|

市场调查报告书

商品编码

1693536

南美微量营养素肥料:市场占有率分析、行业趋势和成长预测(2025-2030 年)South America Micronutrient Fertilizer - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

价格

※ 本网页内容可能与最新版本有所差异。详细情况请与我们联繫。

简介目录

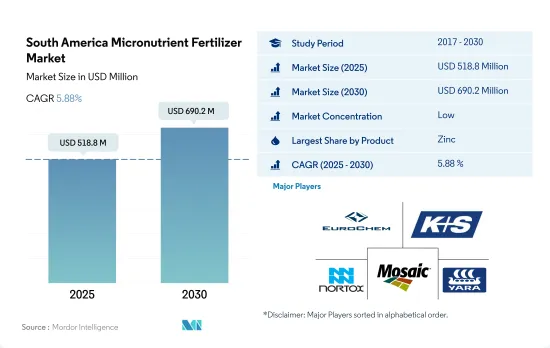

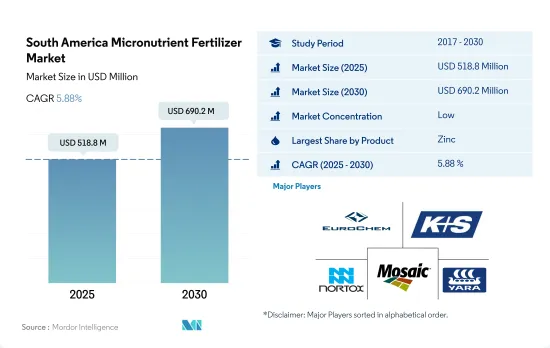

南美微量营养素肥料市场规模预计在 2025 年将达到 5.188 亿美元,预计到 2030 年将达到 6.902 亿美元,预测期内(2025-2030 年)的复合年增长率为 5.88%。

该地区对锌的需求很高,因为需要解决锌缺乏问题,以提高作物产量。

- 微量营养素对许多植物代谢活动至关重要,包括细胞壁发育、花粉产生、发芽、叶绿素产生、固氮和蛋白质合成。微量营养素肥料占整个肥料市场的份额不到 2%,到 2022 年将达到约 5.477 亿美元。

- 在微量营养素肥料中,铁是2022年该地区最常用的微量营养素肥料之一。铁将占微量营养素肥料总市场的约8.5%,到2022年将达到约4,660万美元。铁是参与能量转移、氮还原和固定以及木质素形成的多种酶的组成部分。

- 锌作为微量营养素肥料的使用量是该地区仅次于铁的最高水平。锌缺乏是该地区普遍存在的问题,尤其是南美洲西北部。锌将占微量营养素肥料市场总量的约 27.5%,到 2022 年将达到约 1.505 亿美元。

- 大豆和小麦种植面积约占该地区农业用地总面积的61.13%。这两种作物极易受到锰缺乏的影响。到 2022 年,锰将占微量营养素肥料市场总量的约 3.7%。

- 其他微量营养素包括镍、钴、硒和氯化物。其他微量营养素部分将占该地区微量营养素肥料市场总量的 11.8%,到 2022 年将达到约 6,460 万美元。

- 儘管大多数微量营养素都存在于土壤中,但大多数在自然界中是不可移动的,不能被植物吸收。因此,该地区对微量营养素肥料的需求正在增加。

土壤养分缺乏导致巴西市场占有率大幅下降

- 巴西在南美洲微量营养素肥料市场占据主导地位,2022 年达到 3.317 亿美元,约占整个市场的 60.6%。预计到 2030 年底,巴西的微量营养素肥料市场规模将增至 3.822 亿美元,这得益于耕地面积的增加,2017 年至 2022 年间耕地面积增加了约 14.8%。

- 2022年阿根廷微量营养素肥料市场中,田间作物占据了97.7%的市场。这一优势是由于该国田间作物的种植面积广阔。阿根廷主要种植田间作物为大豆、小麦和玉米,三者占全国作物总种植面积的97.7%。同时,2022年阿根廷园艺作物微量营养素肥料的消耗量价值为284万美元,预计2030年将达到390万美元。

- 依施用类型划分,至2022年,土壤施用将占微量营养素消费量的95.1%,其次是灌溉施用,占2.5%,叶面施用占2.3%。

- 农民正在作物中施用微量营养素肥料,以获得高品质的农产品和更高的产量。植物生长所必需的微量营养素缺乏会导致作物产量下降。在过去的十年中,人们的注意力集中在土壤微量营养素缺乏上,主要是锌、硼和钼。南美洲西北部土壤普遍缺锌。因此,预计巴西微量营养素肥料市场将在 2023-2030 年期间成长。

南美洲微量营养素肥料市场趋势

政府为自给自足而采取的措施极大地促进了田间作物种植面积的扩大

- 南美洲田间作物种植面积预计将从 2017 年的 1.116 亿公顷增加 12.8% 至 2022 年的 1.261 亿公顷。种植面积的扩大预计将推动该地区对化肥的需求。田间作物占比最大,为96.8%。 2022年,巴西将占据56.9%的份额,其次是阿根廷,占29.3%。巴西是全球大豆生产和出口大国,2021年大豆产量接近1.35亿吨,其中出口1.055亿吨,占82%。出口产品中,生豆占82%,豆饼占16%,豆油占2%。

- 在南美洲,巴西和阿根廷是大豆种植最多的国家,分别占全球种植面积的64.4%和26.1%。然而,该地区目前正遭受长期干旱,主要河流的水位低得惊人。这产生了广泛的影响,扰乱了重要夏季作物(特别是大豆)的收穫和运输。因此,这种情况增加了南美洲增加化肥施用的迫切性。

- 受全球强劲需求和良好盈利的推动,南方共同市场地区的大豆种植业蓬勃发展。大豆等原料价格高企,鼓励生产商扩大经营,投资新土地设备,提高规模和效率。因此,该地区准备进一步扩大田间作物种植,以满足国内和国际市场的成长。

2022 年,所有微量营养素的最高平均施用量为锰,约 12.2 公斤/公顷。

- 南美洲的土壤主要为氧化土和老成土。氧化土是高度风化的土壤,质地均匀,含有大量的铁和铝的氧化物,而红壤则风化程度较低,但酸性很强。然而,这两种土壤类型都需要补充微量营养素来优化作物产量,因为土壤中的大多数微量营养素是不稳定的。在南美洲,微量营养素缺乏日益限制一年作物的生产。据报导,水稻、玉米、小麦、大豆和芸豆等作物缺乏锌、铜、硼、锰和铁等必需微量营养素。

- 2022年农田作物微肥平均施用量为4.3公斤/公顷。儘管这些土壤中含有铁,但由于与过量的磷酸盐结合,植物对铁的利用受到限制。因此,该地区田间作物的平均铁施用量为3.3公斤/公顷。锰是微量营养素中最重要的元素,2022 年的平均施用率为 12.2 公斤/公顷。锰在陆稻中很常见,但在雨养稻和低地稻中较不常见,因为锰在涝渍条件下溶解度会增加。缺锰的水稻植株在犁地期间会生长不良、叶片数量减少、重量减轻、根系变小。

- 油菜是南美洲的主要田间作物,比其他作物需要更多的微量营养素。 2022年微量元素肥平均施用量达4.40公斤/公顷。随着人们越来越重视作物均衡营养以及微量营养素在产量中的关键作用,预计未来几年微量营养素的应用将会增加。

南美洲微量营养素肥料产业概况

南美洲微量营养素肥料市场较为分散,前五大公司占了28.08%的市占率。该市场的主要企业包括 EuroChem Group、K+S Aktiengesellschaft、Nortox、The Mosaic Company、Yara International ASA 等。

其他福利

- Excel 格式的市场预测 (ME) 表

- 3个月的分析师支持

目录

第一章执行摘要和主要发现

第二章 报告要约

第三章 引言

- 研究假设和市场定义

- 研究范围

- 调查方法

第四章 产业主要趋势

- 主要作物种植面积

- 田间作物

- 园艺作物

- 平均养分施用量

- 微量营养素

- 田间作物

- 园艺作物

- 微量营养素

- 灌溉农田

- 法律规范

- 价值炼和通路分析

第五章市场区隔

- 产品

- 硼

- 铜

- 铁

- 锰

- 钼

- 锌

- 其他的

- 如何申请

- 受精

- 叶面喷布

- 土壤

- 作物类型

- 田间作物

- 园艺作物

- 草坪和观赏植物

- 原产地

- 阿根廷

- 巴西

- 南美洲其他地区

第六章 竞争格局

- 关键策略趋势

- 市场占有率分析

- 商业状况

- 公司简介

- BMS Micro-Nutrients NV

- EuroChem Group

- Grupa Azoty SA(Compo Expert)

- Haifa Group

- ICL Group Ltd

- Inquima LTDA

- K+S Aktiengesellschaft

- Nortox

- The Mosaic Company

- Yara International ASA

第七章 CEO 的关键策略问题

第 8 章 附录

- 世界概况

- 概述

- 五力分析框架

- 全球价值链分析

- 市场动态(DRO)

- 资讯来源及延伸阅读

- 图片列表

- 关键见解

- 数据包

- 词彙表

简介目录

Product Code: 92601

The South America Micronutrient Fertilizer Market size is estimated at 518.8 million USD in 2025, and is expected to reach 690.2 million USD by 2030, growing at a CAGR of 5.88% during the forecast period (2025-2030).

The demand for zinc is higher in the region due to the need to address deficiency to optimize crop yield

- Micronutrients are vital for many plant metabolic activities, such as cell wall development, pollen creation, germination, chlorophyll production, nitrogen fixation, and protein synthesis. Micronutrient fertilizers account for less than two percent of the total fertilizer market value, which amounted to about USD 547.7 million in 2022.

- Among micronutrient fertilizers, iron is one of the most commonly used micronutrient fertilizer in the region in 2022. Iron accounted for about 8.5% of the total micronutrient fertilizer market value, amounting to about USD 46.6 million in 2022. Iron is a component of many enzymes associated with energy transfer, nitrogen reduction and fixation, and lignin formation.

- The application of zinc as a micronutrient fertilizer is the highest in the region, after iron. Zinc deficiency is a widespread problem in the region, particularly in the northwestern region of South America. Zinc accounts for about 27.5% of the total micronutrient fertilizer market value, which amounted to about USD 150.5 million in 2022.

- Soybean and wheat cultivation accounts for about 61.13% of the total agricultural land in the region. These two crops are most likely to suffer from manganese deficiency. Manganese accounted for about 3.7% of the total micronutrient fertilizer market value in 2022.

- Nickel, cobalt, selenium, and chloride are the other micronutrients. The total other micronutrient segment accounts for 11.8% of the region's total micronutrient fertilizer market value, which amounted to about USD 64.6 million in 2022.

- Even though most micronutrients are available in soils, most are immobile in nature and not available for plant uptake. Hence, the demand for micronutrient fertilizers is increasing in the region.

Nutrient deficiencies in the country's soils translate to a major market share for Brazil

- Brazil dominated the South American micronutrient fertilizer market, accounting for about 60.6% of the total market value, amounting to USD 331.7 million in 2022. The Brazilian micronutrient fertilizer market segment is anticipated to increase to USD 382.2 million by the end of 2030, owing to the growing cultivation area, which increased by about 14.8% from 2017 to 2022.

- Field crops dominated the Argentine micronutrient fertilizer market with a 97.7% market value share in 2022. This dominance was attributed to the larger area occupied by field crops in the country. Major field crops grown in Argentina are soybean, wheat, and maize, which together account for 97.7% of the total crop area. Meanwhile, micronutrient fertilizers consumption by horticultural crops in Argentina was valued at USD 2.84 million in 2022 and is anticipated to reach USD 3.9 million by 2030.

- By application type, soil application dominated micronutrient consumption, accounting for 95.1% of the total volume, followed by fertigation with a 2.5% share and foliar application with a 2.3% share in 2022.

- Farmers are adopting micronutrient fertilizers for their crops to achieve high-quality produce and better yields. Deficiency in micronutrients that are essential for plant growth can lead to lower crop yields. During the past decade, soil micronutrient deficiencies were noticed primarily for zinc, boron, and molybdenum. Soil deficiencies of zinc are widespread in the northwestern region of South America. Hence, the micronutrient fertilizers market in Brazil is expected to grow from 2023 to 2030.

South America Micronutrient Fertilizer Market Trends

The government's initiatives to achieve self-sufficiency have significantly contributed to the increased field crop cultivation

- The cultivation area for field crops in South America witnessed growth from 111.6 million ha in 2017 to 126.1 million ha in 2022, marking a 12.8% increase. This expansion in cultivation is projected to drive up the demand for fertilizers in the region. Field crops dominated the landscape, accounting for a substantial 96.8% share. In 2022, Brazil held the lion's share of the market at 56.9%, with Argentina trailing at 29.3%. Brazil, known as the global leader in soy production and exports, saw its soy output touch nearly 135 million tonnes in 2021. Out of this, a significant 105.5 million tonnes, or 82%, was exported, with 82% in raw soybean form, 16% as soybean cake, and 2% as soybean oil.

- Soybean cultivation reigns supreme in South America, with Brazil and Argentina leading the pack, accounting for 64.4% and 26.1% of the cultivated area, respectively. However, the region is currently grappling with an extended drought, leading to alarmingly low water levels in major rivers. This has far-reaching consequences, hampering both harvests and the transportation of crucial summer crops, especially soybeans. Consequently, this situation amplifies the urgency of increasing fertilizer applications in South America.

- Driven by robust global demand and favorable profitability, soybean cultivation in the Mercosur region has witnessed a surge. The price surge in raw materials, including soy, has incentivized producers to expand their operations, investing in new lands and equipment to enhance their scale and efficiency. As a result, the region is poised for further expansion in its field crop cultivation, aligning with the growth in both domestic and international markets.

In 2022, the highest average application rate among micronutrients is for manganese, approximately 12.2 kg/hectare

- Oxisols and ultisols dominate the South American soil landscape. Oxisols, characterized by high weathering, uniform texture, and abundant iron and aluminum oxides, contrast with ultisols, which are less weathered but more acidic. However, both soil types necessitate micronutrient supplementation for optimal crop yields, given the immobility of most micronutrients in the soil. Micronutrient deficiencies are increasingly limiting annual crop production in South America. Crops like rice, corn, wheat, soybean, and common bean have reported deficits in essential micronutrients such as zinc, copper, boron, manganese, and iron.

- In 2022, the average application rate of micronutrient fertilizers in field crops stood at 4.3 kg/hectare. Despite the presence of iron in these soils, its availability to plants is hampered by its binding with excessive phosphates. Consequently, the average iron application rate in field crops across the region is 3.3 kg/hectare. Manganese, with an average application rate of 12.2 kg/hectare in 2022, leads among the micronutrients. While it is prevalent in upland rice, it is less common in rainfed or lowland rice, as its solubility increases under submerged conditions. Manganese-deficient plants exhibit stunted growth, fewer leaves, reduced weight, and smaller root systems during tillering.

- Rapeseed, a prominent field crop in South America, demands higher micronutrient quantities compared to others. In 2022, its average micronutrient fertilizer application rate reached 4.40 kg/hectare. Given the growing emphasis on balanced crop nutrition and the pivotal role of micronutrients in overall yield, an uptick in micronutrient application is anticipated in the coming years.

South America Micronutrient Fertilizer Industry Overview

The South America Micronutrient Fertilizer Market is fragmented, with the top five companies occupying 28.08%. The major players in this market are EuroChem Group, K+S Aktiengesellschaft, Nortox, The Mosaic Company and Yara International ASA (sorted alphabetically).

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 EXECUTIVE SUMMARY & KEY FINDINGS

2 REPORT OFFERS

3 INTRODUCTION

- 3.1 Study Assumptions & Market Definition

- 3.2 Scope of the Study

- 3.3 Research Methodology

4 KEY INDUSTRY TRENDS

- 4.1 Acreage Of Major Crop Types

- 4.1.1 Field Crops

- 4.1.2 Horticultural Crops

- 4.2 Average Nutrient Application Rates

- 4.2.1 Micronutrients

- 4.2.1.1 Field Crops

- 4.2.1.2 Horticultural Crops

- 4.2.1 Micronutrients

- 4.3 Agricultural Land Equipped For Irrigation

- 4.4 Regulatory Framework

- 4.5 Value Chain & Distribution Channel Analysis

5 MARKET SEGMENTATION (includes market size in Value in USD and Volume, Forecasts up to 2030 and analysis of growth prospects)

- 5.1 Product

- 5.1.1 Boron

- 5.1.2 Copper

- 5.1.3 Iron

- 5.1.4 Manganese

- 5.1.5 Molybdenum

- 5.1.6 Zinc

- 5.1.7 Others

- 5.2 Application Mode

- 5.2.1 Fertigation

- 5.2.2 Foliar

- 5.2.3 Soil

- 5.3 Crop Type

- 5.3.1 Field Crops

- 5.3.2 Horticultural Crops

- 5.3.3 Turf & Ornamental

- 5.4 Country

- 5.4.1 Argentina

- 5.4.2 Brazil

- 5.4.3 Rest of South America

6 COMPETITIVE LANDSCAPE

- 6.1 Key Strategic Moves

- 6.2 Market Share Analysis

- 6.3 Company Landscape

- 6.4 Company Profiles

- 6.4.1 BMS Micro-Nutrients NV

- 6.4.2 EuroChem Group

- 6.4.3 Grupa Azoty S.A. (Compo Expert)

- 6.4.4 Haifa Group

- 6.4.5 ICL Group Ltd

- 6.4.6 Inquima LTDA

- 6.4.7 K+S Aktiengesellschaft

- 6.4.8 Nortox

- 6.4.9 The Mosaic Company

- 6.4.10 Yara International ASA

7 KEY STRATEGIC QUESTIONS FOR FERTILIZER CEOS

8 APPENDIX

- 8.1 Global Overview

- 8.1.1 Overview

- 8.1.2 Porter's Five Forces Framework

- 8.1.3 Global Value Chain Analysis

- 8.1.4 Market Dynamics (DROs)

- 8.2 Sources & References

- 8.3 List of Tables & Figures

- 8.4 Primary Insights

- 8.5 Data Pack

- 8.6 Glossary of Terms

02-2729-4219

+886-2-2729-4219