|

市场调查报告书

商品编码

1911488

印尼二手车融资:市场占有率分析、产业趋势与统计、成长预测(2026-2031)Indonesia Used Car Financing - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2026 - 2031) |

||||||

※ 本网页内容可能与最新版本有所差异。详细情况请与我们联繫。

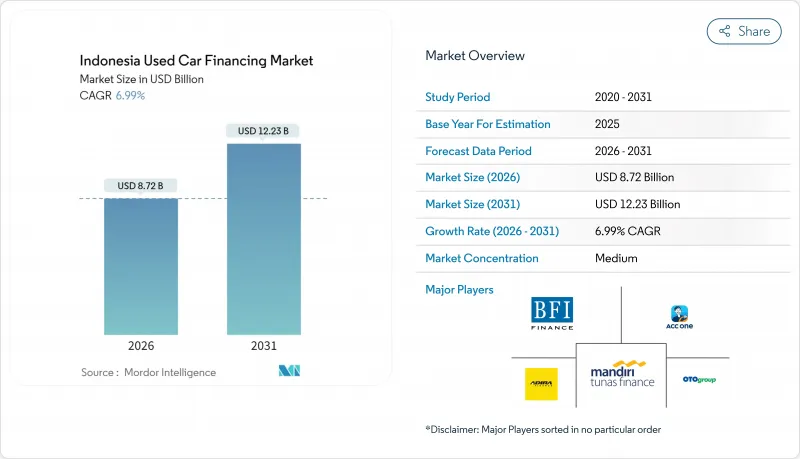

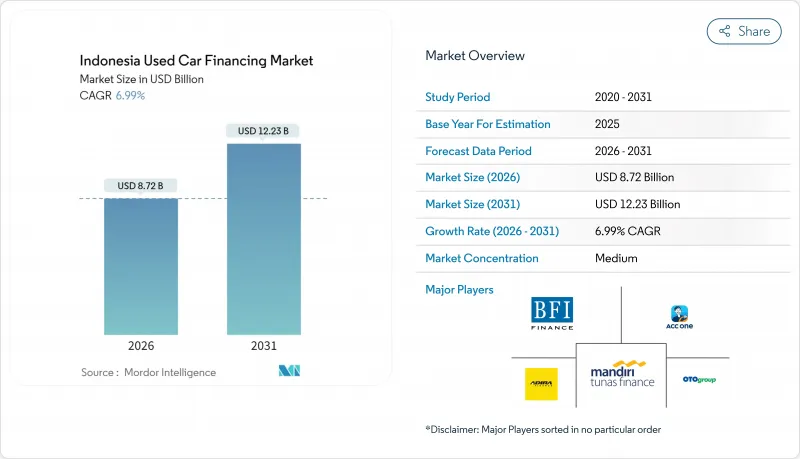

2025年,印尼二手车融资市场价值81.5亿美元,预计到2031年将达到122.3亿美元,高于2026年的87.2亿美元。

预计在预测期(2026-2031 年)内,复合年增长率将达到 6.99%。

儘管新车批发销售下滑,但这一前景依然反映了强劲的潜在需求。二手车融资具有购车价格更低、前期成本更少的优势。数位贷款机构正在迅速扩张,P2P贷款余额已达75.6兆印尼币,年增27.32%。汽车交易平台内建的融资功能将核准时间缩短至几分钟。虽然银行在交易量方面仍主导,但金融科技公司和汽车金融公司正在扩大服务不足地区的信贷覆盖范围。加强监管,例如利率上限和强制性责任险,虽然会增加合规成本,但也有望增强消费者信心并提高贷款组合品质。外国投资者的整合措施显示他们对印尼二手车融资市场的长期盈利充满信心。

印尼二手车融资市场趋势及洞察

高利率环境下,需求从新车转向二手车。

为抑制通膨,印尼央行维持了高政策利率。这项决定推高了新车购买的贷款成本,促使许多家庭考虑购买更实惠的二手车。因此,新车批发量下降,而二手车贷款核准激增。由于平均最低工资水准的下降,许多消费者延长了还款期限,从而减轻了分期付款的负担。印尼中亚银行(BCA)的汽车贷款组合年增14.8%,证实了市场对二手车贷款的持续强劲需求。经销商提供一系列二手认证的二手车,并捆绑保险,以帮助贷款机构管理风险。这种综效使得印尼的二手车融资市场得以渗透到整个中等收入族群。

扩大二手车多通路融资与银行贷款组合

在全国新车销售下滑的背景下,丰田阿斯特拉金融服务公司在2024年底发放了大量汽车贷款,这标誌着其战略重心正转向二手车市场。同时,BFI金融公司透过严格的抵押品评估,将其不良债务率维持在远低于行业平均的水平。印尼金融服务管理局(OJK)的发展蓝图图将汽车金融定位为扩大普惠金融的驱动力,使多元化金融公司能够获得新的、稳健的资金来源。这种制度支持有助于维持印尼二手车融资市场的稳定,即便週期性不利因素抑制了家庭的消费信心。

持续存在的信任问题与里程造假问题

KoinWorks因借款人诈欺损失3,650亿印尼币,凸显了数位核保体系的系统性缺陷。伊斯兰银行资产呈现强劲的年增长势头,推动了以成本加成(murabahah)模式进行的汽车融资业务激增。自2020年以来,印尼伊斯兰教银行(Bank Syariah Indonesia)扩大了资产规模,并在提供汽车贷款的同时开始提供清真认证服务,目标客户群体为重要的穆斯林群体。印尼金融服务管理局(OJK)推出了新的指导方针,简化产品核准,并将消费者保护放在首位。此举巩固了伊斯兰教法融资在印尼二手车融资领域的重要地位。与传统市场不同,该领域优先考虑宗教合规性而非价格,这使得贷款机构能够维持利润率,并将业务拓展到主要大都市以外的地区。

细分市场分析

多用途汽车(MPV)凭藉其多排座椅,非常适合家庭出行和兼职共乘,预计到2025年将占据印尼二手车融资市场43.28%的份额。三年车龄MPV的平均月供不到印尼最低工资的30%,这印证了其受欢迎程度。运动型多用途汽车(SUV)预计将在预测期(2026-2031年)内以7.98%的复合年增长率(CAGR)实现最快增长,这主要得益于混合动力汽车的出现,它们降低了燃油成本和总拥有成本。随着基础建设的推进,大型车辆在郊区变得更加实用,预计到2031年,SUV在印尼二手车融资市场的份额将增加1.7倍。

来自中国的新进口车款(价格低于日本车款)扩大了消费者的选择范围,并压低了残值,使得中等收入消费者也能负担二手二手SUV。经销商提供两年保固和预付服务,以降低消费者对维修保养风险的担忧。市场分析显示,SUV的挂牌到售出週期比轿车更短,贷款机构也利用这一趋势来管理其抵押品清算计画。因此,贷款机构的风险模型现在考虑了更高的残值,从而提高了该细分市场的贷款价值比(LTV)容忍度。

银行业在印尼二手车融资市场占据69.60%的份额,这主要得益于核心存款带来的低资金筹措以及能够进行交叉销售的多产品关係,从而巩固了其在目标市场的主导地位。分店网路的文件审核和符合巴塞尔协议的信用评分系统维持了投资组合的稳定性。同时,P2P和金融科技贷款机构预计将在预测期(2026-2031年)内以8.86%的复合年增长率增长,它们利用电信和电子钱包数据来锁定信用状况不佳的借款人。如果目前的成长动能持续下去,到2031年,印尼由金融科技主导的二手车融资市场规模可能超过25亿美元。

现行法规要求金融科技公司拥有250亿印尼币的实收资本,有利于资金雄厚的平台。与保险和担保公司的策略合作使得风险缓解工具得以内建在每笔贷款中。银行也积极回应,推出基于API的信贷业务,将核准时间从两天缩短至不到一小时。这使得竞争的焦点从名目利率转向用户体验和辅助服务。

其他福利:

- Excel格式的市场预测(ME)表

- 3个月的分析师支持

目录

第一章 引言

- 研究假设和市场定义

- 调查范围

第二章调查方法

第三章执行摘要

第四章 市场情势

- 市场概览

- 市场驱动因素

- 在高利率环境下,新车需求向二手车需求发生强劲转变。

- 扩大二手车市场的多元融资和银行贷款组合

- 提供即时贷款核准的数位化市场

- 符合伊斯兰教法的汽车金融产品的成长

- 后付款服务(BPNL) 首付方案

- 对二手混合动力汽车和电动车的奖励创造了小众需求。

- 市场限制

- 持续存在的信任问题和里程表诈骗

- 贷款利率上升和宏观经济波动

- OJK对金融科技贷款费用设定更严格的上限

- 抵押权诈骗和车辆被盗风险增加

- 价值/供应链分析

- 监管和经济影响分析

- 技术展望

- 波特五力模型

- 新进入者的威胁

- 买方的议价能力

- 供应商的议价能力

- 替代品的威胁

- 竞争加剧

第五章 市场规模与成长预测

- 按车辆类型

- 掀背车

- 轿车

- 运动型多用途车(SUV)

- 多用途汽车(MPV)

- 贷款提供者

- 厂商直接融资

- 商业银行

- 非银行金融公司

- P2P/金融科技贷款机构

- 按贷款期限

- 24个月或以下

- 25至48个月

- 49至72个月

- 72个月或以上

- 车龄

- 3年或以下

- 4-7年

- 超过7年

- 按州

- 雅加达

- 西爪哇

- 东爪哇

- 中爪哇

- 万登

- 北苏门答腊

- 其他州

第六章 竞争情势

- 市场集中度

- 策略趋势

- 市占率分析

- 公司简介

- Astra Credit Companies(ACC)

- BFI Finance Indonesia

- Adira Dinamika Multi Finance

- Oto Multiartha

- Mandiri Tunas Finance

- PT Toyota Astra Financial Services

- Suzuki Finance Indonesia

- PT JACCS MPM Finance Indonesia

- BCA Finance

- Bussan Auto Finance

- Dipo Star Finance

- Batavia Prosperindo Finance

- BRI Multifinance Indonesia

- Clipan Finance Indonesia

- BNI Multifinance

- CIMB Niaga Auto Finance

- Bank Syariah Indonesia-OTO Finance

第七章 市场机会与未来展望

The Indonesian used car financing market was valued at USD 8.15 billion in 2025 and estimated to grow from USD 8.72 billion in 2026 to reach USD 12.23 billion by 2031, at a CAGR of 6.99% during the forecast period (2026-2031).

This outlook captures strong latent demand even as wholesale new-car sales contract, because financing for pre-owned vehicles offers lower entry prices and smaller initial outlays. Digital lenders are scaling quickly; peer-to-peer loan balances grew 27.32% year-on-year to IDR 75.60 trillion; embedded-finance features on automotive marketplaces shrink approval times to minutes. Banks continue to dominate by volume, yet fintech and captive OEM arms widen credit access in underbanked clusters. Regulatory tightening on interest caps and mandatory liability insurance raises compliance costs, but it also strengthens consumer trust and should improve portfolio quality. Consolidation by foreign investors signals confidence in the Indonesian used car financing market's long-run profitability.

Indonesia Used Car Financing Market Trends and Insights

Robust Demand Shift from New- to Used-Cars Amid High Interest Rates

To combat inflation, Bank Indonesia has maintained its benchmark rate at a high level. This decision has increased borrowing costs for new vehicles, prompting many households to consider more affordable, pre-owned options. As a result, while wholesale volumes for new cars have declined, approvals for used car loans have surged. With average minimum wages, many consumers extend payment schedules, and these longer tenors facilitate more manageable installment payments. BCA's auto-loan portfolio rose 14.8% year-on-year, underlining sustained appetite for financed second-hand cars . Dealers respond by curating certified units and bundled insurance to support lender risk controls. The net effect lifts penetration of the Indonesian used car financing market across middle-income brackets.

Expansion of Multi-Finance and Bank Loan Portfolios into Used-Cars

Despite a nationwide decline in new-car sales, Toyota Astra Financial Services made significant auto loan disbursements in late 2024, demonstrating a strategic shift towards pre-owned assets. Meanwhile, due to meticulous collateral valuation, BFI Finance maintains non-performing ratios significantly lower than the industry average. OJK's development roadmap prioritizes automotive financing as an engine for broader financial inclusion, letting multi-finance companies tap new prudential capital sources . Such institutional support sustains the Indonesian used car financing market even when cyclical headwinds weigh on household sentiment.

Persistent Trust and Odometer Fraud Issues

KoinWorks incurred IDR 365 billion in losses from borrower fraud, underscoring systemic gaps in digital underwriting . Islamic banking assets are witnessing robust annual growth, fueling a surge in murabahah-based vehicle financing. Since 2020, Bank Syariah Indonesia has expanded its assets and started offering halal certification services alongside automotive loans, targeting a significant Muslim demographic. The OJK has introduced new guidelines that streamline product approvals and prioritize consumer protection. This move solidifies Sharia finance's role as a cornerstone in Indonesia's used car financing arena. Unlike traditional markets, this segment prioritizes religious compliance over pricing, enabling lenders to maintain their margins while broadening their reach beyond primary urban locales.

Other drivers and restraints analyzed in the detailed report include:

- Digital Marketplaces Embedding Instant Loan Approvals

- Growth of Sharia-Compliant Auto Finance Products

- Elevated Lending Rates and Macro-Volatility

For complete list of drivers and restraints, kindly check the Table Of Contents.

Segment Analysis

Multi-Purpose Vehicles (MPVs) held 43.28% of the Indonesian used car financing market share in 2025 because multi-row seating suits family travel and ride-sharing side gigs. Average monthly installments for a three-year-old MPV remain within 30% of provincial minimum wages, reinforcing popularity. Sports Utility Vehicles (SUVs) are growing fastest at 7.98% CAGR during the forecast period (2026-2031) and now benefit from hybrid variants that lower fuel spend, supporting total cost of ownership. The Indonesia used car financing market size for SUVs is projected to expand 1.7 times by 2031 as infrastructure upgrades make larger vehicles practical across peri-urban zones.

New import entrants from China priced below Japanese peers widened choice and compressed residual values, making used SUVs attainable for middle-income customers. Dealers bundle two-year warranties and prepaid service to offset perceived maintenance risk. Marketplace analytics show SUVs record shorter listing-to-sale cycles than sedans, a pattern lenders exploit to manage collateral liquidation timelines. Consequently, lender risk models now factor in higher salvage values that reinforce loan-to-value comfort levels for the segment.

Banks' segment has a 69.60% share in the Indonesian used car financing market, as their grip on the target market reflects low funding costs from core deposits and multi-product relationships that allow cross-selling. Their branch footprint supports document verification, and Basel-aligned credit scoring maintains portfolio stability. Peer-to-peer and fintech lenders, however, are compounding at 8.86% during the forecast period (2026-2031)and target thin-file borrowers through telecom and e-wallet data. The Indonesia used car financing market size under fintech management could exceed USD 2.5 billion by 2031 if current momentum continues.

Regulation now requires fintechs to hold IDR 25 billion in paid-up capital, a filter that favors well-funded platforms. Strategic partnerships with insurers and warranty providers let them package risk-mitigation tools into every loan. Banks respond by launching API-based credit origination, cutting approval from two days to less than one hour. Competition thereby pivots on user experience and ancillary services rather than headline interest rates alone.

The Indonesia Used Car Financing Market Report is Segmented by Vehicle Type (Hatchback, Sedan, and More), Financing Provider (Captive OEM Finance, Commercial Banks, and More), Financing Tenor (<=24 Months, 25-48 Months, and More), Vehicle Age (<=3 Years Old, 4-7 Years Old, and More), and Province (Jakarta, West Java, and More). The Market Forecasts are Provided in Terms of Value (USD).

List of Companies Covered in this Report:

- Astra Credit Companies (ACC)

- BFI Finance Indonesia

- Adira Dinamika Multi Finance

- Oto Multiartha

- Mandiri Tunas Finance

- PT Toyota Astra Financial Services

- Suzuki Finance Indonesia

- PT JACCS MPM Finance Indonesia

- BCA Finance

- Bussan Auto Finance

- Dipo Star Finance

- Batavia Prosperindo Finance

- BRI Multifinance Indonesia

- Clipan Finance Indonesia

- BNI Multifinance

- CIMB Niaga Auto Finance

- Bank Syariah Indonesia - OTO Finance

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 Introduction

- 1.1 Study Assumptions & Market Definition

- 1.2 Scope of the Study

2 Research Methodology

3 Executive Summary

4 Market Landscape

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 Robust Demand Shift from New- to Used-Cars Amid High Interest Rates

- 4.2.2 Expansion of Multi-Finance and Bank Loan Portfolios into Used-Cars

- 4.2.3 Digital Marketplaces Embedding Instant Loan Approvals

- 4.2.4 Growth of Sharia-Compliant Auto Finance Products

- 4.2.5 Buy-Now-Pay-Later Down-Payment Solutions

- 4.2.6 Second-Hand Hybrid and EV Incentives Creating Niche Demand

- 4.3 Market Restraints

- 4.3.1 Persistent Trust and Odometer Fraud Issues

- 4.3.2 Elevated Lending Rates and Macro-Volatility

- 4.3.3 Stricter OJK Caps on Fintech Lending Fees

- 4.3.4 Rise in Collateral Fraud and Stolen-Vehicle Risk

- 4.4 Value / Supply-Chain Analysis

- 4.5 Regulatory & Economic Impact Analysis

- 4.6 Technological Outlook

- 4.7 Porter's Five Forces

- 4.7.1 Threat of New Entrants

- 4.7.2 Bargaining Power of Buyers

- 4.7.3 Bargaining Power of Suppliers

- 4.7.4 Threat of Substitutes

- 4.7.5 Intensity of Rivalry

5 Market Size & Growth Forecasts (Value, USD)

- 5.1 By Vehicle Type

- 5.1.1 Hatchback

- 5.1.2 Sedan

- 5.1.3 Sport Utility Vehicle (SUV)

- 5.1.4 Multi-Purpose Vehicle (MPV)

- 5.2 By Financing Provider

- 5.2.1 Captive OEM Finance

- 5.2.2 Commercial Banks

- 5.2.3 Non-Bank Finance Companies

- 5.2.4 Peer-to-Peer / Fintech Lenders

- 5.3 By Financing Tenor

- 5.3.1 Less than/Equals 24 Months

- 5.3.2 25 - 48 Months

- 5.3.3 49 - 72 Months

- 5.3.4 Above 72 Months

- 5.4 By Vehicle Age

- 5.4.1 Less than/equals 3 Years Old

- 5.4.2 4 -7 Years Old

- 5.4.3 Above 7 Years Old

- 5.5 By Province

- 5.5.1 Jakarta

- 5.5.2 West Java

- 5.5.3 East Java

- 5.5.4 Central Java

- 5.5.5 Banten

- 5.5.6 North Sumatra

- 5.5.7 Other Provinces

6 Competitive Landscape

- 6.1 Market Concentration

- 6.2 Strategic Moves

- 6.3 Market Share Analysis

- 6.4 Company Profiles (includes Global Level Overview, Market Level Overview, Core Segments, Financials as Available, Strategic Information, Market Rank/Share for Key Companies, Products and Services, SWOT Analysis, and Recent Developments)

- 6.4.1 Astra Credit Companies (ACC)

- 6.4.2 BFI Finance Indonesia

- 6.4.3 Adira Dinamika Multi Finance

- 6.4.4 Oto Multiartha

- 6.4.5 Mandiri Tunas Finance

- 6.4.6 PT Toyota Astra Financial Services

- 6.4.7 Suzuki Finance Indonesia

- 6.4.8 PT JACCS MPM Finance Indonesia

- 6.4.9 BCA Finance

- 6.4.10 Bussan Auto Finance

- 6.4.11 Dipo Star Finance

- 6.4.12 Batavia Prosperindo Finance

- 6.4.13 BRI Multifinance Indonesia

- 6.4.14 Clipan Finance Indonesia

- 6.4.15 BNI Multifinance

- 6.4.16 CIMB Niaga Auto Finance

- 6.4.17 Bank Syariah Indonesia - OTO Finance

7 Market Opportunities & Future Outlook

- 7.1 White-space & Unmet-Need Assessment