|

市场调查报告书

商品编码

1687076

南美货运和物流:市场占有率分析、行业趋势和成长预测(2025-2030 年)South America Freight And Logistics - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

※ 本网页内容可能与最新版本有所差异。详细情况请与我们联繫。

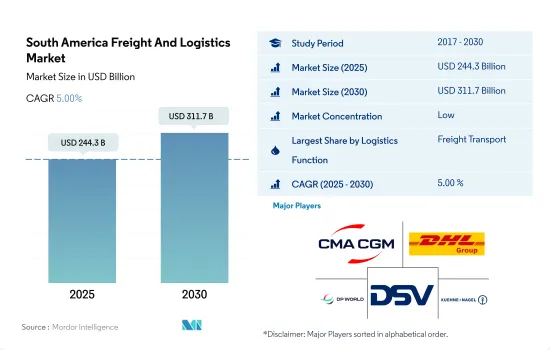

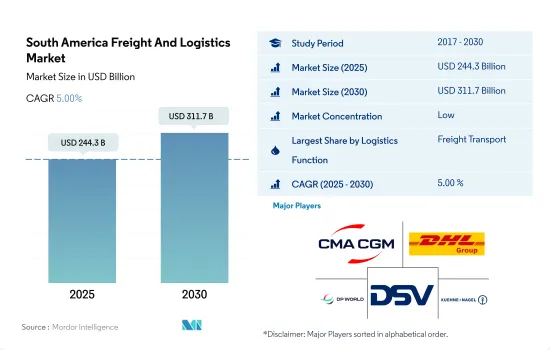

南美货运和物流市场规模预计在 2025 年为 2,443 亿美元,预计到 2030 年将达到 3,117 亿美元,预测期内(2025-2030 年)的复合年增长率为 5.00%。

电子商务产业和基础设施投资,发展该地区的货运市场

- 巴西的目标是在2024年至2026年期间吸引约1800亿雷亚尔(约340.3亿美元)的私人投资用于新的铁路和公路计划。此举是巴西为道路基础设施现代化和扩建以及提高远距货运能力所做的更广泛努力的一部分。引人注目的是,美洲开发银行(IDB)核准为圣保罗州高速公路投资计画提供一笔 4.8 亿美元的贷款,该贷款将于 2023 年到期。该倡议旨在加强该州的生产链、提高生产能力并促进区域一体化。巴西的目标是到2026年确保620亿美元的高速公路投资。

- 南美电子商务的快速成长正在刺激对运输服务的需求。 2023年,该地区电子商务产业的销售额预计将达到583.8亿美元,较2022年的517.9亿美元大幅成长。根据预测,到2027年,收益预计将达到968.7亿美元,2023年至2027年的复合年增长率为13.50%。用户群也将成长,预计到2025年将达到2.441亿。用户渗透率预计在2022年达到54.0%,到2025年将上升到58.7%。

南美货运和物流的成长与变化

- 巴西与阿根廷、智利、哥伦比亚和秘鲁并列为该地区主要经济体之一。巴西正在其卡车车队中采用干净科技,努力实现永续交通运输。例如,百威英博旗下的巴西啤酒製造商安贝夫(Ambev)已与电动卡车供应商FNM合作,计画在2023年底部署约1,000辆电动卡车。巴西已展示了电动卡车在采矿业的应用。例如,2022年10月,淡水河谷宣布将在米纳斯吉拉斯州阿瓜林帕测试一辆72吨的非公路卡车。这些重大的技术创新加上多个产业对货运日益增长的需求。

- 在阿根廷,DHL快递将于2023年9月开通迈阿密至布宜诺斯艾利斯之间的新货运航班,以提高递送效率。该航班将由巴拿马DHL Aero Expreso公司管理,使用一架载重量为52吨的B767-300货机。该航空公司每週营运六班从迈阿密国际机场 (MIA) 经智利圣地牙哥 (SCL) 飞往布宜诺斯艾利斯 (EZE) 的航班。该计划旨在将货物抵达阿根廷当天的通关速度提高 10%,并将当日送达量提高 50%。

南美洲货运和物流市场的趋势

南美国家正大力投资基础建设,以改善交通运输部门。

- 2024年6月,阿根廷联邦政府将914个基础建设计划移交给省级当局,为各省带来了严峻的财政挑战。儘管各州希望重新开放公共服务,但它们的主要收入来源——联邦政府的拨款却大幅削减。 2024 年 6 月,联邦对各州的税收转移(CFI)与去年同期相比下降了 20%,2024 年六个月中有五个月出现两位数的下降。 6 月其他联邦政府转移支付(RON)也下降了 24.1%。

- 2023年,巴西政府已拨款25.9亿美元用于基础建设物流,包括公路、铁路、港口和机场。其中,约 24.2 亿美元用于公路建设,铁路建设获得的拨款较少,为 3,025 万美元。展望未来,政府计划在2024年6月之前启动一项重大国家倡议,旨在透过公共和私营部门的资金结合来增加对货运铁路计划的投资。基于这个雄心勃勃的愿景,政府计划向这些铁路计划注资40亿美元。

俄乌战争对全球油价的影响,导致该地区油价大幅上涨。

- 2024年3月,受季节性波动和经济放缓征兆影响,巴西柴油需求下降。巴西石油公司决定降低柴油价格,以及强制将生质柴油混合率从 12% 提高到 14%,进一步导致传统化石柴油需求下降。国内市场也受到全球油价波动和政府稳定油价努力的影响。儘管巴西库存有 320 万桶俄罗斯轻质原油过剩,但巴西仍维持了出口,而不是完全停止。

- 智利计划在2030年开始大规模生产永续航空燃料(SAF),并计划在2050年利用从石油、生物和城市废弃物中提取的生质燃料来满足其一半的航空燃料需求。预计到2040年,空中交通量将翻一番,智利将SAF视为其脱碳策略的关键要素。此外,SAF 可以与传统喷射机燃料混合,无需对引擎进行任何改造即可减少高达 80% 的排放气体。预计 SAF 将为智利贡献一半以上的碳排放目标,并在该国实现净零目标中发挥关键作用。

南美货运及物流业概况

南美货运和物流市场较为分散,五大主要参与者分别是达飞集团(CMA CGM Group,包括 CEVA Logistics)、DHL 集团、DP World、DSV A/S(De Sammensluttede Vognmaend af Air and Sea)和 Kuehne+Nagel(按字母顺序排列)。

其他福利

- Excel 格式的市场预测 (ME) 表

- 3个月的分析师支持

目录

第一章执行摘要和主要发现

第二章 报告要约

第三章 引言

- 研究假设和市场定义

- 研究范围

- 调查方法

第四章 产业主要趋势

- 人口统计

- 按经济活动分類的GDP分布

- 按经济活动分類的GDP成长

- 通货膨胀率

- 经济表现及概况

- 电子商务产业趋势

- 製造业趋势

- 交通运输仓储业GDP

- 出口趋势

- 进口趋势

- 燃油价格

- 卡车运输成本

- 卡车持有量(按类型)

- 物流绩效

- 主要卡车供应商

- 模态共享

- 海运能力

- 班轮连结性

- 停靠港和表演

- 货运趋势

- 货物吨位趋势

- 基础设施

- 法律规范(公路和铁路)

- 阿根廷

- 巴西

- 智利

- 法律规范(海运和空运)

- 阿根廷

- 巴西

- 智利

- 价值炼和通路分析

第五章市场区隔

- 最终用户产业

- 农业、渔业和林业

- 建设业

- 製造业

- 石油和天然气、采矿和采石

- 批发和零售

- 其他的

- 物流功能

- 快递、快递和小包裹(CEP)

- 目的地

- 国内的

- 国际的

- 货物

- 按交通方式

- 航空

- 海上和内陆水道

- 其他的

- 货物

- 交通方式

- 航空

- 管道

- 铁路

- 路

- 海上和内陆水道

- 仓库存放

- 温度管理

- 无温度控制

- 温度管理

- 其他的

- 快递、快递和小包裹(CEP)

- 国家

- 阿根廷

- 巴西

- 智利

- 南美洲其他地区

第六章 竞争格局

- 关键策略趋势

- 市场占有率分析

- 商业状况

- 公司简介.

- Agunsa

- Alonso Group

- Americold

- 达飞集团(包括CEVA物流)

- 德国铁路公司(包括德铁信可)

- DHL Group

- DP World

- DSV A/S(De Sammensluttede Vognmaend af Air and Sea)

- Kuehne+Nagel

- Romeu

- SAAM

- TASA Logistica

第七章:CEO面临的关键策略问题

第 8 章 附录

- 世界概况

- 概述

- 五力分析框架

- 全球价值链分析

- 市场动态(市场驱动因素、限制因素、机会)

- 技术进步

- 资讯来源及延伸阅读

- 图表清单

- 关键见解

- 资料包

- 词彙表

- 外汇

The South America Freight And Logistics Market size is estimated at 244.3 billion USD in 2025, and is expected to reach 311.7 billion USD by 2030, growing at a CAGR of 5.00% during the forecast period (2025-2030).

E-commerce industry and infrastructure investments, developing the freight transport market in the region

- Brazil has set a target of attracting around BRL 180 billion (USD 34.03 billion) in private investments for new rail and highway projects from 2024 to 2026. This move is part of Brazil's broader efforts to modernize and expand its road infrastructure, which would bolster its long-haul trucking capabilities. In a notable development, the Inter-American Development Bank (IDB) sanctioned a USD 480 million loan in 2023 for the State of Sao Paulo Highway Investment Program. The initiative aims to enhance the state's production chains, improve production capacity, and foster regional integration. Brazil has set its sights on securing USD 62 billion in highway investments by 2026.

- The rapid growth of e-commerce in South America is fueling the demand for transportation services. In 2023, the region's e-commerce sector generated revenues of USD 58.38 billion, marking a significant increase from USD 51.79 billion in 2022. Projections indicate a CAGR of 13.50% from 2023 to 2027, with revenues expected to reach USD 96.87 billion by 2027. The user base is also set to expand, with estimates pegging it at 244.1 million by 2025. In 2022, the user penetration rate stood at 54.0%, and it is projected to rise to 58.7% by 2025.

Growth and transition in South America's freight and logistics

- Brazil is one of the major economies in the region, along with Argentina, Chile, Colombia, and Peru. Brazil is working toward sustainable transport and adopting clean technologies for truck fleets. For instance, Ambev, a Brazilian brewing company owned by Anheuser-Busch InBev, collaborated with electric truck supplier FNM to receive around 1,000 electric trucks by the end of 2023. Brazil witnessed the adoption of electric trucks in mining. For instance, in October 2022, Vale announced testing 72-tonne off-highway trucks at Agua Limpa in Minas Gerais. These significant technological innovations and growing demand for freight transport across several sectors.

- In Argentina, in September 2023, DHL Express launched new freighter flights between Miami and Buenos Aires to improve delivery efficiency. These flights, managed by DHL Aero Expreso in Panama, use a B767-300 freighter with a 52-ton capacity. Operating six times weekly, the service goes from Miami International Airport (MIA) to Buenos Aires (EZE) via Santiago, Chile (SCL), and back. This initiative aims to speed up customs clearance in Argentina by 10% on the same day as arrival and increase same-day deliveries by 50%.

South America Freight And Logistics Market Trends

South American countries are investing heavily in infrastructure development to improve the transportation sector

- In June 2024, Argentina's federal government transferred 914 infrastructure projects to provincial authorities, creating a tough financial challenge for the provinces. Despite wanting to resume public works, provinces have faced deep cuts to federal transfers, their main source of income. Federal tax transfers (CFI) to provinces dropped 20% YoY in June 2024 and have decreased by double digits in five out of the six months of 2024. Other federal transfers (RON) also fell 24.1% in June.

- In 2023, the Brazilian government allocated USD 2.59 billion to infrastructure logistics, encompassing highways, railways, ports, and airports. A significant portion, approximately USD 2.42 billion, was funneled into highways, while railways received a modest allocation of USD 30.25 million. Looking ahead, by June 2024, the government is set to launch a major national initiative aimed at amplifying investments in freight rail projects, leveraging a blend of public and private sector funding. With an ambitious vision, the government plans to inject a substantial USD 4 billion into these rail projects.

Crude oil prices in the region rose significantly owing to the impact of the Russia-Ukraine War on global crude oil

- In March 2024, seasonal fluctuations and signs of an economic slowdown led to a decline in Diesel demand in Brazil. Petrobras' decision to reduce Diesel prices, coupled with the mandated increase in biodiesel blending from 12% to 14%, further fueled this drop in demand for conventional fossil Diesel. The domestic market was also swayed by global fluctuations in crude oil prices and government efforts to stabilize them. Even with an excess of 3.2 million barrels of Russian Diesel on hand, Brazil maintained its shipments without a complete halt.

- By 2030, Chile plans to launch large-scale production of sustainable aviation fuel (SAF) and aims for these biofuel sources derived from oils, fats, and both biological and municipal waste to satisfy half of its aviation fuel needs by 2050. With projections of air traffic doubling by 2040, Chile views SAF as a pivotal element in its decarbonization strategy. Moreover, SAF can be blended with traditional jet fuel to reduce emissions by up to 80% without engine modifications. It is expected to contribute over half of Chile's targeted carbon emissions reductions, playing a key role in the country's net-zero goals.

South America Freight And Logistics Industry Overview

The South America Freight And Logistics Market is fragmented, with the major five players in this market being CMA CGM Group (including CEVA Logistics), DHL Group, DP World, DSV A/S (De Sammensluttede Vognmaend af Air and Sea) and Kuehne+Nagel (sorted alphabetically).

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 EXECUTIVE SUMMARY & KEY FINDINGS

2 REPORT OFFERS

3 INTRODUCTION

- 3.1 Study Assumptions & Market Definition

- 3.2 Scope of the Study

- 3.3 Research Methodology

4 KEY INDUSTRY TRENDS

- 4.1 Demographics

- 4.2 GDP Distribution By Economic Activity

- 4.3 GDP Growth By Economic Activity

- 4.4 Inflation

- 4.5 Economic Performance And Profile

- 4.5.1 Trends in E-Commerce Industry

- 4.5.2 Trends in Manufacturing Industry

- 4.6 Transport And Storage Sector GDP

- 4.7 Export Trends

- 4.8 Import Trends

- 4.9 Fuel Price

- 4.10 Trucking Operational Costs

- 4.11 Trucking Fleet Size By Type

- 4.12 Logistics Performance

- 4.13 Major Truck Suppliers

- 4.14 Modal Share

- 4.15 Maritime Fleet Load Carrying Capacity

- 4.16 Liner Shipping Connectivity

- 4.17 Port Calls And Performance

- 4.18 Freight Pricing Trends

- 4.19 Freight Tonnage Trends

- 4.20 Infrastructure

- 4.21 Regulatory Framework (Road and Rail)

- 4.21.1 Argentina

- 4.21.2 Brazil

- 4.21.3 Chile

- 4.22 Regulatory Framework (Sea and Air)

- 4.22.1 Argentina

- 4.22.2 Brazil

- 4.22.3 Chile

- 4.23 Value Chain & Distribution Channel Analysis

5 MARKET SEGMENTATION (includes 1. Market value in USD for all segments 2. Market volume for select segments viz. freight transport, CEP (courier, express, and parcel) and warehousing & storage 3. Forecasts up to 2030 and analysis of growth prospects)

- 5.1 End User Industry

- 5.1.1 Agriculture, Fishing, and Forestry

- 5.1.2 Construction

- 5.1.3 Manufacturing

- 5.1.4 Oil and Gas, Mining and Quarrying

- 5.1.5 Wholesale and Retail Trade

- 5.1.6 Others

- 5.2 Logistics Function

- 5.2.1 Courier, Express, and Parcel (CEP)

- 5.2.1.1 By Destination Type

- 5.2.1.1.1 Domestic

- 5.2.1.1.2 International

- 5.2.2 Freight Forwarding

- 5.2.2.1 By Mode Of Transport

- 5.2.2.1.1 Air

- 5.2.2.1.2 Sea and Inland Waterways

- 5.2.2.1.3 Others

- 5.2.3 Freight Transport

- 5.2.3.1 By Mode Of Transport

- 5.2.3.1.1 Air

- 5.2.3.1.2 Pipelines

- 5.2.3.1.3 Rail

- 5.2.3.1.4 Road

- 5.2.3.1.5 Sea and Inland Waterways

- 5.2.4 Warehousing and Storage

- 5.2.4.1 By Temperature Control

- 5.2.4.1.1 Non-Temperature Controlled

- 5.2.4.1.2 Temperature Controlled

- 5.2.5 Other Services

- 5.2.1 Courier, Express, and Parcel (CEP)

- 5.3 Country

- 5.3.1 Argentina

- 5.3.2 Brazil

- 5.3.3 Chile

- 5.3.4 Rest of South America

6 COMPETITIVE LANDSCAPE

- 6.1 Key Strategic Moves

- 6.2 Market Share Analysis

- 6.3 Company Landscape

- 6.4 Company Profiles (includes Global Level Overview, Market Level Overview, Core Business Segments, Financials, Headcount, Key Information, Market Rank, Market Share, Products and Services, and Analysis of Recent Developments).

- 6.4.1 Agunsa

- 6.4.2 Alonso Group

- 6.4.3 Americold

- 6.4.4 CMA CGM Group (including CEVA Logistics)

- 6.4.5 Deutsche Bahn AG (including DB Schenker)

- 6.4.6 DHL Group

- 6.4.7 DP World

- 6.4.8 DSV A/S (De Sammensluttede Vognmaend af Air and Sea)

- 6.4.9 Kuehne+Nagel

- 6.4.10 Romeu

- 6.4.11 SAAM

- 6.4.12 TASA Logistica

7 KEY STRATEGIC QUESTIONS FOR FREIGHT AND LOGISTICS CEOS

8 APPENDIX

- 8.1 Global Overview

- 8.1.1 Overview

- 8.1.2 Porter's Five Forces Framework

- 8.1.3 Global Value Chain Analysis

- 8.1.4 Market Dynamics (Market Drivers, Restraints & Opportunities)

- 8.1.5 Technological Advancements

- 8.2 Sources & References

- 8.3 List of Tables & Figures

- 8.4 Primary Insights

- 8.5 Data Pack

- 8.6 Glossary of Terms

- 8.7 Currency Exchange Rate