forces Framework

- 8.1.3 Global Value Chain Analysis

- 8.1.4 Market Dynamics (Market Drivers, Restraints & Opportunities)

- 8.1.5 Technological Advancements

- 8.2 Sources & References

- 8.3 List of Tables & Figures

- 8.4 Primary Insights

- 8.5 Data Pack

- 8.6 Glossary of Terms

- 8.7 Currency Exchange Rate

02-2729-4219

+886-2-2729-4219