|

市场调查报告书

商品编码

1907329

德国货运和物流市场:市场份额分析、行业趋势、统计数据和成长预测(2026-2031 年)Germany Freight And Logistics - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2026 - 2031) |

||||||

※ 本网页内容可能与最新版本有所差异。详细情况请与我们联繫。

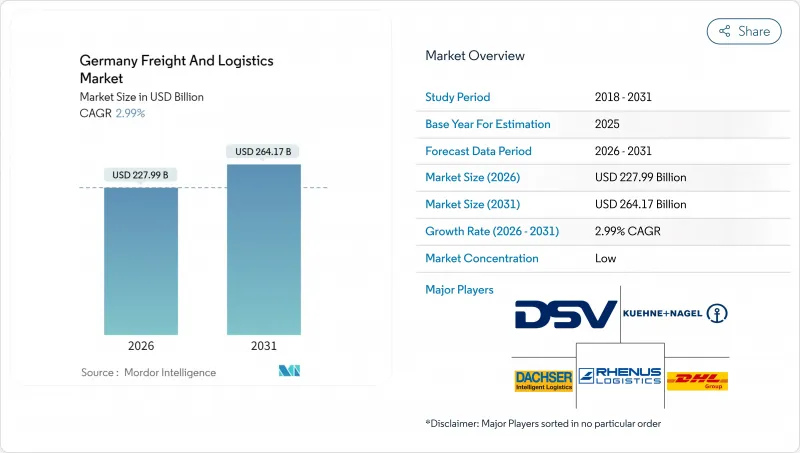

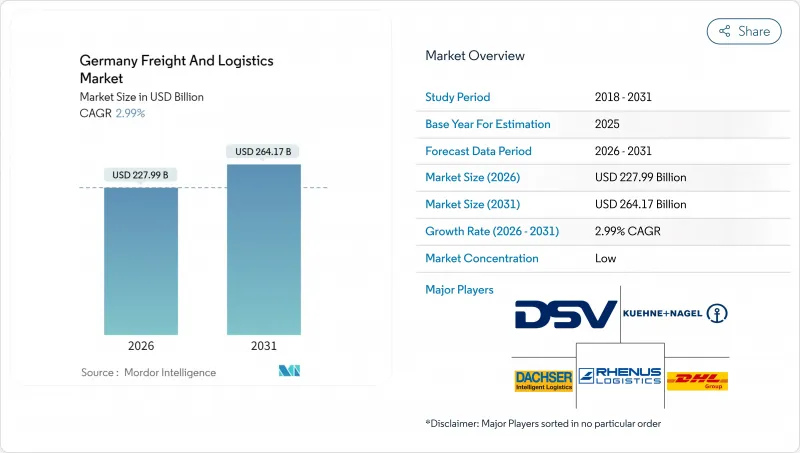

德国货运和物流市场预计将从 2025 年的 2,213.7 亿美元成长到 2026 年的 2,279.9 亿美元,到 2031 年达到 2,641.7 亿美元,2026 年至 2031 年的复合年增长率为 2.99%。

这一温和的成长率反映了围绕电子商务履约、出口导向製造业走廊以及提高道路运输碳排放成本的欧洲绿色交易规则而形成的成熟生态系统的重组。到2030年,铁路激励措施总额将达到17亿欧元(19亿美元),加上每吨55欧元(60.7美元)的碳价稳步上涨,正促使托运人转向多式联运解决方案,同时仍依赖道路运输进行灵活的短途运输。同时,宅配、速递和小包裹(CEP)产业正在蓬勃发展,这得益于87%的消费者网路购物渗透率、人均小包裹密度超过54件以及都市区仓库自动化投资的加速成长。日益严重的司机短缺(到2025年将有7万个职缺)正在加剧卡车运输能力紧张并推高工资,促使承运人实施路线优化软体并试用自动驾驶场内牵引车。在这些结构性变化中,凭藉其位于欧洲中部的位置、41000公里的高速公路网络和世界一流的港口,德国货运和物流市场继续支持洲际贸易流动。

德国货运及物流市场趋势及洞察

B2C电子商务小包裹激增

2024年,德国的电子商务渗透率将达到87%,每年处理45亿个小包裹。这将形成一个密集的「最后一公里」配送网络,平均每位居民每年要接收54次配送。受亚马逊生鲜(Amazon Fresh)和Rewe等公司当日达服务的扩张推动,生鲜平台将年增23%。为此,法兰克福正在试行兴建以路面电车为基础的配送中心,而柏林、汉堡和慕尼黑则在试办停车场微型配送中心。小包裹聚合商也积极回应,安装了每小时可处理3万个包裹的高速分拣机,并扩大了电动配送车的规模,以符合低排放区的相关规定。在「双十一」和圣诞节等购物高峰期,都市区道路拥挤不堪,这进一步凸显了市政当局对都市区包裹收集规划的重视。小小包裹的持续涌入也进一步强化了机器人技术、人工智慧驱动的需求预测以及灵活的轮班安排在包裹配送网路中的战略价值。

製造业出口的韧性

儘管全球经济波动,但由于多元化的出口市场和关键原材料的近岸外包,德国工厂在2024年仍实现了1.56兆欧元(1.72兆美元)的出口额。汽车製造商将其一级供应商集中在巴伐利亚州和巴登-符腾堡州组装厂方圆500公里以内,从而缩短了运输前置作业时间,并稳定了准时制(JIS)生产流程。机械和化学产品出口商在汉堡-慕尼黑和莱茵-鲁尔走廊签订了长期铁路运输合同,使货车周转率提高了15%,并避免了柴油价格上涨对利润率的影响。可预测的货运走廊使物流供应商能够运作高运力班次,并与码头营运商协商批量折扣。出口的可靠性持续支撑着德国的货运和物流市场,维持了对温控货柜、特殊计划货物设备和海关合规服务的需求。

司机短缺和劳动力老化

预计到2025年,德国的司机缺口将达到7万人,其中39%的执照拥有者年龄超过55岁。这导致车辆运转率下降,迫使德国在高峰期运作7%至10%的牵引车。虽然每年有1.8万名新司机从培训学校毕业,但超过2.5万人离开这个行业,加剧了技能缺口。儘管运输公司已将工资提高了10%并提供入职奖金,但夜班、长时间离家以及严格的监管等生活方式障碍仍然难以吸引人才。作为临时解决方案,货主们正在错开送货时间、包租铁路、在仓库内测试自动驾驶穿梭车,并将司机集中在高速公路路段。在自动化和移民政策等解决方案出现之前,这种司机短缺限制了德国货运和物流市场的成长潜力。

细分市场分析

到2025年,製造业将占德国货运和物流市场份额的28.37%,物流支出将达到628.1亿美元。该行业的韧性源自于德国在汽车、机械和加工产业的深厚专业知识,以及这些产业所依赖的有序准时制物流模式。库存过剩和工厂正常运作的要求推动了长期、多服务合约的签订,涵盖生产线旁配送、可回收包装和子组装等领域。同时,批发和零售业虽然目前规模较小,但预计在2026年至2031年间将以3.18%的复合年增长率增长,因为全通路模式推动了门市、暗店和直销通路之间的快速补货。

依赖重型卡车和预製模组现场作业顺序的建筑物流,虽然增长缓慢,但已形成一个稳定且持续的行业。农业、林业和渔业在收穫尖峰时段期需要低温运输能力和准时交付,这推动了对冷藏拖车和多式联运生鲜产品至城市市场运输通道的需求。由于德国的能源转型政策导致风能和太阳能发电厂零件运输量增加,石油、天然气、采矿和采石业略有下降。从医疗技术到氢燃料电池组件等新兴产业,形成了复杂且温控的微型物流,为专业的第三方物流业者创造了有利的市场环境。

儘管货运代理仍将占据主导地位,预计到2025年将占59.29%的市场份额,但宅配、速递和小包裹业务预计将以3.44%的复合年增长率(CAGR)实现最快增长,这主要得益于电子商务习惯带来的住宅配送量增长。此外,仓储和储存产业的成长也对其产生积极影响,因为企业需要消化安全库存以应对供应商中断的情况。货运代理产业正在透过将数位预订平台与多模态视觉化工具相结合进行转型,使中小型出口商无需拥有运输资产即可获得优质的空运和铁路运输服务。

在德国货运和物流市场,「其他」类别中附加价值服务(例如套件组装、快速组装、退货处理)仍然备受重视,与製造业的精益生产实践相辅相成。由于德国消费群庞大,国内小宅配快递 (CEP) 服务占了 66.56% 的市场。同时,欧洲单一市场内的跨境CEP 航线成长更为强劲,这主要得益于面向波兰、法国和斯堪的纳维亚半岛消费者的营运商。货运细分市场的表现则喜忧参半:大宗货车运输受到碳排放税的严重衝击,而专门针对汽车的定期配送服务则带来了稳定的合约收入。第三方物流业者之间的机会主义整合,例如 DSV 收购 DB Schenker,正在增强其与小包裹配送代理商和港口码头的议价能力。

其他福利:

- Excel格式的市场预测(ME)表

- 分析师支持(3个月)

目录

第一章 引言

- 研究假设和市场定义

- 调查范围

第二章调查方法

第三章执行摘要

第四章 市场情势

- 市场概览

- 人口统计数据

- 按经济活动分類的GDP分配

- 按经济活动分類的GDP成长

- 通货膨胀

- 经济表现及概况

- 电子商务产业的趋势

- 製造业趋势

- 运输和仓储业的GDP

- 出口趋势

- 进口趋势

- 燃油价格

- 卡车运输营运成本

- 卡车运输车队规模(按类型)

- 主要卡车供应商

- 物流绩效

- 透过交通方式分享

- 海运船队运力

- 班轮运输连接

- 停靠港口和演出

- 货运费率趋势

- 货物吨位趋势

- 基础设施

- 法规结构(公路和铁路)

- 法规结构(海事和航空)

- 价值炼和通路分析

- 市场驱动因素

- 电子商务(B2C)小包裹递送业务快速成长

- 製造业出口的韧性

- 中小型企业 3PL 外包的扩展

- 与欧盟绿色交易相关的模式转换促进措施

- 扩展我们的按需仓储平台

- 由OEM厂商支持的电池物流走廊的电动车供应链

- 市场限制

- 驾驶人和劳动力老化

- 高速公路通行费上涨和碳定价

- 都市区缺乏收集点

- 内河水位过低造成的交通中断

- 市场创新

- 波特五力分析

- 新进入者的威胁

- 买方的议价能力

- 供应商的议价能力

- 替代品的威胁

- 竞争对手之间的竞争

第五章 市场规模与成长预测

- 终端用户产业

- 农业、渔业、林业

- 建设业

- 製造业

- 石油天然气、采矿和采石

- 批发和零售

- 其他的

- 物流职能

- 宅配、速递和小包裹(CEP)

- 按目的地

- 国内的

- 国际的

- 按目的地

- 货运代理

- 透过交通工具

- 航空

- 海路和内河航道

- 其他的

- 透过交通工具

- 货物运输

- 透过交通工具

- 航空

- 管道

- 铁路

- 路

- 海路和内河航道

- 透过交通工具

- 仓储

- 透过温度控制

- 非温控型

- 温度控制

- 透过温度控制

- 其他服务

- 宅配、速递和小包裹(CEP)

第六章 竞争情势

- 市场集中度

- 关键策略倡议

- 市占率分析

- 公司简介

- A. Hartrodt

- AP Moller-Maersk

- Amazon

- BLG Logistics Group AG & Co. KG

- CMA CGM Group(Including CEVA Logistics)

- DACHSER

- DHL Group

- DSV A/S(Including DB Schenker)

- Emons Services GmbH

- FedEx

- Fiege Logistik Holding Stiftung and Co. KG

- GEODIS

- Hellmann Worldwide Logistics

- Hermes Europe GmbH

- International Distributions Services(Including GLS)

- Kuehne+Nagel

- La Poste Group

- Rhenus Group

- ROHLIG SUUS Logistics SA

- United Parcel Service of America, Inc.(UPS)

第七章 市场机会与未来展望

The Germany freight and logistics market is expected to grow from USD 221.37 billion in 2025 to USD 227.99 billion in 2026 and is forecast to reach USD 264.17 billion by 2031 at 2.99% CAGR over 2026-2031.

The moderate growth pace reflects an already-mature ecosystem that is repositioning around e-commerce fulfillment, export-oriented manufacturing corridors, and European Green Deal rules that raise carbon costs for road haulage. Rail incentive packages worth EUR 1.7 billion (USD 1.9 billion) through 2030, coupled with steadily climbing carbon prices of EUR 55 (USD 60.7) per tonne, are steering shippers toward intermodal solutions while still relying on road for flexible, short-haul moves. At the same time, the courier, express, and parcel (CEP) wave gains momentum from 87% consumer online-shopping penetration, pushing parcel density past 54 items per capita and accelerating automation investments in urban depots. Rising driver vacancies-70,000 open positions in 2025-tighten trucking capacity and elevate wages, motivating carriers to adopt route-optimization software and test autonomous yard tractors. Amid these structural shifts, the Germany freight and logistics market continues to leverage its central European location, 41,000 km highway grid, and world-class ports to anchor continental trade flows.

Germany Freight And Logistics Market Trends and Insights

E-commerce B2C Parcel Boom

Germany's e-commerce penetration hit 87% in 2024, translating into 4.5 billion annual parcels and driving a dense last-mile network that now averages 54 deliveries per resident. Grocery platforms grew 23% year over year as Amazon Fresh and Rewe expanded same-day services, prompting operators to pilot tram-based drop-offs in Frankfurt and micro-depots in parking structures across Berlin, Hamburg, and Munich. Parcel integrators responded by installing high-speed sorters capable of 30,000 items per hour and by adding electric delivery vans to comply with low-emission-zone rules. Seasonal peaks such as Singles' Day and Christmas overloaded city streets, making urban consolidation schemes a priority for municipalities. The sustained flow of small parcels reinforces the strategic value of robotics, AI-driven demand forecasting, and flexible shift scheduling for CEP networks.

Manufacturing Export Resilience

German factories shipped EUR 1.56 trillion (USD 1.72 trillion) worth of goods in 2024 despite global volatility, thanks to diversified destination markets and near-shoring of critical inputs. Automakers clustered tier-1 suppliers within 500 km of final-assembly plants in Bavaria and Baden-Wurttemberg, trimming transport lead times and stabilizing just-in-sequence flows. Machinery and chemical exporters locked in long-term rail contracts on the Hamburg-Munich and Rhine-Ruhr corridors, improving wagon-turnaround rates by 15% and shielding margins from diesel price spikes. The predictable freight corridors enable logistics providers to run high-capacity shuttles and negotiate volume-based discounts with terminal operators. Export reliability continues to underpin the Germany freight and logistics market, sustaining demand for temperature-controlled containers, specialized project cargo gear, and customs compliance services.

Driver Shortage and Aging Workforce

Vacancies hit 70,000 in 2025, with 39% of licensed truckers older than 55, eroding fleet utilization and forcing companies to park 7-10% of tractors during peak weeks. Training schools graduate only 18,000 new drivers annually, against retirement outflows above 25,000, widening the skills gap. Carriers raised wages 10% and offered sign-on bonuses, but lifestyle deterrents-night work, days away from home, dense regulation-limit attraction. As a stop-gap, shippers stagger delivery windows, charter rail blocks, and trial autonomous shuttles inside warehouse yards to free humans for open-road segments. The shortage constrains the Germany freight and logistics market's growth potential until automation or immigration solutions emerge.

Other drivers and restraints analyzed in the detailed report include:

- Growing 3PL Outsourcing Among Mittelstand

- EU Green Deal-Linked Modal Shift Incentives

- Rising Motorway Tolls and Carbon Pricing

For complete list of drivers and restraints, kindly check the Table Of Contents.

Segment Analysis

Manufacturing accounted for 28.37% of Germany freight and logistics market share in 2025, translating into USD 62.81 billion in logistics spend. The segment's robustness derives from Germany's deep specialization in autos, machinery, and process industries that rely on sequenced just-in-time flows. Outsized inventory values and plant uptime requirements foster long-term, multi-service contracts for line-side delivery, returnable packaging, and sub-assembly. In contrast, wholesale and retail trade, while smaller at present, registers a 3.18% CAGR (2026-2031) as omnichannel models force rapid replenishment between stores, dark stores, and direct-to-consumer channels.

Construction logistics hinges on heavy-lift trucking and on-site sequencing for prefabricated modules, creating a steady if slower-growing slice of activity. Agriculture, Fishing & Forestry calls for cold chain capacity and time-critical windows during harvest peaks, bolstering reefer trailer demand and multimodal fresh-produce corridors to urban markets. Oil, Gas, Mining & Quarrying edges downward as Germany's Energiewende moves tonnage toward components for wind and solar installations. Emerging verticals, from medical technology to hydrogen fuel-cell components, add complexity and temperature-controlled micro-flows that favor specialized 3PLs.

Freight Transport remained the cornerstone at 59.29% share in 2025; however, the Courier, Express, and Parcel arm is forecast to post the quickest expansion at 3.44% CAGR between 2026-2031, propelled by residential delivery volumes tied to the e-commerce habit. Growth also favors Warehousing & Storage, which absorbs safety stocks as firms hedge against supplier shocks. Freight Forwarding adapts by bundling digital booking portals with multimodal visibility tools, enabling smaller exporters to tap premium air and rail services without owning transportation assets.

The Germany freight and logistics market continues to prioritize value-added services such as kitting, light assembly, and returns processing under the Others banner, all of which complement manufacturers' lean-production mandates. Domestic CEP registered a 66.56% share thanks to Germany's dense consumer base, yet cross-border CEP lanes inside the European single market post stronger growth as merchants court Polish, French, and Nordic shoppers. Freight Transport sub-segments show diverging fortunes: bulk trucking feels the brunt of carbon taxes, while specialized automotive milk-runs deliver stable contract revenue. Opportunistic consolidation among 3PLs, exemplified by DSV's purchase of DB Schenker, amplifies bargaining power over parcel integrators and port terminals.

The Germany Freight and Logistics Market Report is Segmented by End User Industry (Agriculture, Fishing, and Forestry, Construction, Manufacturing, Oil and Gas, Mining and Quarrying, Wholesale and Retail Trade, and Others) and by Logistics Function (Courier, Express, and Parcel (CEP), Freight Forwarding, Freight Transport, Warehousing and Storage, and Other Services). The Market Forecasts are Provided in Terms of Value (USD).

List of Companies Covered in this Report:

- A. Hartrodt

- A.P. Moller - Maersk

- Amazon

- BLG Logistics Group AG & Co. KG

- CMA CGM Group (Including CEVA Logistics)

- DACHSER

- DHL Group

- DSV A/S (Including DB Schenker)

- Emons Services GmbH

- FedEx

- Fiege Logistik Holding Stiftung and Co. KG

- GEODIS

- Hellmann Worldwide Logistics

- Hermes Europe GmbH

- International Distributions Services (Including GLS)

- Kuehne+Nagel

- La Poste Group

- Rhenus Group

- ROHLIG SUUS Logistics SA

- United Parcel Service of America, Inc. (UPS)

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 Introduction

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 Research Methodology

3 Executive Summary

4 Market Landscape

- 4.1 Market Overview

- 4.2 Demographics

- 4.3 GDP Distribution by Economic Activity

- 4.4 GDP Growth by Economic Activity

- 4.5 Inflation

- 4.6 Economic Performance and Profile

- 4.6.1 Trends in E-Commerce Industry

- 4.6.2 Trends in Manufacturing Industry

- 4.7 Transport and Storage Sector GDP

- 4.8 Export Trends

- 4.9 Import Trends

- 4.10 Fuel Price

- 4.11 Trucking Operational Costs

- 4.12 Trucking Fleet Size by Type

- 4.13 Major Truck Suppliers

- 4.14 Logistics Performance

- 4.15 Modal Share

- 4.16 Maritime Fleet Load Carrying Capacity

- 4.17 Liner Shipping Connectivity

- 4.18 Port Calls and Performance

- 4.19 Freight Pricing Trends

- 4.20 Freight Tonnage Trends

- 4.21 Infrastructure

- 4.22 Regulatory Framework (Road and Rail)

- 4.23 Regulatory Framework (Sea and Air)

- 4.24 Value Chain and Distribution Channel Analysis

- 4.25 Market Drivers

- 4.25.1 E-Commerce B2C Parcel Boom

- 4.25.2 Manufacturing Export Resilience

- 4.25.3 Growing 3PL Outsourcing Among Mittelstand

- 4.25.4 EU Green Deal-Linked Modal Shift Incentives

- 4.25.5 On-Demand Warehousing Platforms Scaling Up

- 4.25.6 OEM-Backed Battery-Logistics Corridors for EV Supply Chains

- 4.26 Market Restraints

- 4.26.1 Driver Shortage and Ageing Workforce

- 4.26.2 Rising Motorway Tolls and Carbon Pricing

- 4.26.3 Limited Urban Consolidation Hubs

- 4.26.4 Inland Waterway Low-Water Disruptions

- 4.27 Technology Innovations in the Market

- 4.28 Porter's Five Forces Analysis

- 4.28.1 Threat of New Entrants

- 4.28.2 Bargaining Power of Buyers

- 4.28.3 Bargaining Power of Suppliers

- 4.28.4 Threat of Substitutes

- 4.28.5 Competitive Rivalry

5 Market Size and Growth Forecasts (Value, USD)

- 5.1 End User Industry

- 5.1.1 Agriculture, Fishing, and Forestry

- 5.1.2 Construction

- 5.1.3 Manufacturing

- 5.1.4 Oil and Gas, Mining and Quarrying

- 5.1.5 Wholesale and Retail Trade

- 5.1.6 Others

- 5.2 Logistics Function

- 5.2.1 Courier, Express, and Parcel (CEP)

- 5.2.1.1 By Destination Type

- 5.2.1.1.1 Domestic

- 5.2.1.1.2 International

- 5.2.1.1 By Destination Type

- 5.2.2 Freight Forwarding

- 5.2.2.1 By Mode of Transport

- 5.2.2.1.1 Air

- 5.2.2.1.2 Sea and Inland Waterways

- 5.2.2.1.3 Others

- 5.2.2.1 By Mode of Transport

- 5.2.3 Freight Transport

- 5.2.3.1 By Mode of Transport

- 5.2.3.1.1 Air

- 5.2.3.1.2 Pipelines

- 5.2.3.1.3 Rail

- 5.2.3.1.4 Road

- 5.2.3.1.5 Sea and Inland Waterways

- 5.2.3.1 By Mode of Transport

- 5.2.4 Warehousing and Storage

- 5.2.4.1 By Temperature Control

- 5.2.4.1.1 Non-Temperature Controlled

- 5.2.4.1.2 Temperature Controlled

- 5.2.4.1 By Temperature Control

- 5.2.5 Other Services

- 5.2.1 Courier, Express, and Parcel (CEP)

6 Competitive Landscape

- 6.1 Market Concentration

- 6.2 Key Strategic Moves

- 6.3 Market Share Analysis

- 6.4 Company Profiles (Includes Global Level Overview, Market Level Overview, Core Segments, Financials as Available, Strategic Information, Market Rank/Share for Key Companies, Products and Services, and Recent Developments)

- 6.4.1 A. Hartrodt

- 6.4.2 A.P. Moller - Maersk

- 6.4.3 Amazon

- 6.4.4 BLG Logistics Group AG & Co. KG

- 6.4.5 CMA CGM Group (Including CEVA Logistics)

- 6.4.6 DACHSER

- 6.4.7 DHL Group

- 6.4.8 DSV A/S (Including DB Schenker)

- 6.4.9 Emons Services GmbH

- 6.4.10 FedEx

- 6.4.11 Fiege Logistik Holding Stiftung and Co. KG

- 6.4.12 GEODIS

- 6.4.13 Hellmann Worldwide Logistics

- 6.4.14 Hermes Europe GmbH

- 6.4.15 International Distributions Services (Including GLS)

- 6.4.16 Kuehne+Nagel

- 6.4.17 La Poste Group

- 6.4.18 Rhenus Group

- 6.4.19 ROHLIG SUUS Logistics SA

- 6.4.20 United Parcel Service of America, Inc. (UPS)

7 Market Opportunities and Future Outlook

- 7.1 White-Space and Unmet-Need Assessment