|

市场调查报告书

商品编码

1911423

欧洲二手车市场:市场占有率分析、产业趋势与统计、成长预测(2026-2031)Europe Used Car - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2026 - 2031) |

||||||

※ 本网页内容可能与最新版本有所差异。详细情况请与我们联繫。

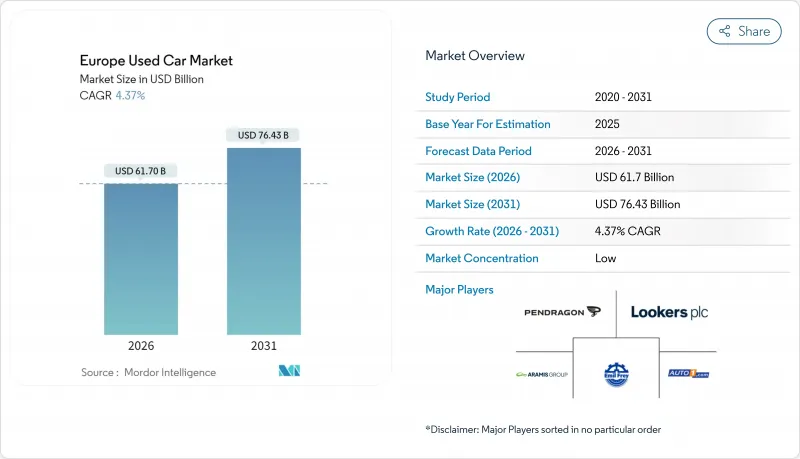

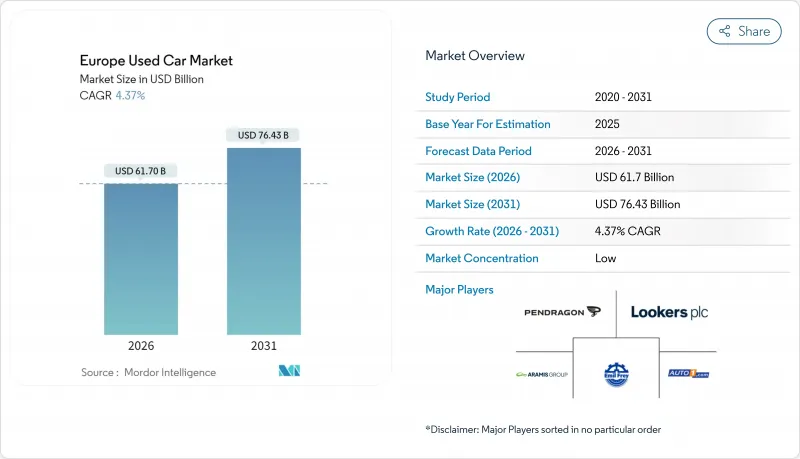

欧洲二手车市场预计将从 2025 年的 591.2 亿美元成长到 2026 年的 617 亿美元,到 2031 年达到 764.3 亿美元,2026 年至 2031 年的复合年增长率为 4.37%。

数位化市场、OEM支援的认证二手(CPO)专案以及嵌入式融资解决方案正在融合,透过提高价格透明度、可靠性和可负担性来加速需求成长。随着西欧逐步淘汰柴油车的政策将车辆重新分配到中欧和东欧,跨境库存流动正在创造增量销售。大量车龄3-5年的二手租赁车辆供应正在缓解新车库存持续短缺的问题。同时,儘管估值不确定性,电池式电动车(BEV)仍代表着一个快速成长的高端细分市场。随着传统经销商、数位颠覆者和OEM直销通路都在寻求融合线上研究、展示室和交付流程的全通路模式,日益激烈的竞争正在重塑利润率和客户拥有週期。

欧洲二手车市场趋势与洞察

原厂配套认证二手车(CPO)专案的激增

原厂认证二手车 (CPO) 计划将厂商保固、保养标准和数位化预约工具引入二手车销售流程,使准新车成为新车的可靠替代品。高残值和更高的单车盈利促使各大品牌将 CPO 纳入其核心策略;然而,消费者对 CPO 的认知度仍然较低。德国和英国的经销商协会正在持续进行教育活动,旨在将技术保固资讯转化为更清晰的价值讯息。有效的 CPO 计划能够引导车主使用授权服务,并在整个车主生命週期内增强配件和保养方面的收入来源。

由于强制性车队电气化,租赁期满(3-5年车龄)的车辆供应量增加。

大量租赁到期车辆,尤其是车龄3-5年的车辆,正在改变欧洲各地的库存格局,为市场参与企业带来挑战和机会。车队电气化强制令加速了这一趋势,企业车队为了实现永续性目标并利用不断发展的技术,正在加快车辆的更新换代速度。在德国和荷兰等租赁渗透率较高的市场,这种供应激增尤其明显,在这些市场,租赁仍是电池式电动车(BEV)的主要购买方式。

里程表造假问题削弱了买家信心

里程表造假问题持续困扰着欧洲二手车市场,削弱了消费者信心,并导致受影响细分市场的车辆价格下跌。这种人为降低车辆里程数以提高售价的做法,每年对欧洲消费者造成数十亿欧元的损失,并且对跨境交易的影响尤其严重,因为跨境交易的检验难度更高。东欧、义大利和西班牙的情况尤其严峻,这些地区的监管力道参差不齐。基于区块链的车辆历史记录等数位化解决方案展现出一定的潜力,但其在欧洲的应用仍十分分散。

细分市场分析

到2025年,SUV/MUV车型将占欧洲二手车市场33.78%的份额,这反映出即使在油价达到峰值后,消费者仍然渴望拥有多功能性和舒适的乘坐体验。越来越多的纯电动SUV租约到期,也支撑了9.67%的复合年增长率预测。由于都市区拥堵费使车身较长的轿车处于不利地位,轿车市场将持续下滑。掀背车在人口密集的城市中心,仍受到价格敏感型首次购车者的青睐。

在法国和西班牙,高残值促使特许经销商预留展位空间展示中阶跨界车,而中小型服务型企业对轻型商用车的需求依然稳定。符合欧盟6排放标准的厢型车在低排放气体区售价高出12%,凸显了合规车辆和不合规车辆之间的市场两极化。南欧市场对SUV的需求日益增长,葡萄牙对标緻2008等小型跨界车的需求实现了两位数成长。

到2025年,柴油车在欧洲二手车市场的份额将占41.52%,低于历史最高水平,这主要归因于空气品质措施的加强。儘管目前规模仍然较小,但纯电动车(BEV)正以17.95%的复合年增长率快速增长,早期采用者发布的示范车辆有助于缓解人们对技术的担忧。在充电基础设施不发达的国家,汽油车仍然十分重要,而混合动力汽车(HEV)和插电式混合动力汽车(PHEV)则弥合了法规遵循和续航里程之间的差距。

跨境套利正推动柴油车从法国和德国流向保加利亚和罗马尼亚,延长车辆的生命週期回报期;同时,随着荷兰二手车补贴的减少,纯电动车交易正在兴起。电池健康状况的透明度仍然是一个障碍,但随着检验工具包的广泛普及,预计在欧盟7标准实施后,市场流动性将进一步提升。

点对点交易、个人广告和小规模经销商仍占交易量的54.60%,但在投资者的支持下,数据丰富的市场平台正以6.18%的复合年增长率快速扩张。排名前五的零售商仅占B2C交易量的6%,显示市场整合空间庞大。由製造商支援的认证二手车(CPO)经销商提供更严格的库存管理、捆绑式服务计划和融资方案,这些都吸引了风险规避型消费者。

欧洲二手车市场由平台主导,这些平台提供集中库存、自动化维护和产权保障等服务。在波兰,结合运输和税务服务,有组织的经销商能够在跨境交易中击败分散的竞争对手,从而建立信任并促进重复购买。

其他福利:

- Excel格式的市场预测(ME)表

- 分析师支持(3个月)

目录

第一章 引言

- 调查范围

第二章调查方法

第三章执行摘要

第四章 市场情势

- 市场驱动因素

- 原厂配套认证二手车(CPO)专案的激增

- 由于强制性车队电气化,二手租赁车辆(3-5年车龄)供应量增加。

- 纯线上市场的成长和数位渗透率的不断提高

- 由于符合WLTP/欧7排放标准,新车价格上涨,与二手车的价格差距扩大。

- 加速柴油车淘汰政策将促进跨境贸易流动

- 透过嵌入式金融/先买后付解决方案提升首次购屋者的购屋能力

- 市场限制

- 里程表造假行为持续存在,削弱了买家的信心。

- 税收制度和登记规则的碎片化阻碍了二级分配的顺利进行。

- 电动车电池健康状态标准化工作的延误导致二手电动车的残值下降。

- 老旧车辆的品质和可靠性问题

- 价值/价值链分析

- 监理展望

- Euro 7 欧盟电池法规增值税利润率方法修订

- 技术展望

- 人工智慧驱动的车辆评估* 用于转售的数位双胞胎* OTA保固分析

- 波特五力模型

- 供应商的议价能力

- 买方的议价能力

- 新进入者的威胁

- 替代品的威胁

- 竞争对手之间的竞争

第五章 市场规模及成长预测(价值(美元)及销售量(单位))

- 按车辆类型

- 轿车

- SUV/MUV

- 掀背车

- 按燃料类型

- 汽油车

- 柴油车

- 电池式电动车(BEV)

- 混合动力汽车和插电式混合动力汽车(HEV/PHEV)

- 其他(液化石油气、压缩天然气、生质燃料)

- 依供应商类型

- 有组织的

- 杂乱无章

- 按销售管道

- 离线

- 在线的

- 按车辆型号年份

- 0-2岁

- 3-5年

- 6-8岁

- 超过9年

- 以所有者数量计算

- 单一车主车辆

- 多车主车辆

- 价格范围(美元)

- 低于 10,000 美元

- 10,000 美元至 20,000 美元

- 20,000美元至30,000美元

- 超过3万美元

- 透过融资方式

- 贷款购买

- 现金购买

- 按国家/地区

- 德国

- 英国

- 法国

- 义大利

- 西班牙

- 俄罗斯

- 荷兰

- 瑞典

- 波兰

- 其他欧洲地区

第六章 竞争情势

- 策略性倡议(併购、资金筹措、船队合作)

- 市占率分析

- 公司简介

- Auto1 Group SE

- Emil Frey AG

- BCA Marketplace(Constellation Automotive)

- Pendragon PLC

- Aramis Group SA

- Lookers PLC

- Autorola A/S

- Arnold Clark Automobiles Ltd

- Sytner Group Ltd

- Cazoo Group Ltd

- CarNext BV

- Inchcape PLC

- Hedin Mobility Group

- Heycar(Mobility Trader GmbH)

- Penske Automotive Group/CarShop

- ALD Automotive and LeasePlan

- Groupe Renault Retail Group

- Bilia AB

- Motorpoint Group PLC

- Vertu Motors PLC

第七章 市场机会与未来展望

The Europe used car market is expected to grow from USD 59.12 billion in 2025 to USD 61.7 billion in 2026 and is forecast to reach USD 76.43 billion by 2031 at 4.37% CAGR over 2026-2031.

Digital marketplaces, OEM-backed certified pre-owned (CPO) programs, and embedded finance solutions together accelerate demand by improving price transparency, trust, and affordability. Cross-border inventory flows unlock incremental volume as diesel phase-out policies in Western Europe redirect vehicles to Central and Eastern Europe. The mid-age supply wave of 3 to 5-year-old ex-lease cars balances out persistent shortages of younger stock, while battery-electric vehicles (BEVs) add a fast-growing premium layer despite valuation uncertainty. Competitive intensity is rising as traditional dealers, digital disruptors, and OEM captive channels pursue omnichannel models that blend online research with showroom or delivery hand-offs, reshaping margins and customer ownership cycles.

Europe Used Car Market Trends and Insights

Surge in OEM-Backed Certified Pre-Owned (CPO) Programs

OEM CPO schemes inject manufacturer warranties, refurbishment standards, and digital booking tools into the resale journey, positioning near-new cars as credible substitutes for new models. Strong residuals and higher per-unit profitability motivate brands to mainstream CPO in core planning. Consumer awareness, however, remains muted; ongoing education initiatives by dealer councils in Germany and the UK aim to translate technical coverage into clearer value messaging. Effective programs also loop owners back into authorized service lanes, reinforcing accessory and maintenance revenue streams across the ownership lifecycle.

Rising Supply of Ex-Lease Vehicles (3-5-Year Bracket) Driven by Fleet Electrification Mandates

The influx of off-lease vehicles, particularly in the 3-5 year bracket, is reshaping inventory dynamics across Europe, creating both challenges and opportunities for market participants. Fleet electrification mandates are accelerating this trend, with corporate fleets cycling through vehicles more rapidly to meet sustainability targets and take advantage of evolving technology. This supply surge is particularly pronounced in markets with strong leasing penetration, such as Germany and the Netherlands, where leasing remains a key acquisition method for battery electric vehicles (BEVs).

Persisting Odometer Fraud Undermining Buyer Trust

Odometer fraud continues to plague the European used car market, eroding consumer confidence and depressing values across affected segments. This practice, where vehicle mileage is artificially reduced to increase selling prices, costs European consumers billions annually and disproportionately impacts cross-border transactions where verification is more challenging.The problem is particularly acute in Eastern Europe, Italy, and Spain, where regulatory enforcement varies significantly. While digital solutions like blockchain-based vehicle history records show promise, implementation remains fragmented across the continent.

Other drivers and restraints analyzed in the detailed report include:

- Growth of Pure-Play Online Marketplaces Increasing Digital Penetration

- Elevated New-Car Prices from WLTP/Euro-7 Compliance Widening Price Gap to Used

- Slow EV Battery-Health Standardisation Depressing Residual Values of Used BEVs

For complete list of drivers and restraints, kindly check the Table Of Contents.

Segment Analysis

SUV/MUV models commanded 33.78% of the Europe used car market size in 2025, reflecting consumer appetite for versatility and higher seating positions even after fuel-cost pressures peaked. BEV-compatible SUVs now exit lease pools in greater numbers, which underpins a 9.67% CAGR outlook. Sedans continue to slide as urban congestion charges penalise longer body formats. Hatchbacks retain loyalty inside dense city cores among price-sensitive first-time buyers.

Dynamic residuals encourage franchised dealers in France and Spain to dedicate rooftop space to mid-spec crossovers, while LCV uptake remains steady in service-oriented SMEs. Euro 6-compliant vans trade at 12% premiums inside low-emission zones, highlighting a bifurcation between compliant and non-compliant workhorses. Southern Europe leans even harder into SUVs; Portugal's demand for sub-compact crossovers such as the Peugeot 2008 grows by double digits.

Diesel vehicles captured 41.52% of the Europe used car market share in 2025, down from previous highs as clean-air measures rise. Though starting small, battery electric vehicles are advancing at 17.95% CAGR as early adopter fleets de-risk technology fears by releasing documented vehicles. Petrol maintains relevance in countries with nascent charging grids, while HEV and PHEV bridge compliance and range concerns.

Cross-border arbitrage channels diesel cars from France and Germany into Bulgaria and Romania, prolonging lifecycle yields. Meanwhile, BEV bargains appear in the Netherlands, where resale subsidies tighten. Transparency around battery state of health remains a gating factor, yet growth in verification kits is expected to unlock further liquidity after Euro 7 implementation.

Independent traders, private classifieds, and micro-dealerships still account for 54.60% of the volume, but organized players scale quicker at 6.18% CAGR as investors back data-rich marketplaces. The top five retailers account for only 6% of B2C transactions, signalling ample consolidation headroom. OEM-sponsored CPO outlets add inventory discipline, bundled service plans, and financing that resonate with risk-averse shoppers.

The Europe used car market rewards platforms able to syndicate stock, automate reconditioning, and guarantee title. In Poland, bundled transport and taxation services enable organised sellers to undercut fragmented rivals on cross-border purchases, boosting trust and repeat business.

The Europe Used Car Market Report is Segmented by Vehicle Type (Hatchback, Sedan, and More), Fuel Type (Gasoline, Diesel, and More), Vendor Type (Organized and Unorganized), Sales Channel (Offline and Online), Vehicle Age (0 To 2 Years, 3 To 5 Years, and More), Ownership Count (Single-Owner Vehicles and More), Price Band, Financing Type, and Country. The Market Forecasts are Provided in Terms of Value (USD) and Volume (Units).

List of Companies Covered in this Report:

- Auto1 Group SE

- Emil Frey AG

- BCA Marketplace (Constellation Automotive)

- Pendragon PLC

- Aramis Group SA

- Lookers PLC

- Autorola A/S

- Arnold Clark Automobiles Ltd

- Sytner Group Ltd

- Cazoo Group Ltd

- CarNext B.V.

- Inchcape PLC

- Hedin Mobility Group

- Heycar (Mobility Trader GmbH)

- Penske Automotive Group/CarShop

- ALD Automotive and LeasePlan

- Groupe Renault Retail Group

- Bilia AB

- Motorpoint Group PLC

- Vertu Motors PLC

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 Introduction

- 1.1 Scope of the Study

2 Research Methodology

3 Executive Summary

4 Market Landscape

- 4.1 Market Drivers

- 4.1.1 Surge in OEM-Backed Certified Pre-Owned (CPO) Programs

- 4.1.2 Rising Supply of Ex-Lease Vehicles (3-5-Year Bracket) Driven by Fleet Electrification Mandates

- 4.1.3 Growth of Pure-Play Online Marketplaces Increasing Digital Penetration

- 4.1.4 Elevated New-Car Prices from WLTP/Euro-7 Compliance Widening Price Gap to Used

- 4.1.5 Accelerated Diesel Phase-Out Policies Boosting Cross-Border Trade Flows

- 4.1.6 Embedded Finance/BNPL Solutions Improving Affordability for First-Time Buyers

- 4.2 Market Restraints

- 4.2.1 Persisting Odometer Fraud Undermining Buyer Trust

- 4.2.2 Fragmented Tax and Registration Rules Hampering Seamless Secondary Trade

- 4.2.3 Slow EV Battery-Health Standardisation Depressing Residual Values of Used BEVs

- 4.2.4 Quality and Reliability Concerns in Older-Age Vehicles

- 4.3 Value/Supply-Chain Analysis

- 4.4 Regulatory Outlook

- 4.4.1 Euro-7 EU Battery Regulation VAT margin scheme revisions

- 4.5 Technological Outlook

- 4.5.1 AI-driven vehicle grading * Digital twins for re-marketing * OTA warranty analytics

- 4.6 Porter's Five Forces

- 4.6.1 Bargaining Power of Suppliers

- 4.6.2 Bargaining Power of Buyers

- 4.6.3 Threat of New Entrants

- 4.6.4 Threat of Substitutes

- 4.6.5 Intensity of Competitive Rivalry

5 Market Size and Growth Forecasts (Value (USD) and Volume (Units))

- 5.1 By Vehicle Type

- 5.1.1 Sedan

- 5.1.2 SUV/MUV

- 5.1.3 Hatchback

- 5.2 By Fuel Type

- 5.2.1 Gasoline

- 5.2.2 Diesel

- 5.2.3 Battery Electric Vehicle (BEV)

- 5.2.4 Hybrid and Plug-in Hybrid (HEV/PHEV)

- 5.2.5 Others (LPG, CNG, Bio-fuel)

- 5.3 By Vendor Type

- 5.3.1 Organized

- 5.3.2 Unorganized

- 5.4 By Sales Channel

- 5.4.1 Offline

- 5.4.2 Online

- 5.5 By Vehicle Age

- 5.5.1 0 to 2 Years

- 5.5.2 3 to 5 Years

- 5.5.3 6 to 8 Years

- 5.5.4 More Than 9 Years

- 5.6 By Ownership Count

- 5.6.1 Single-Owner Vehicles

- 5.6.2 Multi-Owner Vehicles

- 5.7 By Price Band (USD)

- 5.7.1 Less than 10k

- 5.7.2 10k to 20k

- 5.7.3 20k to 30k

- 5.7.4 More than 30k

- 5.8 By Financing Type

- 5.8.1 Financed Purchase

- 5.8.2 Outright Purchase

- 5.9 By Country

- 5.9.1 Germany

- 5.9.2 United Kingdom

- 5.9.3 France

- 5.9.4 Italy

- 5.9.5 Spain

- 5.9.6 Russia

- 5.9.7 Netherlands

- 5.9.8 Sweden

- 5.9.9 Poland

- 5.9.10 Rest of Europe

6 Competitive Landscape

- 6.1 Strategic Moves (M&A, Fund-Raises, Fleet Partnerships)

- 6.2 Market Share Analysis

- 6.3 Company Profiles (Includes Global Level Overview, Market Level Overview, Core Segments, Financials as Available, Strategic Information, Market Rank/Share for Key Companies, Products and Services, SWOT Analysis, and Recent Developments)

- 6.3.1 Auto1 Group SE

- 6.3.2 Emil Frey AG

- 6.3.3 BCA Marketplace (Constellation Automotive)

- 6.3.4 Pendragon PLC

- 6.3.5 Aramis Group SA

- 6.3.6 Lookers PLC

- 6.3.7 Autorola A/S

- 6.3.8 Arnold Clark Automobiles Ltd

- 6.3.9 Sytner Group Ltd

- 6.3.10 Cazoo Group Ltd

- 6.3.11 CarNext B.V.

- 6.3.12 Inchcape PLC

- 6.3.13 Hedin Mobility Group

- 6.3.14 Heycar (Mobility Trader GmbH)

- 6.3.15 Penske Automotive Group/CarShop

- 6.3.16 ALD Automotive and LeasePlan

- 6.3.17 Groupe Renault Retail Group

- 6.3.18 Bilia AB

- 6.3.19 Motorpoint Group PLC

- 6.3.20 Vertu Motors PLC