|

市场调查报告书

商品编码

1906861

拉丁美洲工厂自动化和工业控制:市场份额分析、行业趋势、统计数据和成长预测(2026-2031 年)Latin America Factory Automation And Industrial Controls - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2026 - 2031) |

||||||

※ 本网页内容可能与最新版本有所差异。详细情况请与我们联繫。

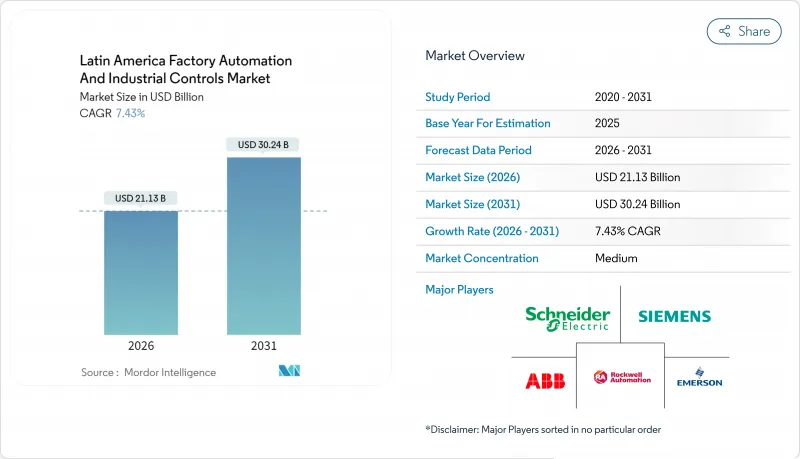

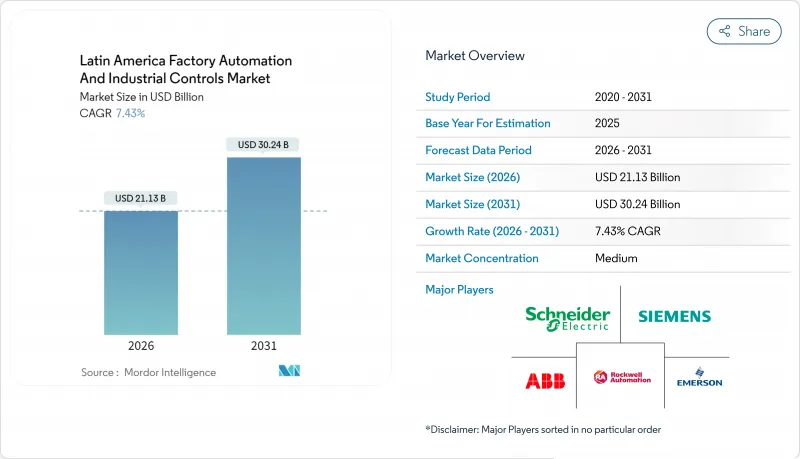

2025年拉丁美洲工厂自动化和工业控制市场价值为196.7亿美元,预计到2031年将达到302.4亿美元,高于2026年的211.3亿美元。

预计在预测期(2026-2031 年)内,复合年增长率将达到 7.43%。

数位转型加速、近岸外包活动日益增多以及政府激励措施,正持续推动对端到端自动化解决方案的需求。各行各业的製造商都在优先考虑即时分析、预测性维护和灵活的生产线,以减少停机时间并达到出口导向的品质标准。供应商的策略重点在于在地化生产、附加价值服务和利基伙伴关係关係,以降低汇率波动和供应链中断的影响。随着工厂对其传统资产进行现代化改造,该地区也正在快速采用协作机器人、人工智慧驱动的数位双胞胎和基于云端的监控系统。

拉丁美洲工厂自动化与工业控制市场趋势及洞察

製造业对工业4.0和工业物联网的采用日益增长

预计到2028年,巴西在工业4.0领域的支出将成长两倍,这将推动企业范围内的感测器应用和边缘分析。阿卡大陆集团(Arca Continental)正在利用云端平台连接其遍布四个国家的45家工厂和1.25亿消费者,从而实现即时效能仪錶板。製造商正从月度指标转向近乎即时的关键绩效指标(KPI),以提高应对力并消除生产瓶颈。水泥巨头沃托兰廷水泥公司(Votorantim Cimentos)利用预测分析,将每个工厂的纠正性维护成本降低了2,300万雷亚尔(约460万美元),并将资产可靠性提高了6%。因此,拉丁美洲的工厂自动化和工业控制市场,无论是在离散製造业或製程工业,都在持续推动智慧感测器网路和数据驱动型工作流程的应用。

政府奖励计画加速了智慧工厂投资

巴西已累计1866亿雷亚尔(约373亿美元)用于工业设施现代化改造,而墨西哥在2024年前七个月新增製造业投资达480亿美元,其中超过一半将用于自动化倡议。针对中小企业的定向补贴、税额扣抵和工程师安置计划降低了其采用新技术的门槛,而中小企业正是拉丁美洲工厂自动化和工业控制市场的重要组成部分。光是WEG一家公司就计划投资1.22亿美元用于双边产能扩张项目,该项目将整合机器人拣选、搬运和製造执行系统(MES)平台。阿根廷的矿业政策也为先进控制系统提供关税豁免,巩固了该国作为该地区技术应用最快国家之一的地位。这些激励措施透过整合公共和私人资本产生协同效应,加速了科技的应用。

中小企业面临初始资本投入高、投资报酬率不确定性等问题。

调查数据显示,巴西中小企业在自动化应用方面落后大型企业近两倍,资金筹措和技术知识不足是主要障碍。协作机器人缩小了这一差距,其实施成本比传统机器人低20-30%,且投资回收期短。然而,总投资额仍会对资本预算带来压力。虽然租赁模式和厂商主导的培训可以降低部分风险,但拉丁美洲工厂自动化和工业控制市场仍需进一步调整资金筹措结构,以释放中小企业的潜力。像SENAI这样的公共机构提供低成本的模拟研讨会,帮助企业在购买设备前检验投资报酬率。

细分市场分析

2025年,工业控制系统(ICS)将占据拉丁美洲工厂自动化和工业控制市场30.38%的份额,这主要得益于石油天然气、采矿和食品工厂对PLC、SCADA和DCS的广泛应用。巴西石油公司(Petrobras)正利用预测分析技术优化其炼油厂,而墨西哥国家石油公司(Pemex)则在全部区域部署SCADA系统,用于管道洩漏检测和流量控制。系统升级通常会整合製造执行系统(MES)和人机介面(HMI)层,使操作人员能够简化批次排序和监管报告流程。随着流程工业更新老化的控制设备并加强网路安全措施,该领域的成长保持稳定。

在拉丁美洲,现场设备正以8.46%的复合年增长率成长,成为工厂自动化和工业控制市场中成长最快的领域,这主要得益于机器人应用的激增和智慧感测器改装的普及。 2021年,巴西新增安装工业机器人1,595台,其中协作机器人(cobot)的普及率是传统机器人的四倍。用于品质检测的视觉系统和用于内部物流的自动导引运输车(AGV)在电子、金属和製药行业正变得越来越普遍。节能驱动装置也帮助製造商满足永续性要求,降低每千瓦时的电力消耗量和维护成本。

受大型计划(例如价值 50 亿美元的 Squilio 造纸厂)的推动,硬体设备(需要各种感测器、致动器和开关设备)将在 2025 年继续占据拉丁美洲工厂自动化和工业控制市场 30.25% 的份额。然而,由于全球供应链调整和外汇波动,零件利润率正在下降。

服务板块正以 8.07% 的复合年增长率快速成长,客户对承包整合、培训和预测性维护的需求日益增长,这使得供应商能够获得持续的收入来源。以绩效为基础的合约十分普遍,例如 Votorantim Cimentos 公司支付的服务费与避免停机时间挂钩。软体约占市场份额的四分之一,透过提供以资产为中心的分析和多站点可视性来支援这些模式。

其他福利:

- Excel格式的市场预测(ME)表

- 3个月的分析师支持

目录

第一章 引言

- 研究假设和市场定义

- 调查范围

第二章调查方法

第三章执行摘要

第四章 市场情势

- 市场概览

- 市场驱动因素

- 製造业对工业4.0和工业物联网的采用日益增长

- 政府奖励计画加速了智慧工厂投资

- 成本压力和优化生产力的需要

- 将电力转移至巴西用于低碳可再生能源生产

- 墨西哥加工出口区相关近岸外包业务的激增正在推动该国的自动化需求。

- 人工智慧驱动的数位双胞胎在现有工厂的试点部署取得了快速进展

- 市场限制

- 中小企业面临初始资本投入高、投资报酬率不确定性等问题。

- 在高度自动化的世界里,技术纯熟劳工严重短缺。

- 该地货币波动阻碍了长期投资

- 针对工业控制系统的网实整合攻击日益增多

- 产业价值链分析

- 监管环境

- 技术展望

- 宏观经济因素的影响

- 波特五力分析

- 新进入者的威胁

- 供应商的议价能力

- 买方的议价能力

- 替代品的威胁

- 竞争对手之间的竞争

第五章 市场规模与成长预测

- 依产品类型

- 工业控制系统

- 分散式控制系统(DCS)

- 可程式逻辑控制器(PLC)

- 监控与数据采集(SCADA)

- 製造执行系统(MES)

- 产品生命週期管理(PLM)

- 人机介面(HMI)

- 企业资源规划(ERP)

- 现场设备

- 机器视觉

- 工业机器人

- 感测器和发射器

- 马达和驱动器

- 继电器和开关

- 工业控制系统

- 依组件类型

- 硬体

- 软体

- 服务

- 按最终用户行业划分

- 车

- 食品/饮料

- 石油和天然气

- 化工/石油化工

- 电力/公共产业

- 製药

- 电子电器设备

- 采矿和金属

- 其他终端用户产业

- 透过部署模式

- 本地部署

- 云

- 杂交种

- 按国家/地区

- 巴西

- 墨西哥

- 阿根廷

- 智利

- 哥伦比亚

- 其他拉丁美洲地区

第六章 竞争情势

- 市场集中度

- 策略趋势

- 市占率分析

- 公司简介

- Siemens AG

- ABB Ltd

- Rockwell Automation Inc.

- Schneider Electric SE

- Emerson Electric Co.

- Honeywell International Inc.

- Mitsubishi Electric Corporation

- General Electric Co.

- Dassault Systemes SE

- Autodesk Inc.

- Aspen Technology Inc.

- Bosch Rexroth AG

- Yokogawa Electric Corporation

- Omron Corporation

- FANUC Corporation

- Yaskawa Electric Corporation

- KUKA AG

- Festo SE and Co. KG

- Endress+Hauser Group Services AG

- WEG Industrias SA

第七章 市场机会与未来展望

The Latin America factory automation and industrial controls market was valued at USD 19.67 billion in 2025 and estimated to grow from USD 21.13 billion in 2026 to reach USD 30.24 billion by 2031, at a CAGR of 7.43% during the forecast period (2026-2031).

Accelerated digital transformation, growing nearshoring activity, and government incentives are creating sustained demand for end-to-end automation solutions. Manufacturers across diverse sectors are prioritizing real-time analytics, predictive maintenance, and flexible production lines to reduce downtime and meet export-oriented quality standards. Vendor strategies emphasize localized production, value-added services, and domain-specific partnerships to mitigate currency volatility and supply chain disruptions. The region is also witnessing rapid uptake of collaborative robots, AI-enabled digital twins, and cloud-based supervisory systems as plants modernize legacy assets.

Latin America Factory Automation And Industrial Controls Market Trends and Insights

Rising Industry 4.0 and IIoT Adoption Across Manufacturing

Brazil's Industry 4.0 spending is forecast to triple by 2028, catalyzing enterprise-wide sensor rollouts and edge analytics. Arca Continental uses a cloud-based platform to connect 45 plants and serve 125 million consumers across four countries, enabling real-time performance dashboards. Manufacturers are shifting from monthly metrics to near-instant KPIs, elevating responsiveness and trimming production bottlenecks. Cement major Votorantim Cimentos reduced corrective maintenance costs by BRL 23 million (USD 4.6 million) per site through the use of predictive analytics, improving asset reliability by 6%. As a result, the Latin America factory automation and industrial controls market continues to embed smart-sensor networks and data-driven workflows across both discrete and process industries.

Government Incentive Programs Accelerating Smart-Factory Investments

Brazil earmarked BRL 186.6 billion (USD 37.3 billion) for modernizing industrial facilities, while Mexico reported USD 48 billion in new manufacturing commitments during the first seven months of 2024, over half of which was tied to automation initiatives. Targeted subsidies, tax credits, and technical residencies lower adoption barriers for small and mid-sized enterprises, a priority segment for the Latin America factory automation and industrial controls market. WEG alone plans USD 122 million in dual-country capacity expansions that integrate robotic picking, conveyance, and MES platforms. Argentina's mining policy also grants duty exemptions on advanced controls, supporting its position as the region's fastest-growing adopter. These incentives deliver a multiplier effect by blending public finance with private capital, thereby accelerating the diffusion of technology.

High Upfront Capex and ROI Uncertainty for SMEs

Survey data show that Brazilian SMEs lag behind large firms by as much as 2 times in automation adoption, constrained by access to finance and technical know-how. Collaborative robots narrow this gap, costing 20-30% less to deploy than traditional robots and offering quick paybacks, yet total investment still stretches capital budgets. Leasing models and vendor-led training mitigate some risk, but the Latin America factory automation and industrial controls market must further adapt financing structures to unlock SME potential. Public institutions, such as SENAI, offer low-cost simulation workshops that enable companies to validate ROI scenarios before committing to equipment purchases.

Other drivers and restraints analyzed in the detailed report include:

- Cost-Reduction Pressure and Productivity Optimization Mandates

- Rapid Uptake of AI-Enabled Digital-Twin Pilots in Brownfield Plants

- Acute Skilled-Labor Shortage for Advanced Automation

For complete list of drivers and restraints, kindly check the Table Of Contents.

Segment Analysis

Industrial Control Systems (ICS) represented 30.38% of the Latin America factory automation and industrial controls market in 2025, underpinned by deployments of PLC, SCADA, and DCS across oil and gas, mining, and food plants. Petrobras leverages predictive analytics to optimize refineries, while PEMEX employs region-wide pipeline SCADA for leak detection and flow control. Upgrades frequently bundle MES and HMI layers, enabling operators to streamline batch sequencing and regulatory reporting. The segment's growth remains steady as process industries refresh aging controllers and expand cybersecurity safeguards.

Field Devices are advancing at an 8.46% CAGR, the fastest pace within the Latin America factory automation and industrial controls market, propelled by surging robot installations and smart-sensor retrofits. Brazil added 1,595 new industrial robots in 2021, with cobots outpacing conventional units by a factor of four. Vision systems for quality inspection and autonomous guided vehicles for intralogistics are gaining traction in the electronics, metals, and pharmaceutical industries. Energy-efficient drives also support sustainability mandates, as manufacturers target lower kilowatt-hour intensity and reduced maintenance bills.

Hardware retained a 30.25% share of the Latin America factory automation and industrial controls market size in 2025, supported by mega-projects such as the USD 5 billion Sucuriu pulp mill that requires extensive sensors, actuators, and switchgear. However, component margins are tightening due to global supply chain rebalancing and currency fluctuations.

Services are expanding at 8.07% CAGR as clients demand turnkey integration, training, and predictive maintenance, positioning vendors for recurring revenue streams. Outcome-based contracts are common, with Votorantim Cimentos paying service fees tied to the avoidance of downtime. Software, at roughly one-quarter market share, anchors these models by providing asset-centric analytics and multi-site visibility.

The Latin America Factory Automation and Industrial Controls Market Report is Segmented by Product Type (Industrial Control Systems, Field Devices), Component Type (Hardware, Software, Services), End-User Industry (Automotive, Food and Beverages, and More), Deployment Mode (On-Premise, Cloud, Hybrid), and Country (Brazil, Mexico, Argentina, Chile, Colombia, and More). The Market Forecasts are Provided in Terms of Value (USD).

List of Companies Covered in this Report:

- Siemens AG

- ABB Ltd

- Rockwell Automation Inc.

- Schneider Electric SE

- Emerson Electric Co.

- Honeywell International Inc.

- Mitsubishi Electric Corporation

- General Electric Co.

- Dassault Systemes SE

- Autodesk Inc.

- Aspen Technology Inc.

- Bosch Rexroth AG

- Yokogawa Electric Corporation

- Omron Corporation

- FANUC Corporation

- Yaskawa Electric Corporation

- KUKA AG

- Festo SE and Co. KG

- Endress+Hauser Group Services AG

- WEG Industrias S.A.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET LANDSCAPE

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 Rising Industry 4.0 and IIoT adoption across manufacturing

- 4.2.2 Government incentive programmes accelerating smart-factory investments

- 4.2.3 Cost-reduction pressure and productivity optimisation mandates

- 4.2.4 Powershoring to Brazil for low-carbon renewable-energy manufacturing

- 4.2.5 Maquiladora-linked near-shoring surge driving automation demand in Mexico

- 4.2.6 Rapid uptake of AI-enabled digital-twin pilots in brownfield plants

- 4.3 Market Restraints

- 4.3.1 High upfront capex and ROI uncertainty for SMEs

- 4.3.2 Acute skilled-labour shortage for advanced automation

- 4.3.3 Local-currency volatility stalling long-cycle investments

- 4.3.4 Escalating cyber-physical attacks on industrial control systems

- 4.4 Industry Value Chain Analysis

- 4.5 Regulatory Landscape

- 4.6 Technological Outlook

- 4.7 Impact of Macroeconomic Factors

- 4.8 Porter's Five Forces Analysis

- 4.8.1 Threat of New Entrants

- 4.8.2 Bargaining Power of Suppliers

- 4.8.3 Bargaining Power of Buyers

- 4.8.4 Threat of Substitute Products

- 4.8.5 Intensity of Competitive Rivalry

5 MARKET SIZE AND GROWTH FORECASTS (VALUE)

- 5.1 By Product Type

- 5.1.1 Industrial Control Systems

- 5.1.1.1 Distributed Control System (DCS)

- 5.1.1.2 Programmable Logic Controller (PLC)

- 5.1.1.3 Supervisory Control AND Data Acquisition (SCADA)

- 5.1.1.4 Manufacturing Execution System (MES)

- 5.1.1.5 Product Lifecycle Management (PLM)

- 5.1.1.6 Human Machine Interface (HMI)

- 5.1.1.7 Enterprise Resource Planning (ERP)

- 5.1.2 Field Devices

- 5.1.2.1 Machine Vision

- 5.1.2.2 Robotics (Industrial)

- 5.1.2.3 Sensors and Transmitters

- 5.1.2.4 Motors and Drives

- 5.1.2.5 Relays and Switches

- 5.1.1 Industrial Control Systems

- 5.2 By Component Type

- 5.2.1 Hardware

- 5.2.2 Software

- 5.2.3 Services

- 5.3 By End-user Industry

- 5.3.1 Automotive

- 5.3.2 Food and Beverages

- 5.3.3 Oil and Gas

- 5.3.4 Chemical and Petrochemical

- 5.3.5 Power and Utilities

- 5.3.6 Pharmaceutical

- 5.3.7 Electronics and Electrical

- 5.3.8 Mining and Metals

- 5.3.9 Other End-user Industries

- 5.4 By Deployment Mode

- 5.4.1 On-premise

- 5.4.2 Cloud

- 5.4.3 Hybrid

- 5.5 By Country

- 5.5.1 Brazil

- 5.5.2 Mexico

- 5.5.3 Argentina

- 5.5.4 Chile

- 5.5.5 Colombia

- 5.5.6 Rest of Latin America

6 COMPETITIVE LANDSCAPE

- 6.1 Market Concentration

- 6.2 Strategic Moves

- 6.3 Market Share Analysis

- 6.4 Company Profiles (includes Global level Overview, Market level overview, Core Segments, Financials as available, Strategic Information, Market Rank/Share for key companies, Products and Services, and Recent Developments)

- 6.4.1 Siemens AG

- 6.4.2 ABB Ltd

- 6.4.3 Rockwell Automation Inc.

- 6.4.4 Schneider Electric SE

- 6.4.5 Emerson Electric Co.

- 6.4.6 Honeywell International Inc.

- 6.4.7 Mitsubishi Electric Corporation

- 6.4.8 General Electric Co.

- 6.4.9 Dassault Systemes SE

- 6.4.10 Autodesk Inc.

- 6.4.11 Aspen Technology Inc.

- 6.4.12 Bosch Rexroth AG

- 6.4.13 Yokogawa Electric Corporation

- 6.4.14 Omron Corporation

- 6.4.15 FANUC Corporation

- 6.4.16 Yaskawa Electric Corporation

- 6.4.17 KUKA AG

- 6.4.18 Festo SE and Co. KG

- 6.4.19 Endress+Hauser Group Services AG

- 6.4.20 WEG Industrias S.A.

7 MARKET OPPORTUNITIES AND FUTURE OUTLOOK

- 7.1 White-space and Unmet-need Assessment