|

市场调查报告书

商品编码

1693552

中东和非洲微量营养素肥料:市场占有率分析、行业趋势、统计数据、成长预测(2025-2030 年)Middle East & Africa Micronutrient Fertilizer - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

※ 本网页内容可能与最新版本有所差异。详细情况请与我们联繫。

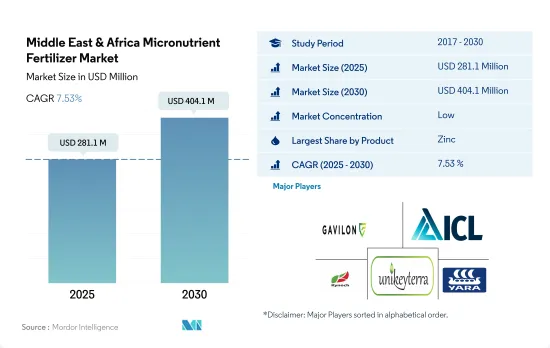

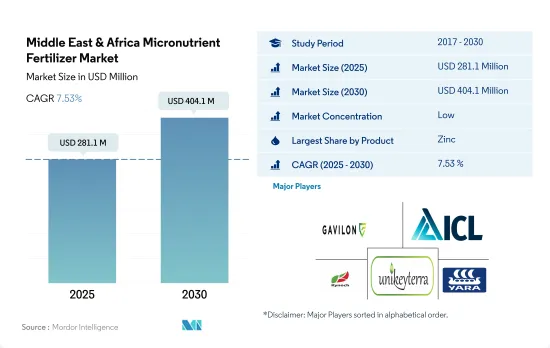

预计 2025 年中东和非洲微量营养素肥料市场规模将达到 2.811 亿美元,到 2030 年将达到 4.041 亿美元,预测期内(2025-2030 年)的复合年增长率为 7.53%。

营养缺乏现象加剧推动对微量营养素肥料的需求

- 该地区的微量营养素市场预计将经历强劲成长,2023 年至 2030 年的复合年增长率预计为 7.3%。特别是,该地区植物的铁和锌缺乏症正在增加,推动了对微量营养素肥料的需求,以增强植物健康。

- 2022年,锌和黑色金属占据市场主导地位,分别占市场价值的31.4%和23.9%。这些微量营养素对于植物的生长至关重要,土壤中缺乏这些营养素会导致作物产量下降。过去十年来,土壤中铁和锌的缺乏一直是市场成长的主要驱动力。

- 微量营养素缺乏症常见于谷物、油籽、豆类和蔬菜等集约化种植的作物中。因此,农民越来越多地转向微量营养素的应用,特别是在田间作物中,微量营养素市场到2022年将占市场价值的71.3%。

- 土壤中微量营养素缺乏的增加是产量下降的主要因素。非洲土壤尤其缺乏硫、锌、硼和铜等中微量营养素。透过肥料平衡这些营养缺陷不仅可以提高产量,还可以保持土壤健康,使其成为未来几年重要的市场驱动力。

- 因此,微量营养素肥料市场规模预计将稳定成长,2023 年至 2030 年期间的复合年增长率为 3.8%。

人口增长和对粮食不安全的日益担忧推动微量营养素肥料市场

- 中东和非洲的微量营养素肥料市场约占中东和非洲整个肥料市场的 5.1%,2022 年市场规模约 4.826 亿美元。儘管水资源短缺和气温上升,但该地区许多国家仍然依赖农业。奈及利亚、沙乌地阿拉伯和埃及是该地区的主要农业生产国。

- 尼日利亚是该地区最大的农业生产国。尼日利亚农业用地面积为6,860万公顷,玉米、木薯、珍珠玉米、山药、小米和水稻是2022年的主要作物。 2022年,奈及利亚将占非洲微量营养素肥料市场的12.6%。

- 叶面施肥是该地区使用最广泛的微量营养素施用方法,2022 年约占市场份额的 43.6%。

- 中东和非洲其他地区是该地区最大的微量营养素肥料市场之一。中东和非洲其他地区将占该地区微量营养素肥料市场总量的约 52.7%,2022 年市场规模约为 1.482 亿美元。中东和非洲其他主要农业生产国包括埃及、阿尔及利亚、摩洛哥和伊拉克。

- 锌缺乏是一个严重的问题,尤其是在土耳其、奈及利亚和沙乌地阿拉伯等国家。光是锌就将占整个微量营养素肥料市场的约 46.2%,到 2022 年价值约为 2.231 亿美元。

- 全部区域微量营养素的短缺正在推动该地区微量营养素肥料市场的发展。

中东和非洲微量营养素肥料市场趋势

由于侵蚀导致雨养土地和灌溉土地劣化,为作物种植带来了挑战。

- 在中东和非洲,玉米、水稻、高粱和大豆等田间作物通常在四月和五月种植,九月和十月收穫。然而,该地区的农业部门面临重大挑战。土地和水资源稀缺,雨养土地因风蚀和水蚀而退化,不可持续的农业实践使情况更加恶化。农业以农田作物为主,占该地区农地总面积的90%。 2022年,该地区田间作物作物面积预计将达到2.49亿公顷,比2017年增加3.9%。其中,玉米占比较大,占田间作物总面积的17.8%。小麦种植面积也显着增加,2017年至2022年间成长4.6%。具体而言,2022年该地区玉米种植面积将达4,430万公顷。

- 在非洲,奈及利亚是最大的高粱生产国,紧随其后的是衣索比亚。高粱是主要的谷物作物,占尼日利亚谷物总产量的 50%,占全国谷物种植面积的 45% 左右。高粱耐旱耐涝,适应各种土壤条件,是中东和非洲干旱地区的首选主要作物,有助于确保粮食和收入安全。

- 过去十年,该地区人口增加了23%以上。儘管生产能力有限,但预测显示粮食进口量将会增加。然而,农业依然强劲,耕地面积不断扩大。

锰含量高的酸性土壤在潮湿的环境条件下会导致缺铁。

- 植物营养依赖生长所必需的微量营养素。微量营养素缺乏会阻碍植物生长并降低产量。微量营养素肥料含有硼、铜、锰、锌和钴等微量元素,这些元素对植物的各个方面都极为重要。 2022年该区田间作物对锰、铜和锌的需求量较大,消费量分别为10.8公斤/公顷、7.14公斤/公顷和6.73公斤/公顷。

- 2022年,非洲田间作物种植总面积为2.283亿公顷。值得注意的是,大豆、油菜籽、棉花和高粱等作物的平均养分施用量最高,范围从4.44公斤/公顷到4.34公斤/公顷。南非以其蓬勃发展的商业农业而闻名,其农业严重依赖微量营养素。土壤分析很常见,然后采取纠正措施,例如将微量营养素加入肥料或叶面喷布中。

- 2022 年,大豆的平均养分消耗率最高,锰消耗量为 12.15 公斤/公顷,铜消耗量为 7.2 公斤/公顷。该地区也透过叶面喷布来解决影响小麦和其他田间作物的锰缺乏问题。该地区潮湿环境中常见的酸性土壤经常导致缺铁,可以透过叶面喷布或使用铁螯合剂来补救。为了应对这些挑战,叶面喷布施用微量营养素的现象正在增加,预计这一趋势将在 2023-2030 年期间持续下去。

中东和非洲微量营养素肥料产业概况

中东及非洲微量营养素肥料市场细分,前五大公司占30.27%。该市场的主要企业包括 Gavilon South Africa(MacroSource, LLC)、ICL Group Ltd、Kynoch Fertilizer、Unikeyterra Chemical、Yara International ASA 等。

其他福利

- Excel 格式的市场预测 (ME) 表

- 3个月的分析师支持

目录

第一章执行摘要和主要发现

第二章 报告要约

第三章 引言

- 研究假设和市场定义

- 研究范围

- 调查方法

第四章 产业主要趋势

- 主要作物种植面积

- 田间作物

- 园艺作物

- 平均养分施用量

- 微量营养素

- 田间作物

- 园艺作物

- 微量营养素

- 灌溉农田

- 法律规范

- 价值炼和通路分析

第五章市场区隔

- 产品

- 硼

- 铜

- 铁

- 锰

- 钼

- 锌

- 其他的

- 如何申请

- 受精

- 叶面喷布

- 土壤

- 作物类型

- 田间作物

- 园艺作物

- 草坪和观赏植物

- 原产地

- 奈及利亚

- 沙乌地阿拉伯

- 南非

- 土耳其

- 其他中东和非洲地区

第六章 竞争格局

- 关键策略趋势

- 市场占有率分析

- 商业状况

- 公司简介

- Azra Group AS

- Gavilon South Africa(MacroSource, LLC)

- ICL Group Ltd

- Kynoch Fertilizer

- Unikeyterra Chemical

- Yara International ASA

第七章 CEO 的关键策略问题

第 8 章 附录

- 世界概况

- 概述

- 五力分析框架

- 全球价值链分析

- 市场动态(DRO)

- 资讯来源及延伸阅读

- 图片列表

- 关键见解

- 数据包

- 词彙表

The Middle East & Africa Micronutrient Fertilizer Market size is estimated at 281.1 million USD in 2025, and is expected to reach 404.1 million USD by 2030, growing at a CAGR of 7.53% during the forecast period (2025-2030).

Demand for micronutrient fertilizers is growing due to increasing nutrient deficiency

- The micronutrient market in the region is projected to witness robust growth, with an estimated CAGR of 7.3% between 2023 and 2030. Notably, deficiencies of iron and zinc in plants are on the rise in the region, amplifying the demand for micronutrient fertilizers to bolster plant health.

- In 2022, zinc and iron dominated the market, accounting for 31.4% and 23.9% of the market value, respectively. These micronutrients are crucial for plant growth, and their deficiencies in soil have been linked to lower crop yields. Over the past decade, iron and zinc deficiencies in soils have been the primary drivers of the growth of the market.

- Micronutrient deficiencies are commonly observed in intensively cultivated crops like cereals, oilseeds, pulses, and vegetables. Consequently, farmers are increasingly turning to micronutrient applications, especially in field crops, which dominated the micronutrient market in 2022, capturing 71.3% of the market value.

- The escalating micronutrient deficiency in soils is a key factor contributing to yield declines. African soils, in particular, exhibit deficiencies in secondary and micronutrients, including sulfur, zinc, boron, and copper. Balancing these nutrient deficiencies through fertilizers not only enhances yields but also sustains soil health, making it a pivotal driver for the market in the coming years.

- As a result, the micronutrient fertilizer market volume is anticipated to witness steady growth, with a projected CAGR of 3.8% during the period of 2023-2030.

The growing population and increasing concerns regarding food insecurity propel the micronutrient fertilizer market

- The Middle East & African micronutrient fertilizer market accounted for about 5.1% of the overall Middle East & African fertilizer market, valued at about USD 482.6 million in 2022. Despite water scarcity and higher temperatures, many countries in the region depend on agriculture. Nigeria, Saudi Arabia, and Egypt are some of the major agricultural producers in the region.

- Nigeria is the largest agricultural producer in the region. Nigeria has 68.6 million hectares of agricultural land area, with maize, cassava, guinea corn, yam beans, millet, and rice being the major crops in 2022. Nigeria accounted for 12.6% of the African micronutrient fertilizer market in 2022.

- The foliar method of fertilizer application is the most used method for micronutrient application in the region, accounting for about 43.6% of the market value in 2022.

- The Rest of Middle East & Africa is one of the largest markets for micronutrient fertilizers in the region. The Rest of Middle East & Africa accounted for about 52.7% of the total micronutrient fertilizer market in the region, valued at about USD 148.2 million in 2022. The major agricultural producers in the Rest of Middle East & Africa are Egypt, Algeria, Morocco, and Iraq.

- Among micronutrient fertilizers, zinc is the most applied micronutrient, as zinc deficiency is a severe problem in the region, particularly in countries like Turkey, Nigeria, and Saudi Arabia. Zinc alone accounted for about 46.2% of the total micronutrient fertilizer market, valued at about USD 223.1 million in 2022.

- The deficiency of micronutrients in the overall agricultural area drives the micronutrient fertilizer market in the region.

Middle East & Africa Micronutrient Fertilizer Market Trends

Deterioration of both rain-fed and irrigated lands due to erosion pose a challenge in crop cultivation.

- In the Middle East & Africa, field crops such as corn, rice, sorghum, and soybeans are typically planted between April and May, with harvests taking place in September and October. However, the agricultural sector in this region faces significant challenges. Land and water resources are scarce and rain-fed and irrigated lands are deteriorating due to erosion from wind and water, which is exacerbated by unsustainable farming practices. Field crops dominate the agricultural landscape, occupying 90% of the total agricultural land in the region. In 2022, the region's field crop cultivation area reached 249 million hectares, marking a 3.9% increase from 2017. Corn alone commands a substantial share, accounting for 17.8% of the total field crop area. Wheat cultivation also saw a notable rise, with a 4.6% increase between 2017 and 2022. Specifically, the region's corn cultivation area reached 44.3 million hectares in 2022.

- In Africa, Nigeria takes the lead as the largest sorghum producer, closely followed by Ethiopia. Sorghum stands out as the primary cereal crop, contributing to 50% of the total cereal output in Nigeria and occupying approximately 45% of the cereal cropland. Sorghum's resilience to drought and waterlogging, coupled with its adaptability to diverse soil conditions, positions it as the preferred staple crop in the drier regions of the Middle East & Africa, ensuring both food and income security.

- Over the past decade, the region has witnessed a population growth of over 23%. Despite limited production capacity, the forecast indicates a rise in food imports. However, the agricultural industry has remained robust, with an expanding footprint in terms of cultivated land.

The acidic soils with high manganese content, under moist environmental conditions, results in iron deficiency

- Plant nutrition relies on micronutrients, which are essential for growth. Insufficient micronutrients can hinder plant growth and reduce yields. Micronutrient fertilizers containing trace elements like boron, copper, manganese, zinc, and cobalt are crucial for plants, each at varying levels. In 2022, field crops in the region had a significant demand for manganese, copper, and zinc, with consumption rates of 10.8 kg/hectare, 7.14 kg/hectare, and 6.73 kg/hectare, respectively.

- In 2022, Africa had a total field crop cultivation area of 228.3 million hectares. Notably, crops like soybean, rapeseed, cotton, and sorghum had the highest average nutrient application rates, ranging from 4.44 kg/hectare to 4.34 kg/hectare. South Africa, known for its prominent commercial farming sector, heavily relies on micronutrients in agriculture. Soil analysis is a common practice, followed by corrective measures like incorporating micronutrients into fertilizers or using foliar applications.

- Soybean, in particular, stood out in 2022 with the highest average nutrient consumption rates, utilizing 12.15 kg/hectare of manganese and 7.2 kg/hectare of copper. Through foliar applications, the region also addresses manganese deficiencies, which impact wheat and other field crops. The acidic soils, prevalent in the region's moist environment, often lead to iron deficiencies, remedied by foliar sprays or iron chelate applications. To tackle these challenges, micronutrients are increasingly being applied via foliar sprays, a trend expected to continue during the 2023-2030 period.

Middle East & Africa Micronutrient Fertilizer Industry Overview

The Middle East & Africa Micronutrient Fertilizer Market is fragmented, with the top five companies occupying 30.27%. The major players in this market are Gavilon South Africa (MacroSource, LLC), ICL Group Ltd, Kynoch Fertilizer, Unikeyterra Chemical and Yara International ASA (sorted alphabetically).

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 EXECUTIVE SUMMARY & KEY FINDINGS

2 REPORT OFFERS

3 INTRODUCTION

- 3.1 Study Assumptions & Market Definition

- 3.2 Scope of the Study

- 3.3 Research Methodology

4 KEY INDUSTRY TRENDS

- 4.1 Acreage Of Major Crop Types

- 4.1.1 Field Crops

- 4.1.2 Horticultural Crops

- 4.2 Average Nutrient Application Rates

- 4.2.1 Micronutrients

- 4.2.1.1 Field Crops

- 4.2.1.2 Horticultural Crops

- 4.2.1 Micronutrients

- 4.3 Agricultural Land Equipped For Irrigation

- 4.4 Regulatory Framework

- 4.5 Value Chain & Distribution Channel Analysis

5 MARKET SEGMENTATION (includes market size in Value in USD and Volume, Forecasts up to 2030 and analysis of growth prospects)

- 5.1 Product

- 5.1.1 Boron

- 5.1.2 Copper

- 5.1.3 Iron

- 5.1.4 Manganese

- 5.1.5 Molybdenum

- 5.1.6 Zinc

- 5.1.7 Others

- 5.2 Application Mode

- 5.2.1 Fertigation

- 5.2.2 Foliar

- 5.2.3 Soil

- 5.3 Crop Type

- 5.3.1 Field Crops

- 5.3.2 Horticultural Crops

- 5.3.3 Turf & Ornamental

- 5.4 Country

- 5.4.1 Nigeria

- 5.4.2 Saudi Arabia

- 5.4.3 South Africa

- 5.4.4 Turkey

- 5.4.5 Rest of Middle East & Africa

6 COMPETITIVE LANDSCAPE

- 6.1 Key Strategic Moves

- 6.2 Market Share Analysis

- 6.3 Company Landscape

- 6.4 Company Profiles

- 6.4.1 Azra Group AS

- 6.4.2 Gavilon South Africa (MacroSource, LLC)

- 6.4.3 ICL Group Ltd

- 6.4.4 Kynoch Fertilizer

- 6.4.5 Unikeyterra Chemical

- 6.4.6 Yara International ASA

7 KEY STRATEGIC QUESTIONS FOR FERTILIZER CEOS

8 APPENDIX

- 8.1 Global Overview

- 8.1.1 Overview

- 8.1.2 Porter's Five Forces Framework

- 8.1.3 Global Value Chain Analysis

- 8.1.4 Market Dynamics (DROs)

- 8.2 Sources & References

- 8.3 List of Tables & Figures

- 8.4 Primary Insights

- 8.5 Data Pack

- 8.6 Glossary of Terms