|

市场调查报告书

商品编码

1911722

德国行动通讯业者(MNO):市场占有率分析、产业趋势与统计、成长预测(2026-2031 年)Germany Telecom MNO - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2026 - 2031) |

||||||

※ 本网页内容可能与最新版本有所差异。详细情况请与我们联繫。

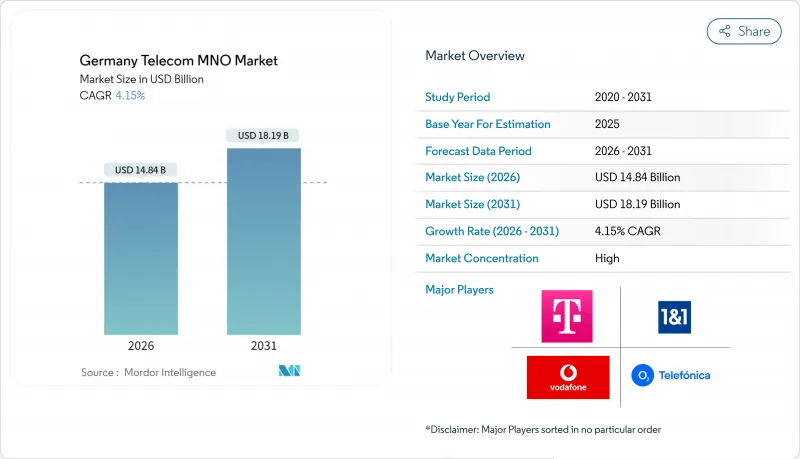

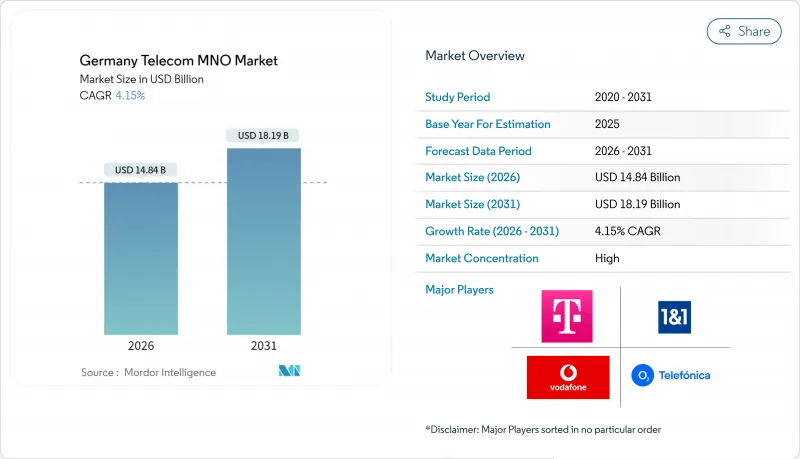

2025年德国行动通讯业者(MNO)市场价值为142.5亿美元,预计到2031年将达到181.9亿美元,高于2026年的148.4亿美元。

预计在预测期(2026-2031 年)内,复合年增长率将达到 4.15%。

到2030年,网路现代化投资将接近500亿欧元,联邦Gigabit战略以及5G独立组网的快速部署,即便经济成长放缓,仍保持强劲势头。营运商正优先推进光纤到户(FTTH)覆盖范围的扩展、固移融合套餐以及人工智慧驱动的网路自动化,以提高每用户平均收入(ARPU)并降低营运成本。企业数位化,尤其是在製造业和汽车产业丛集中,正在推动对高端连接的需求。同时,受串流媒体需求的驱动,消费者数据流量持续成长。包括严格的能源效率法规和覆盖范围强制性要求在内的监管压力,正在重新调整资本配置的优先顺序,并促使中小型业者选择合作或退出市场。

德国行动通讯业者(MNO)市场趋势与分析

光纤到府(FTTH)的快速扩张和政府的Gigabit目标

德国的Gigabit策略旨在2025年实现50%的家庭光纤接入,并在2030年实现近乎全国范围的覆盖,为此制定了一项雄心勃勃的资本计划。联邦政府的Gigabit支持计画「Gigabitforderung 2.0」提供的30亿欧元补贴正在加速服务欠缺地区的建设。同时,德国电信的目标是到2030年新增1,000万多条光纤线路,沃达丰则计画利用UnityMedia的资产为2,500万户家庭提供服务。拥有更广泛光纤网路的营运商可以透过多业务组合和高端商务线路实现更高的每用户平均收入(ARPU)。虽然早期部署会造成暂时的市场碎片化,并使光纤覆盖率高的地区受益,但全国范围的部署对于长期竞争力仍然至关重要。此策略的成功将透过提升数据密集型服务的容量,直接推动德国电信市场的收入成长。

快速部署5G SA将推动eMBB需求

德国三大通讯业者已实现2024年99%的网路覆盖目标,德国电信计画在2025年实现99%的人口覆盖。独立组网架构(SA)支援低延迟网路切片,这对宝马、梅赛德斯-奔驰和大众的製造工厂和汽车园区至关重要。预计消费者收入也将成长。通讯业者的行动数据使用量年增30-34%,并透过高容量和无限流量套餐推动营收成长。通讯业者透过逐步淘汰传统核心网路和整合频宽来提高效率,同时降低每GB成本并改善用户体验。在此背景下,5G SA的早期采用者可望获得可持续的竞争优势,并推动德国电信市场的成长。

MDU有线电视法案削减固定收入

2024年7月「公用事业豁免」(Nebenkostenprivileg)的取消,使得有线电视费用不再自动计入租金。这使得沃达丰的多用户住宅用户群面临直接竞争,导致其用户数量从850万骤降至400万。整个产业约有8亿欧元的年收入面临风险,而Telecolumbus在短短几个月内就流失了40%的电视用户。 Netflix、Amazon Prime、 擦拭巾和Zatu等串流平台无需承担网路成本,便与营运商争夺同一批用户,加剧了价格竞争。为了保住市场份额,营运商必须重新评估电视服务在融合套餐中的定位,但短期内用户解约率的激增和EBITDA的压缩仍然令人担忧。

细分市场分析

预计到2025年,数据和网路服务市场规模将达到61.5亿美元(占德国电信市场份额的43.12%),并在2031年之前以4.33%的复合年增长率增长,这主要得益于对影片串流媒体和企业云端连接的强劲需求。营运商的行动数据流量成长显着:沃达丰成长34%至18亿GB,德国电信成长30%至24亿GB,O2的行动数据流量超过30亿GB。同时,固定线路的流量消费量超过1,210亿GB,平均每个家庭每月使用量为275GB。 5G独立组网和光纤升级支援差异化的服务层级,为寻求网路切片保障的工业用户提供了高价位选择。因此,预计德国电信市场规模将继续在细分市场层面超越传统类别。

语音服务在2025年仍将创造39.1亿美元的收入(占27.45%),但由于向OTT(网路电视)的转型以及计划在2028年前逐步淘汰2G服务,预计这一数字将逐渐下降。德国电信(Telefónica Deutschland)已将其80%的通话路由至VoLTE,德国电信(Deutsche Telekom)和沃达丰(Vodafone)也在将频宽重新分配给5G。物联网(IoT)和机器对机器(M2M)服务在2025年将达到13.6亿美元,复合年增长率(CAGR)高达4.45%,是成长最快的领域,这反映了德国在连网工厂和车用通讯系统领域的主导地位。付费电视和其他附加价值服务面临来自串流媒体服务的直接竞争,但随着国际旅行的復苏,漫游和批发流量正在回升。随着以数据为中心的产品超越语音服务,整体产品组合正向高成长、利润率更高的类别转变。

德国通讯业者市场按服务类型(语音服务、数据和互联网服务、通讯服务、物联网和机器对机器通讯服务、OTT和付费电视服务等)和最终用户(企业、消费者)进行细分。市场预测以价值(美元)和数量(用户数)为单位。

其他福利:

- Excel格式的市场预测(ME)表

- 3个月的分析师支持

目录

第一章 引言

- 研究假设和市场定义

- 调查范围

第二章调查方法

第三章执行摘要

第四章 市场情势

- 市场概览

- 监理与政策框架分析

- 当前频宽拥有情形及竞争所有权

- 通讯业生态系统

- 宏观经济与外在因素

- 波特五力分析

- 竞争对手之间的竞争

- 新进入者的威胁

- 供应商的议价能力

- 买方的议价能力

- 替代品的威胁

- 领先行动网路营运商的关键绩效指标(2020-2025)

- 独立行动用户和渗透率

- 行动网路使用者数量和普及率

- 按接入技术分類的SIM卡连线数和渗透率

- 蜂巢式物联网/M2M连接

- 宽频连线(移动和固定)

- ARPU(每位用户平均收入)

- 每用户平均数据使用量(GB/月)

- 市场驱动因素

- 光纤到户部署的快速扩张和政府的Gigabit目标

- 快速部署 5G SA 推动 eMBB 需求

- 企业数位化与校园网路实施

- 固移融合套餐提升每位用户平均收入

- 透过基于人工智慧的网路自动化降低营运成本(不太常见)

- 频谱共用增加和中立主机模式(不太突出)

- 市场限制

- 根据《多户住宅有线电视法》减少固定收入

- 由于严格的节能法规,资本投资增加。

- 光纤和5G设备领域新加入经营者的投资负担加重(这个问题很少受到关注)

- 由于向OTT语音转型而导致的传统收入下滑(一个鲜为人知的问题)

- 技术展望

- 电信业主要经营模式分析

- 定价模型和定价分析

第五章 市场规模与成长预测

- 通信总收入和每位用户平均收入

- 服务类型

- 语音服务

- 数据和网际网路服务

- 通讯服务

- 物联网和机器对机器服务

- OTT和付费电视服务

- 其他服务类型(附加价值服务、漫游和国际服务、企业/批发服务等)

- 最终用户

- 公司

- 一般消费者

第六章 竞争情势

- 市场集中度

- 主要供应商的策略与投资动向(2023-2025)

- 2024年行动网路营运商市场占有率分析

- 行动网路营运商概况(用户数、流失率、ARPU 等)

- MNO公司简介

- Deutsche Telekom

- Vodafone Germany

- O2 Telefonica Deutschland

- 1&1 AG

第七章 市场机会与未来展望

The Germany Telecom MNO Market was valued at USD 14.25 billion in 2025 and estimated to grow from USD 14.84 billion in 2026 to reach USD 18.19 billion by 2031, at a CAGR of 4.15% during the forecast period (2026-2031).

Network-modernization investments approaching EUR 50 billion through 2030, the federal Gigabit Strategy, and swift 5G standalone roll-outs are sustaining momentum even as economic growth moderates. Operators are prioritizing fiber-to-the-home coverage, fixed-mobile convergence bundles, and AI-enabled network automation to strengthen average revenue per user (ARPU) and cut operating costs. Enterprise digitalization, particularly in manufacturing and automotive clusters, is accelerating premium connectivity demand, while consumer data traffic keeps climbing on the back of streaming. Regulatory pressure, including stringent energy-efficiency rules and spectrum-coverage obligations, is reshaping capital-allocation priorities and nudging smaller players toward partnership or exit.

Germany Telecom MNO Market Trends and Insights

Surging FTTH Build-out and Government Gigabit Targets

Germany's Gigabit Strategy requires 50% of premises to be fiber-connected by 2025 and near-universal coverage by 2030, spurring aggressive capital programs. EUR 3 billion in federal Gigabitforderung 2.0 subsidies accelerates builds in underserved districts, while Deutsche Telekom aims for 10 million additional fiber lines by 2030 and Vodafone leverages Unitymedia assets to pass 25 million homes. Operators with deeper fiber footprints command higher ARPU through multi-play bundles and premium enterprise links. Early deployments create temporary market fragmentation favoring fiber-rich localities, yet nationwide roll-out remains a prerequisite for long-term competitiveness. Successful execution directly lifts German telecom market revenue trajectories by expanding capacity for data-heavy services.

Rapid 5G SA Roll-outs Powering eMBB Demand

All three national carriers met initial 99% coverage targets by 2024, and Deutsche Telekom plans 99% population reach in 2025. Standalone architecture unlocks low-latency network slicing crucial for manufacturing and automotive campuses at BMW, Mercedes-Benz, and Volkswagen sites. Consumers are also driving revenue uplift as mobile data usage rose 30-34% year-over-year across operators, monetized via larger allowances and unlimited plans. Operators gain efficiency from retiring legacy cores and converging frequency layers, which lowers per-gigabyte costs while improving user experience. Early 5G SA adopters therefore secure durable competitive advantages and stimulate incremental German telecom market growth.

MDU Cable-TV Law Slashing Fixed Revenue

The July 2024 repeal of the Nebenkostenprivileg removed automatic inclusion of cable TV in rental bills, exposing Vodafone's MDU subscriber base to direct competition and slashing the cohort from 8.5 million to 4 million accounts. An estimated EUR 800 million in annual revenue is at risk sector-wide, with Tele Columbus losing 40% of TV customers in mere months. Streaming platforms such as Netflix, Amazon Prime, Waipu, and Zattoo now vie for the same households without bearing network costs, intensifying price pressure. Operators must reposition TV within convergent bundles to defend share, yet short-term churn spikes and EBITDA compression remain likely.

Other drivers and restraints analyzed in the detailed report include:

- Enterprise Digitalization and Campus-Network Uptake

- Fixed-Mobile Convergence Bundles Boosting ARPU

- Stringent Energy-Efficiency Rules Raising Capex

For complete list of drivers and restraints, kindly check the Table Of Contents.

Segment Analysis

Data and Internet Services delivered USD 6.15 billion in 2025, 43.12% of the German telecom market share, and are CAGR-forecast at 4.33% through 2031 on buoyant video streaming and enterprise cloud connectivity. Operators documented mobile data surges-Vodafone 34% to 1.8 billion GB, Deutsche Telekom 30% to 2.4 billion GB, and O2 beyond 3 billion GB-while fixed consumption surpassed 121 billion GB with average household loads of 275 GB monthly. 5G standalone and fiber upgrades underpin differentiated service tiers that fetch premium pricing from industrial users seeking network-slice guarantees. Consequently, German telecom market size gains at the segment level will continue to eclipse legacy categories.

Voice Services still produced USD 3.91 billion (27.45% share) in 2025, but OTT migration and planned 2G shutdowns by 2028 portend gradual contraction. Telefonica Deutschland already routes 80% of calls via VoLTE, and both Deutsche Telekom and Vodafone are reallocating spectrum to 5G. IoT and M2M Services, worth USD 1.36 billion in 2025, exhibit the fastest 4.45% CAGR, reflecting Germany's leadership in connected-factory and automotive telematics. Pay-TV and other value-added services face direct streaming competition, yet roaming and wholesale traffic are recovering alongside international travel. As data-centric products outpace voice, overall portfolio mix shifts toward higher-growth, margin-accretive categories.

The Germany Telecom MNO Market is Segmented by Service Type (Voice Services, Data and Internet Services, Messaging Services, Iot and M2M Services, OTT and PayTV Services, and More), and End User (Enterprises, and Consumer). The Market Forecasts are Provided in Terms of Value (USD) and Volume (Subscribers).

List of Companies Covered in this Report:

- Deutsche Telekom

- Vodafone Germany

- O2 Telefonica Deutschland

- 1&1 AG

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 Market Landscape

- 4.1 Market Overview

- 4.2 Regulatory And Policy Framework

- 4.3 Spectrum Landscape And Competitive Holdings

- 4.4 Telecom Industry Ecosystem

- 4.5 Macroeconomic And External Drivers

- 4.6 Porter's Five Forces Analysis

- 4.6.1 Competitive Rivalry

- 4.6.2 Threat of New Entrants

- 4.6.3 Bargaining Power of Suppliers

- 4.6.4 Bargaining Power of Buyers

- 4.6.5 Threat of Substitutes

- 4.7 Key MNO KPIs (2020-2025)

- 4.7.1 Unique Mobile Subscribers And Penetration Rate

- 4.7.2 Mobile Internet Users And Penetration Rate

- 4.7.3 SIM Connections by Access Technology And Penetration

- 4.7.4 Cellular IoT / M2M Connections

- 4.7.5 Broadband Connections (Mobile And Fixed)

- 4.7.6 ARPU (Average Revenue Per User)

- 4.7.7 Average Data Usage per Subscription (GB/month)

- 4.8 Market Drivers

- 4.8.1 Surging FTTH Build-out and Government Gigabit Targets

- 4.8.2 Rapid 5G SA Roll-outs Powering eMBB Demand

- 4.8.3 Enterprise Digitalization And Campus-Network Uptake

- 4.8.4 Fixed-Mobile Convergence Bundles Boosting ARPU

- 4.8.5 AI-based Network Automation Cutting OPEX (Under-the-radar)

- 4.8.6 Rising Spectrum-Sharing And Neutral-Host Models (Under-the-radar)

- 4.9 Market Restraints

- 4.9.1 MDU Cable-TV Law Slashing Fixed Revenue

- 4.9.2 Stringent Energy-Efficiency Rules Raising Capex

- 4.9.3 High Fibre And 5G Capex Burden on Challengers (Under-the-radar)

- 4.9.4 OTT Voice Migration Eroding Legacy Revenues (Under-the-radar)

- 4.10 Technological Outlook

- 4.11 Analysis of key business models in Telecom

- 4.12 Analysis of Pricing Models and Pricing

5 MARKET SIZE AND GROWTH FORECASTS (VALUE)

- 5.1 Overall Telecom Revenue and ARPU

- 5.2 Service Type

- 5.2.1 Voice Services

- 5.2.2 Data and Internet Services

- 5.2.3 Messaging Services

- 5.2.4 IoT and M2M Services

- 5.2.5 OTT and PayTV Services

- 5.2.6 Other Service Types (VAS, Roaming And International Services, Enterprise And Wholesale Services, etc.)

- 5.3 End-user

- 5.3.1 Enterprises

- 5.3.2 Consumer

6 COMPETITIVE LANDSCAPE

- 6.1 Market Concentration

- 6.2 Strategic Moves and Investments by key vendors, 2023-2025

- 6.3 Market share analysis for MNOs, 2024

- 6.4 MNO snapshot (subscribers, churn rate, ARPU, etc.)

- 6.5 Company Profiles* of MNOs (Includes Business Overview | Service Portfolio | Financials | Business Strategy and Recent Developments | SWOT Analysis)

- 6.5.1 Deutsche Telekom

- 6.5.2 Vodafone Germany

- 6.5.3 O2 Telefonica Deutschland

- 6.5.4 1&1 AG

7 MARKET OPPORTUNITIES AND FUTURE OUTLOOK

- 7.1 White-space And Unmet-Need Assessment