|

市场调查报告书

商品编码

1692558

日本公路货运:市场占有率分析、产业趋势与统计、成长预测(2025-2030 年)Japan Road Freight Transport - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

价格

※ 本网页内容可能与最新版本有所差异。详细情况请与我们联繫。

简介目录

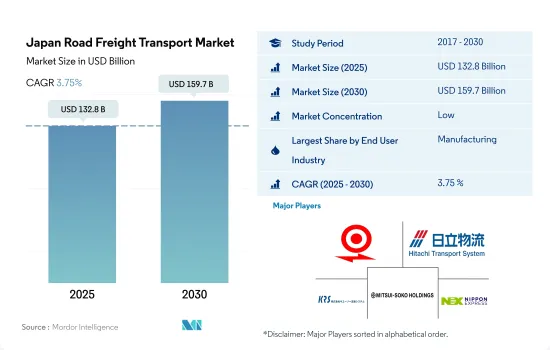

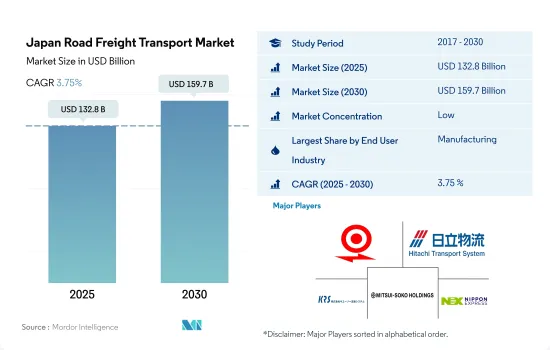

预计 2025 年日本公路货运市场规模为 1,328 亿美元,到 2030 年将达到 1,597 亿美元,预测期内(2025-2030 年)的复合年增长率为 3.75%。

以汽车产业为主导的日本製造业一直推动着日本经济的发展。

- 日本製造业是日本经济的支柱,也是全球第三大经济体,被誉为「製造业强国」。而且,预计2023年日本汽车出口量将年增与前一年同期比较%至442万辆,而国内汽车销量预计将达到近478万辆。出口成长推动了公路货运服务的需求。

- 零售和批发业也对日本经济贡献庞大,占比超过13.00%。由于便利商店销售额的成长,该细分市场在 2022 年实现了强劲成长。营收创历史新高,达971亿美元,与前一年同期比较增3.70%。 2022年的购物者数量与前一年同期比较增加了0.6%。这些正面趋势显示便利商店产业将强劲復苏。此外,预计从 2023 年到 2027 年,日本电子商务市场的复合年增长率将达到 9.75%。预计未来几年网路销售额的成长速度将比零售成长七到十倍。

日本公路货运市场趋势

随着宅配需求的不断增长和劳动力短缺,国土交通省正致力于建造自动化货运道路和物流隧道

- 2024 年 5 月 17 日,在东京车站举行的展览会上,重点强调了高速客运列车上轻型货运的不断扩大。这一转变是由于商用驾驶人短缺和新的加班法导致公路运输成本增加高达 20%。自 2023 年 8 月起,JR 东日本将使用 12 节车厢的 E 系列专用列车实施从新舄到东京的当日送货服务。运送的物品包括生鲜食品、糖果零食、饮料、鲜花、精密零件、医疗用品等。 2023 年 9 月,JR 东日本在东北新干线推出了仅限货运的服务,现在在其高速和特快网路中提供「Hako BYUN」品牌货运服务。

- 2024年3月,由于静冈县持续反对环保问题,JR东海放弃了2027年前在东京和名古屋之间引入高速磁浮列车的计划,该计划可能会被推迟到2034年或更晚。中央新干线的目标是以每小时 500 公里的速度连接东京和大阪,但静冈的一小段路段构成了重大障碍。

儘管有政府补贴,2024 年 7 月燃油价格仍将上涨至 2023 年 10 月以来的最高水平

- 日本资源能源厅2024年7月宣布,一般汽油零售价已达每公升1.33美元。这一价格是自2023年10月以来约九个月以来的最高价格。零售价格的上涨是由于批发价格上涨。为了解决这个问题,各国政府向精製提供补贴,以压低批发价格。此外,补贴金额也有所增加,6月27日至7月3日期间补贴金额为0.19美元,较前一週增加0.01美元。

- 日本天然气公司预测,由于 2023-24 年天气异常温暖,城市天然气使用量将下降,因此在 2024 年 4 月至 2025 年 3 月的财年中,城市天然气需求将会增加。日本最大的瓦斯零售商东京瓦斯公司预测,到2025年,城市瓦斯销售量将成长1.1%,达到114.22亿立方公尺。其中,住宅用气预计成长3.4%,达28亿立方米,工业和商用预计成长0.3%,达86亿立方公尺。

日本公路货运业概况

日本公路货运市场较为分散,主要有五家公司:福山运输、日立运输系统、KRS、三井仓库控股和日本通运控股(依字母顺序排列)。

其他福利:

- Excel 格式的市场预测 (ME) 表

- 3个月的分析师支持

目录

第一章执行摘要和主要发现

第二章 报告要约

第三章 引言

- 研究假设和市场定义

- 研究范围

- 调查方法

第四章 产业主要趋势

- 按经济活动分類的GDP分布

- 按经济活动分類的GDP成长

- 经济表现及概况

- 电子商务产业趋势

- 製造业趋势

- 交通运输仓储业GDP

- 物流绩效

- 道路长度

- 出口趋势

- 进口趋势

- 燃油价格趋势

- 卡车运输成本

- 卡车持有量(按类型)

- 主要卡车供应商

- 公路货运吨位趋势

- 公路货运价格趋势

- 模态共享

- 通货膨胀率

- 法律规范

- 价值炼和通路分析

第五章市场区隔

- 最终用户产业

- 农业、渔业和林业

- 建设业

- 製造业

- 石油和天然气、采矿和采石

- 批发和零售

- 其他的

- 汇出目的地

- 国内的

- 卡车装载规格

- 整车装载 (FTL)

- 零担运输 (LTL)

- 货柜运输

- 货柜运输

- 没有容器

- 运输距离

- 远距

- 短途运输

- 产品成分

- 流体产品

- 固体货物

- 温度控制

- 非温控

- 温度控制

第六章 竞争格局

- 关键策略趋势

- 市场占有率分析

- 商业状况

- 公司简介

- DHL Group

- Fukuyama Transporting Co., Ltd.

- Hitachi Transport System

- KRS Corporation

- Konoike Group(including Konoike Transport Co., Ltd.)

- Mitsui-Soko Holdings Co., Ltd.

- Nippon Express Holdings

- Sankyu Inc.

- Seino Holdings Co., Ltd.

- Trancom Co. Ltd.

第七章:CEO面临的关键策略问题

第 8 章 附录

- 全球物流市场概览

- 概述

- 五力分析框架

- 全球价值链分析

- 市场动态(市场驱动因素、限制因素、机会)

- 资讯来源及延伸阅读

- 图片列表

- 关键见解

- 资料包

- 词彙表

- 外汇

简介目录

Product Code: 92375

The Japan Road Freight Transport Market size is estimated at 132.8 billion USD in 2025, and is expected to reach 159.7 billion USD by 2030, growing at a CAGR of 3.75% during the forecast period (2025-2030).

The Japanese manufacturing sector, led by the automobile industry, has propelled the Japanese economy

- The Japanese manufacturing sector has driven the country's economy to the point where it is now the third-largest economy in terms of GDP and is regarded as one of the "Manufacturing Superpowers." Furthermore, Japan exported 4.42 million vehicles in 2023, up 16% from a year earlier, while domestic auto sales totaled nearly 4.78 million vehicles. The growth in exports drove the demand for road freight services.

- The retail and wholesale trade sector is another major contributor to the Japanese economy, with more than a 13.00% share. The segment grew significantly in 2022 due to increased sales in convenience stores. Sales reached a new high of USD 97.10 billion, representing a 3.70% increase over the previous year. The number of shoppers in 2022 rose by 0.6% compared to the previous year. These positive trends indicate a strong recovery of the convenience store industry. Moreover, during 2023-2027, the Japanese e-commerce market is expected to register a CAGR of 9.75%. Over the next few years, online sales are projected to increase seven to ten times faster than retail sales.

Japan Road Freight Transport Market Trends

With growing demand for home deliveries & labor shortages, the MLIT is focusing on construction of automatic cargo transport roads and logistics tunnels

- On May 17, 2024, a fair at Tokyo Station highlighted the growing use of high-speed passenger trains for light freight. This shift, driven by a shortage of commercial drivers and new overtime laws, has increased road delivery costs by up to 20%. Since August 2023, JR East has been running a same-day delivery service from Niigata to Tokyo using a dedicated 12-car Series E trainset. Items transported include fresh food, confectionery, drinks, flowers, precision components, and medical supplies. In September 2023, JR East launched a freight-only service on the Tohoku Shinkansen and now offers Hakobyun-branded freight services across its high-speed and Limited Express networks.

- In March 2024, Central Japan Railway Co. abandoned its plan to launch a high-speed maglev train between Tokyo and Nagoya by 2027 due to ongoing environmental opposition in Shizuoka Prefecture, possibly delaying the project until 2034 or later. The Linear Chuo Shinkansen aims to connect Tokyo and Osaka with trains reaching speeds of 500 kilometers per hour, but a small section in Shizuoka has been a major obstacle.

Rising prices of fuel in Japan witnessed in July 2024, highest since October 2023, despite government subsidies

- In July 2024, the Agency for Natural Resources and Energy announced that the retail price of regular gasoline reached USD 1.33 per liter, marking an increase of USD 0.006 from June 2024. This price point is the highest observed in nearly nine months, dating back to October 2023. The uptick in retail prices is attributed to surging wholesale prices. To counteract this, the government has been subsidizing oil refiners, ensuring that wholesale prices remain subdued. Moreover, the subsidy amount saw an uptick, rising to USD 0.19 between June 27 and July 3, which is an increase of USD 0.01 from the week prior.

- Japanese gas utilities expect city gas demand to rise in the fiscal year April 2024 to March 2025, following reduced usage in 2023-24 due to unusually warm weather. Tokyo Gas, Japan's largest gas retailer, forecasts city gas sales will increase by 1.1% to 11.422 billion cubic meters by 2025. Household sales are expected to grow by 3.4% to 2.8 billion cubic meters, while supplies to industry and commercial users are projected to rise by 0.3% to 8.6 billion cubic meters.

Japan Road Freight Transport Industry Overview

The Japan Road Freight Transport Market is fragmented, with the major five players in this market being Fukuyama Transporting Co., Ltd., Hitachi Transport System, K R S Corporation, Mitsui-Soko Holdings Co., Ltd. and Nippon Express Holdings (sorted alphabetically).

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 EXECUTIVE SUMMARY & KEY FINDINGS

2 REPORT OFFERS

3 INTRODUCTION

- 3.1 Study Assumptions & Market Definition

- 3.2 Scope of the Study

- 3.3 Research Methodology

4 KEY INDUSTRY TRENDS

- 4.1 GDP Distribution By Economic Activity

- 4.2 GDP Growth By Economic Activity

- 4.3 Economic Performance And Profile

- 4.3.1 Trends in E-Commerce Industry

- 4.3.2 Trends in Manufacturing Industry

- 4.4 Transport And Storage Sector GDP

- 4.5 Logistics Performance

- 4.6 Length Of Roads

- 4.7 Export Trends

- 4.8 Import Trends

- 4.9 Fuel Pricing Trends

- 4.10 Trucking Operational Costs

- 4.11 Trucking Fleet Size By Type

- 4.12 Major Truck Suppliers

- 4.13 Road Freight Tonnage Trends

- 4.14 Road Freight Pricing Trends

- 4.15 Modal Share

- 4.16 Inflation

- 4.17 Regulatory Framework

- 4.18 Value Chain & Distribution Channel Analysis

5 MARKET SEGMENTATION (includes market size in Value in USD, Forecasts up to 2030 and analysis of growth prospects)

- 5.1 End User Industry

- 5.1.1 Agriculture, Fishing, and Forestry

- 5.1.2 Construction

- 5.1.3 Manufacturing

- 5.1.4 Oil and Gas, Mining and Quarrying

- 5.1.5 Wholesale and Retail Trade

- 5.1.6 Others

- 5.2 Destination

- 5.2.1 Domestic

- 5.3 Truckload Specification

- 5.3.1 Full-Truck-Load (FTL)

- 5.3.2 Less than-Truck-Load (LTL)

- 5.4 Containerization

- 5.4.1 Containerized

- 5.4.2 Non-Containerized

- 5.5 Distance

- 5.5.1 Long Haul

- 5.5.2 Short Haul

- 5.6 Goods Configuration

- 5.6.1 Fluid Goods

- 5.6.2 Solid Goods

- 5.7 Temperature Control

- 5.7.1 Non-Temperature Controlled

- 5.7.2 Temperature Controlled

6 COMPETITIVE LANDSCAPE

- 6.1 Key Strategic Moves

- 6.2 Market Share Analysis

- 6.3 Company Landscape

- 6.4 Company Profiles

- 6.4.1 DHL Group

- 6.4.2 Fukuyama Transporting Co., Ltd.

- 6.4.3 Hitachi Transport System

- 6.4.4 K R S Corporation

- 6.4.5 Konoike Group (including Konoike Transport Co., Ltd.)

- 6.4.6 Mitsui-Soko Holdings Co., Ltd.

- 6.4.7 Nippon Express Holdings

- 6.4.8 Sankyu Inc.

- 6.4.9 Seino Holdings Co., Ltd.

- 6.4.10 Trancom Co. Ltd.

7 KEY STRATEGIC QUESTIONS FOR ROAD FREIGHT CEOS

8 APPENDIX

- 8.1 Global Logistics Market Overview

- 8.1.1 Overview

- 8.1.2 Porter's Five Forces Framework

- 8.1.3 Global Value Chain Analysis

- 8.1.4 Market Dynamics (Market Drivers, Restraints & Opportunities)

- 8.2 Sources & References

- 8.3 List of Tables & Figures

- 8.4 Primary Insights

- 8.5 Data Pack

- 8.6 Glossary of Terms

- 8.7 Currency Exchange Rate

02-2729-4219

+886-2-2729-4219