|

市场调查报告书

商品编码

1911472

马来西亚二手车市场:市场占有率分析、产业趋势与统计、成长预测(2026-2031)Malaysia Used Car - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2026 - 2031) |

||||||

※ 本网页内容可能与最新版本有所差异。详细情况请与我们联繫。

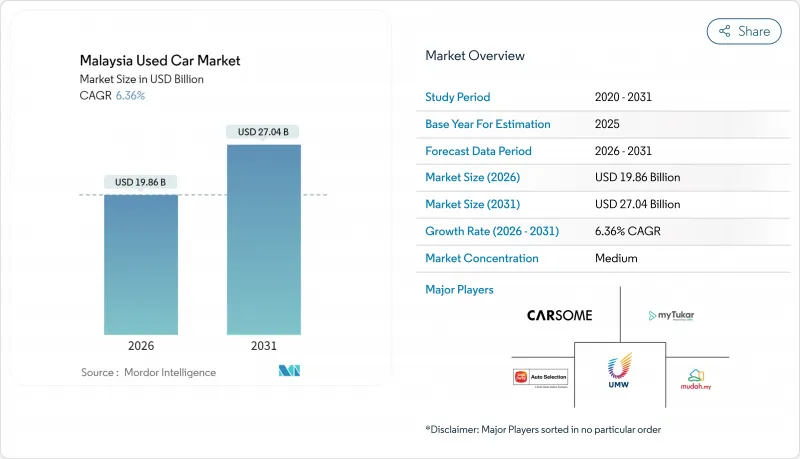

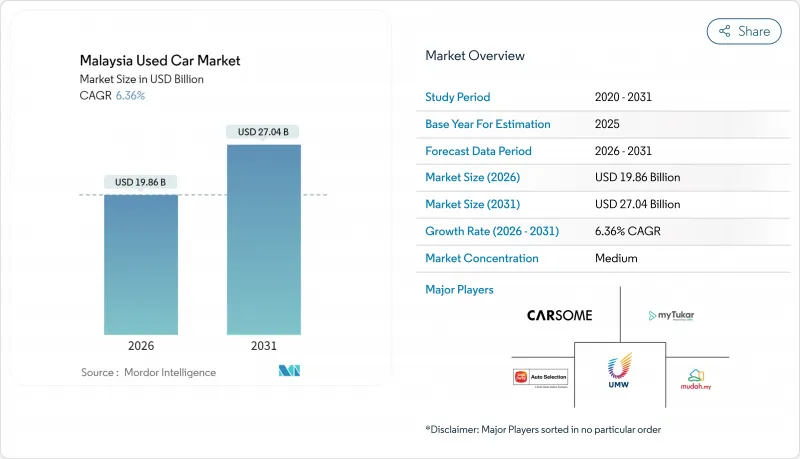

2025年马来西亚二手车市场价值为186.7亿美元,预计从2026年的198.6亿美元成长到2031年的270.4亿美元,在预测期(2026-2031年)内复合年增长率为6.36%。

强劲的家庭支出、策略性的消费税减免以及国家汽车政策下逐步放宽的进口管制,都在支撑二手车需求,并进一步推动二手车供应的未来成长。随着越来越多的消费者寻求更适合混合交通和季节性洪涝灾害的驾驶位置,SUV的需求正在加速增长;同时,由于充电基础设施的不断完善,纯电动车也越来越受欢迎。

马来西亚二手车市场趋势及分析

新车价格上涨

预计2024年新车标价将上涨,2026年销售税改革实施后进一步上涨8%至20%。这很可能促使许多中等收入家庭转向5,000至9,999美元的二手车市场,目前已占38.74%的份额。持续的通货膨胀和疲软的马币推高了进口成本,导致价格差距不断扩大。这一价格差距有利于Perodua和Proton等本土品牌保持稳定的存货周转,这些品牌拥有充足的供应和价格合理的零件。

拓展数位零售平台

CARSOME每年利用其175项人工智慧检测系统处理超过10万辆汽车,创造约10亿美元的收入,并树立了新的品质标准。它与Google云端的合作实现了即时定价和优化的客户体验,而实体经销商则正在采用虚拟展示室来维持市场份额。线上通路6.73%的复合年增长率表明,马来西亚消费者越来越多地透过行动搜寻开始购车流程,儘管许多消费者仍然重视在最后阶段进行实地验车。

假车/非法进口车

马来西亚取消开放式核准许可製度,并对新加坡註册车辆入境处以马币的车辆入境许可罚款,凸显了边境管制的收紧。虽然此举短期内会增加合规成本,但最终将保护授权经销商的利益,并鼓励消费者选择检验、文件齐全的正规经销商。

细分市场分析

儘管轿车在2025年仍将以37.68%的市场份额继续占据马来西亚二手车市场最大份额,但SUV预计将以7.03%的复合年增长率超越其他车型。 SUV的成长趋势归功于其更高的驾驶座椅位置、更优异的防水性能以及Proton X70租赁到期车辆的供应。 CARSOME报告显示,SUV的平均售价更高,即使销量尚未赶上轿车,也能提高单车盈利。

预计到2031年,SUV在马来西亚二手车市场将快速成长。同时,由于运行成本低,掀背车仍将是颇受欢迎的入门车型。多功能车(MPV)将继续满足大家庭和重视灵活座椅布局的叫车营运商的需求。随着基础设施计划预计将延长都市区通勤时间,库存丰富的SUV车型经销商将占据有利地位,领先市场需求成长。

儘管非正规二手车经销商仍占马来西亚二手车市场的62.54%,但正规经营者正以6.47%的复合年增长率快速扩张,这主要得益于保固和数位化服务的推动。消费者愿意为经过认证的车辆侦测支付适度的溢价,因为这有助于降低风险,并提供安心的售后服务。

随着 CARSOME 扩大检测中心规模,以及 Carro 推出即时线上估价服务,马来西亚正规二手车市场规模不断扩大。森那美收购 UMW Holdings,将丰田和 Perodua 的二手车业务合併为一个品牌,预示着未来市场将进一步整合。

到2025年,汽油车将占交易总量的75.92%,而纯电动车在奖励和充电基础设施不断完善的推动下,增长速度最快,达到7.15%。柴油车仍将是物流车队的主流,而混合动力汽车则为那些专注于续航里程的驾驶者提供了过渡选择。

随着充电桩数量增加到 10,000 个,以及税收优惠政策持续到 2025 年,马来西亚 xEV(电动和混合动力汽车)二手车市场规模预计将在 2026 年至 2031 年间增长三倍。经销商已开始培训高压技术人员,以便在第一批大众市场电动车进入二手市场时抓住残值机会。

马来西亚二手车市场报告按车辆类型(例如,掀背车)、供应商类型(有组织/无组织)、燃料类型(例如,汽油、柴油)、车龄(例如,0-2 年、3-5 年)、价格范围(例如,低于 5,000 美元)、销售管道(线路上、线下)、所有权类型(首次销售数量、多组数)以及市场规模、数位和数量(市场规模、数位)以及市场规模(首次销售数量)以及市场规模和市场规模(首次细分市场数量)以及市场规模(首次数量)以及市场规模和市场数量(首次销售数量)以及市场规模和市场数量(首次市场规模和数量)。

其他福利:

- Excel格式的市场预测(ME)表

- 3个月的分析师支持

目录

第一章 引言

- 研究假设和市场定义

- 调查范围

第二章调查方法

第三章执行摘要

第四章 市场情势

- 市场概览

- 市场驱动因素

- 新车价格上涨

- 拓展数位零售平台

- 多种型号可供选择

- 综合金融和保险

- OEM赞助的CPO项目

- 透过远端资讯处理确保透明度

- 市场限制

- 假车/非法进口车

- 电动车残值存在不确定性

- 测试标准碎片化

- 有限售后保固

- 价值/供应链分析

- 监管环境

- 技术展望

- 波特五力模型

- 新进入者的威胁

- 买方和消费者的议价能力

- 供应商的议价能力

- 替代品的威胁

- 竞争对手之间的竞争

第五章 市场规模及成长预测(价值(美元))

- 按车辆类型

- 掀背车车

- 轿车

- 运动型多用途车(SUV)

- 多用途汽车(MPV)

- 其他(敞篷车、小轿车、跨界车、跑车)

- 依供应商类型

- 组织

- 杂乱无章

- 按燃料类型

- 汽油车

- 柴油引擎

- 混合动力汽车(HEV 和 PHEV)

- 电池式电动车(BEV)

- 液化石油气/压缩天然气/其他

- 按车辆年份

- 0-2岁

- 3-5年

- 6-8岁

- 9-12岁

- 已经过去12年多了。

- 按价格范围

- 不到5000美元

- 5,000 美元至 9,999 美元

- 10,000 美元至 14,999 美元

- 15,000 美元至 19,999 美元

- 20,000美元至29,999美元

- 超过3万美元

- 按销售管道

- 在线的

- 数位分类广告入口网站

- 纯粹的电子零售商

- OEM授权网路商店

- 离线

- OEM特许经销商

- 多品牌独立零售商

- 实体竞标行

- 在线的

- 依所有权类型

- 原车主转售

- 多位业主

第六章 竞争情势

- 市场集中度

- 策略趋势

- 市占率分析

- 公司简介

- CARSOME Sdn Bhd

- myTukar Sdn Bhd

- Sime Darby Auto Selection

- UMW Toyota Motor Sdn Bhd(TOPMARK)

- Mercedes-Benz Malaysia(CPO)

- Mudah.my Sdn Bhd

- Carlist.my

- Caricarz Sdn Bhd

- BMW Malaysia(Premium Selection)

- Perodua Pre-Owned Vehicles

- Proton Certified Pre-Owned

- Bermaz Auto Pre-Owned

- TC Euro Cars(Renault)

- GoCar Subs/GoEV Marketplace

- EasyCars

- MUV Marketplace

- Big Three Auto

- Motor Trader Malaysia

- eBid Motors

- Carsome Certified Lab

第七章 市场机会与未来展望

The Malaysia Used Car Market was valued at USD 18.67 billion in 2025 and estimated to grow from USD 19.86 billion in 2026 to reach USD 27.04 billion by 2031, at a CAGR of 6.36% during the forecast period (2026-2031).

Robust household spending, strategic sales-tax exemptions and the National Automotive Policy's gradual import liberalization underpin demand further enlarged the future supply of pre-owned vehicles. SUV demand is accelerating as buyers look for elevated driving positions suited to mixed traffic and seasonal flooding, while battery-electric models gain traction on the back of expanding charging infrastructure.

Malaysia Used Car Market Trends and Insights

Escalating New-Car Prices

New-vehicle sticker prices climbed during 2024 and are expected to rise another 8-20% once excise duty reforms are activated in 2026, pushing many middle-income families toward the USD 5,000-9,999 used segment that already commands 38.74% share. Persistent inflation and a weak ringgit inflate import costs, keeping the price gap wide. The differential supports steady inventory turnover for local brands such as Perodua and Proton that provide ample supply and affordable parts.

Digital Retail Platform Expansion

CARSOME processes more than 100,000 vehicles a year through its AI-driven 175-point inspection regime, delivering roughly USD 1 billion in revenue and setting new quality benchmarks. Partnerships with Google Cloud allow real-time pricing and customer-experience optimization, while traditional lots now add virtual showrooms to defend market share. The online channel's 6.73% CAGR shows that Malaysian shoppers increasingly begin their journey with a mobile search even though many still insist on a last-mile physical inspection.

Counterfeit / Illegally Imported Vehicles

The end of the Open Approved Permit model and fresh Vehicle Entry Permit fines of RM300 for Singapore-registered cars entering Malaysia underscore tighter border controls. The crackdown lifts compliance costs in the short run but ultimately shields legitimate dealers, encouraging customers to gravitate toward organised lots with verifiable documentation.

Other drivers and restraints analyzed in the detailed report include:

- Diverse Selection Among Models

- Integrated Financing & Insurance

- Fragmented Inspection Standards

For complete list of drivers and restraints, kindly check the Table Of Contents.

Segment Analysis

Sedans maintained the largest 37.68% slice of the Malaysia used car market in 2025, though SUVs are forecast to post a 7.03% CAGR, outpacing every other body style. The SUV uptrend stems from elevated driving positions, better flood clearance and fresh supply from Proton X70 lease returns. CARSOME reports that SUV transactions command higher average selling prices, boosting per-unit profitability even while unit volumes are still catching sedans.

The Malaysia used car market size for SUVs is projected to grow exponentially by 2031, while hatchbacks retain strong entry-level resonance because of low running costs. Multi-Purpose Vehicles continue serving large families and ride-hailing operators that value flexible seating. Dealers stocking diversified SUV trims position themselves ahead of the demand curve as infrastructure projects lengthen urban commutes.

Unorganised yards still control 62.54% of the Malaysia used car market share, but organised operators are growing faster at 6.47% CAGR due to warranty coverage and digital service layers. Consumers are willing to pay modest premiums for certified inspections that reduce risk and provide after-sales peace of mind.

The Malaysia used car market size attributable to organised vendors as CARSOME expands to increase its inspection centres and Carro introduces instant online valuations. Sime Darby's purchase of UMW Holdings integrates Toyota and Perodua pre-owned programs under a single banner, signalling deeper consolidation ahead.

Petrol cars commanded 75.92% of 2025 transactions, yet battery-electric units are charting the fastest 7.15% trajectory on incentives and charging rollouts. Diesel remains the province of logistics fleets, whereas hybrids deliver a transitional option for drivers worried about range.

Malaysia used car market size for xEVs is projected to triple between 2026 and 2031 as charging points climb to 10,000 and tax holidays stay intact through 2025. Dealers are beginning to train technicians in high-voltage servicing to capture the residual-value opportunity once the first wave of mass-market EVs enters secondary circulation.

The Malaysia Used Car Market Report is Segmented by Vehicle Type (Hatchbacks and More), Vendor Type (Organized and Unorganized), Fuel Type (Petrol, Diesel, and More), Vehicle Age (0 - 2 Years, 3 - 5 Years, and More), Price Segment (Less Than USD 5 000, and More), Sales Channel (Online and Offline), and Ownership (First-Owner Resale and Multi-Owner). Market Size & Growth Forecasts (Value (USD) and Volume (Units)).

List of Companies Covered in this Report:

- CARSOME Sdn Bhd

- myTukar Sdn Bhd

- Sime Darby Auto Selection

- UMW Toyota Motor Sdn Bhd (TOPMARK)

- Mercedes-Benz Malaysia (CPO)

- Mudah.my Sdn Bhd

- Carlist.my

- Caricarz Sdn Bhd

- BMW Malaysia (Premium Selection)

- Perodua Pre-Owned Vehicles

- Proton Certified Pre-Owned

- Bermaz Auto Pre-Owned

- TC Euro Cars (Renault)

- GoCar Subs / GoEV Marketplace

- EasyCars

- MUV Marketplace

- Big Three Auto

- Motor Trader Malaysia

- eBid Motors

- Carsome Certified Lab

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 Introduction

- 1.1 Study Assumptions & Market Definition

- 1.2 Scope of the Study

2 Research Methodology

3 Executive Summary

4 Market Landscape

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 Escalating new-car prices

- 4.2.2 Digital retail platform expansion

- 4.2.3 Diverse selection among models

- 4.2.4 Integrated financing & insurance

- 4.2.5 OEM-backed CPO programs

- 4.2.6 Telematics-enabled transparency

- 4.3 Market Restraints

- 4.3.1 Counterfeit / illegally imported vehicles

- 4.3.2 EV residual-value uncertainty

- 4.3.3 Fragmented inspection standards

- 4.3.4 Limited aftermarket warranty

- 4.4 Value / Supply-Chain Analysis

- 4.5 Regulatory Landscape

- 4.6 Technological Outlook

- 4.7 Porter's Five Forces

- 4.7.1 Threat of New Entrants

- 4.7.2 Bargaining Power of Buyers/Consumers

- 4.7.3 Bargaining Power of Suppliers

- 4.7.4 Threat of Substitute Products

- 4.7.5 Intensity of Competitive Rivalry

5 Market Size & Growth Forecasts (Value (USD))

- 5.1 By Vehicle Type

- 5.1.1 Hatchbacks

- 5.1.2 Sedans

- 5.1.3 Sport-Utility Vehicles (SUVs)

- 5.1.4 Multi-Purpose Vehicles (MPVs)

- 5.1.5 Others (convertibles, coupes, crossovers, sports cars)

- 5.2 By Vendor Type

- 5.2.1 Organised

- 5.2.2 Unorganised

- 5.3 By Fuel Type

- 5.3.1 Petrol

- 5.3.2 Diesel

- 5.3.3 Hybrid (HEV & PHEV)

- 5.3.4 Battery-Electric (BEV)

- 5.3.5 LPG / CNG / Others

- 5.4 By Vehicle Age

- 5.4.1 0 - 2 Years

- 5.4.2 3 - 5 Years

- 5.4.3 6 - 8 Years

- 5.4.4 9 - 12 Years

- 5.4.5 More than 12 Years

- 5.5 By Price Segment

- 5.5.1 Less than USD 5 000

- 5.5.2 USD 5 000 - USD 9 999

- 5.5.3 USD 10 000 - USD 14 999

- 5.5.4 USD 15 000 - USD 19 999

- 5.5.5 USD 20 000 - USD 29 999

- 5.5.6 More than or equal to USD 30 000

- 5.6 By Sales Channel

- 5.6.1 Online

- 5.6.1.1 Digital Classified Portals

- 5.6.1.2 Pure-play e-Retailers

- 5.6.1.3 OEM-Certified Online Stores

- 5.6.2 Offline

- 5.6.2.1 OEM-Franchised Dealers

- 5.6.2.2 Multi-brand Independent Dealers

- 5.6.2.3 Physical Auction Houses

- 5.6.1 Online

- 5.7 By Ownership

- 5.7.1 First-owner Resale

- 5.7.2 Multi-owner

6 Competitive Landscape

- 6.1 Market Concentration

- 6.2 Strategic Moves

- 6.3 Market Share Analysis

- 6.4 Company Profiles (Includes Global Level Overview, Market Level Overview, Core Segments, Financials as Available, Strategic Information, Market Rank/Share for Key Companies, Products and Services, SWOT Analysis, and Recent Developments)

- 6.4.1 CARSOME Sdn Bhd

- 6.4.2 myTukar Sdn Bhd

- 6.4.3 Sime Darby Auto Selection

- 6.4.4 UMW Toyota Motor Sdn Bhd (TOPMARK)

- 6.4.5 Mercedes-Benz Malaysia (CPO)

- 6.4.6 Mudah.my Sdn Bhd

- 6.4.7 Carlist.my

- 6.4.8 Caricarz Sdn Bhd

- 6.4.9 BMW Malaysia (Premium Selection)

- 6.4.10 Perodua Pre-Owned Vehicles

- 6.4.11 Proton Certified Pre-Owned

- 6.4.12 Bermaz Auto Pre-Owned

- 6.4.13 TC Euro Cars (Renault)

- 6.4.14 GoCar Subs / GoEV Marketplace

- 6.4.15 EasyCars

- 6.4.16 MUV Marketplace

- 6.4.17 Big Three Auto

- 6.4.18 Motor Trader Malaysia

- 6.4.19 eBid Motors

- 6.4.20 Carsome Certified Lab

7 Market Opportunities & Future Outlook

- 7.1 White-space & Unmet-Need Assessment